AMB Credit Consultants Review

AMB Credit Consultants are committed to equipping individuals with the credit and financial tools they require to flourish and prosper.

AMB Credit Consultants are committed to equipping individuals with the credit and financial tools they require to flourish and prosper.

AMB Credit Consultants have been at the forefront of credit repair and counseling services for well over a decade, offering their expertise to individuals and businesses alike. This steadfast team of professionals is committed to walking the extra mile to uplift their clients' credit scores and manage their finances. They do this by delivering tailor-made credit counseling, thorough assessments of credit reports, and efficient credit repair services.

Is your dream lifestyle slipping through your fingers due to credit score woes? Do you aspire to bolster your personal credit and secure a brighter financial future? If a resounding 'yes' echoes your thoughts, then let your search end at the doorstep of AMB Credit Consultants! Known for their stellar credit repair services, AMB Credit Consultants are committed to equipping individuals with the credit and financial tools they require to flourish and prosper.

Their credit repair program is a meticulously designed four-tier strategy comprising of guidance, scrutiny, education, and initiative. Certified credit consultants from AMB take you under their wing, provide bespoke consultation, conduct a thorough examination of your credit reports, and assist in devising a potent action plan.

Moreover, their holistic empowerment program proffers a treasure trove of resources engineered to boost and sustain your credit score. AMB's Dispute Resolution Team stands as your shield, engaging with credit bureaus, collection agencies, and creditors, and contests any anomalies on your credit reports, all on your behalf.

In essence, placing your trust in AMB Credit Consultants could be the game-changing decision that turns around your credit score, enabling you to fulfill your financial aspirations and live the life you've always dreamt of. So, let's embark on a detailed exploration of AMB Credit Consultants and their flagship initiative - the AMB Credit Empowerment Program, a dynamic solution crafted by the company.

Let's dive in, shall we?

AMB Credit Consultants have been at the forefront of credit repair and counseling services for well over a decade, offering their expertise to individuals and businesses alike. This steadfast team of professionals is committed to walking the extra mile to uplift their clients' credit scores and manage their finances. They do this by delivering tailor-made credit counseling, thorough assessments of credit reports, and efficient credit repair services.

What sets AMB Credit Consultants apart is their unparalleled 180-day money-back guarantee, stretching beyond the usual industry norm. This extended assurance exemplifies their unwavering belief in their ability to provide customers with results that exceed expectations.

A robust team of seasoned experts, proficient in credit analysis, dispute resolution, and debt management, form the backbone of AMB Credit Consultants. They dive deep into clients' credit reports to spot inaccuracies and errors, and subsequently, dispute them with credit bureaus. Additionally, they provide personalized credit counseling and education to equip clients with the skills to manage their finances and boost their credit scores.

The firm has garnered positive feedback from clients and is acclaimed for its top-tier customer service. Its sterling reputation in the credit repair industry stands testimony to their dedication to steering clients towards their financial dreams.

In a nutshell, AMB Credit Consultants is a well-regarded firm that offers a broad spectrum of credit repair and counseling services. Instead of merely repairing your credit, our mission is to inculcate good credit decisions for sustained financial health.

AMB Credit Consultants, an eminent player in the credit repair and financial empowerment landscape, has been serving clients across the nation since its inception in 2007. Stationed in Dallas, Texas, the firm was the brainchild of Arnita Johnson-Hall, a woman who personally battled the tribulations of poor credit and financial mismanagement. Johnson-Hall's deep-seated desire to help others navigate the rough seas of credit issues led to the birth of the AMB Credit Empowerment Program. This innovative program offers clients personalized consultation, exhaustive audits of credit reports, and a wealth of resources to improve and maintain their credit.

As the sands of time slipped through the hourglass, the company evolved, broadening its service offerings. Today, this customer-centric firm enjoys its place among the premier credit repair companies, winning over a multitude of satisfied customers.

Choosing a credit repair company like AMB Credit Consultants comes with its own advantages and possible shortcomings. Let's swiftly delve into the key pros and cons to give you a concise snapshot of what to expect.

Now, let's shed some light on the aspects that make AMB Credit Consultants shine. These advantages underscore why they are a go-to choice for many seeking credit repair services.

According to the website, AMB Credit Consultants offers customized credit solutions tailored to the individual needs of their clients. The company takes a personalized approach to credit repair and works closely with clients to design a strategy that works for them.

Boasting over a decade and a half of market experience, AMB Credit Consultants bring a rich reservoir of knowledge and expertise to the table. Their deep understanding of the credit repair industry assures a steady upward trajectory in the credit score improvement journey.

AMB Credit Consultants operates on a 'no progress, no pay' policy. Clients aren't required to part with their money until they witness tangible results, instilling a sense of security and reinforcing the company's commitment to meet client expectations.

AMB Credit Consultants grants clients access to an online portal, allowing them to track their credit repair journey in real-time. This underscores the company's commitment to transparency and keeps clients abreast of the steps taken to enhance their credit scores.

AMB Credit Consultants brings legal expertise to the table, with a team of legal professionals ready to guide clients through credit-related legal intricacies. The company empowers clients by enlightening them about their rights and legal avenues when interacting with creditors, debt collectors, and credit bureaus.

In the unlikely event that AMB Credit Consultants can't remove any negative items from a client's credit report, they offer a money-back guarantee. This ensures peace of mind for clients who may have reservations about the effectiveness of the services.

AMB Credit Consultants don't just fix credit; they also focus on educating their clients about credit management. This creates a sense of financial empowerment and promotes long-term financial health.

A specialized team is on hand to challenge inaccuracies on credit reports, dealing directly with credit bureaus, collection agencies, and creditors, thus relieving clients of this burden.

Recognizing that one size doesn't fit all, AMB Credit Consultants offers flexible payment plans to accommodate different budgets, making their services accessible to a wide range of clients.

While AMB Credit Consultants bring several compelling advantages to the table, it's essential to address the other side of the coin as well. No company is perfect, and there can be certain aspects that might not align with everyone's expectations. Let's explore ten potential downsides associated with AMB Credit Consultants to provide a balanced perspective.

While AMB Credit Consultants boasts a wide reach, they may not be available in all states, potentially limiting the access for individuals living in certain regions.

The lack of a one-size-fits-all package may be less appealing for those seeking a simple, straightforward credit repair service without the need for additional features.

AMB Credit Consultants' services come with a monthly fee that may be higher compared to other credit repair companies. This could pose a financial hurdle for budget-conscious clients.

While the company does boast legal expertise, it's unclear if they have fully licensed attorneys on board, which could potentially impact the handling of complex credit repair cases.

The duration of service can greatly depend on the intricacies of a client's credit situation, potentially requiring a longer commitment period for some, which could be a potential deterrent.

While AMB Credit Consultants generally provide good customer service, there have been reports of slower response times, which might be a drawback for clients in need of immediate assistance.

While they do offer services to businesses, their offerings in this area might not be as extensive as those tailored for individual clients, potentially limiting the company's effectiveness for business credit repair.

In today's fast-paced digital world, the absence of a mobile application could be a setback for clients who prefer managing their credit repair process on their mobile devices.

Unlike some competitors, AMB Credit Consultants do not offer a free initial consultation, which could be a barrier for individuals exploring credit repair options.

While AMB Credit Consultants provide educational resources, they may not be as diverse or comprehensive as those offered by some of their counterparts in the credit repair industry.

Maintaining an impressively clean slate, AMB Credit Consultants has managed to steer clear of significant controversies or complaints. This absence of grievances speaks volumes about their reputable standing in the industry.

A quick peek at the Better Business Bureau (BBB) website reveals that AMB Credit Consultants has faced only three customer complaints over the past three years. This count is quite minimal, adding another feather to their reputation cap.

Even with these few complaints, AMB Credit Consultants' industry reputation remains robust. Their unwavering commitment to offer personalized consultations and resources aimed at improving and upholding clients' credit scores has earned them a chorus of commendations from a host of contented customers. To sum it up, entrusting your credit health to this company can indeed be a decision worth your while.

AMB Credit Consultants has multiple competitors in the market that have some similar features and vary in many scenarios too. Let’s learn some of their features:

Although both AMB Credit Consultants and DisputeBee.com are in the business of credit repair, their strategies towards credit score improvement diverge considerably. AMB Credit Consultants pride themselves on a personalized approach, tailoring individual strategies for clients to boost their credit scores. Conversely, DisputeBee.com empowers customers with a suite of do-it-yourself tools and resources to contest inaccuracies on their credit reports.

While DisputeBee.com's cost-effective model may appeal to those on a tight budget, the dedicated expertise and bespoke service from AMB Credit Consultants could justify the investment for those seeking a more comprehensive and hands-on credit repair journey.

In a face-off between AMB Credit Consultants and CreditRepair.com, the distinction lies in their range of offerings. While both firms specialize in credit repair services, CreditRepair.com goes a step further by offering credit monitoring, identity theft protection, and a wider array of financial services. Moreover, CreditRepair.com employs a three-step credit repair process encompassing a review, dispute, and monitoring of credit reports.

AMB Credit Consultants, on the other hand, emphasize a tailored approach, taking into account each client's unique financial circumstances. In summary, both companies enjoy a reputable standing in the credit repair arena, but CreditRepair.com may be a more fitting choice for individuals seeking a broader spectrum of financial services.

When comparing AMB Credit Consultants with Lexington Law, the differences become apparent in their pricing and credit repair methodologies. AMB Credit Consultants opt for a more budget-friendly pricing model, including a one-time setup fee and subsequent monthly payments. Conversely, Lexington Law leans towards a higher setup fee and monthly subscription pricing.

While both firms provide credit repair services, Lexington Law boasts a team of attorneys adept at handling credit disputes and legal issues, while AMB Credit Consultants counts on their cadre of seasoned credit professionals.

In conclusion, both companies hold their respective strengths and may appeal to different clientele. AMB Credit Consultants might be a more attractive choice for those seeking an affordable and personalized touch, whereas those requiring legal expertise might find Lexington Law's services more beneficial.

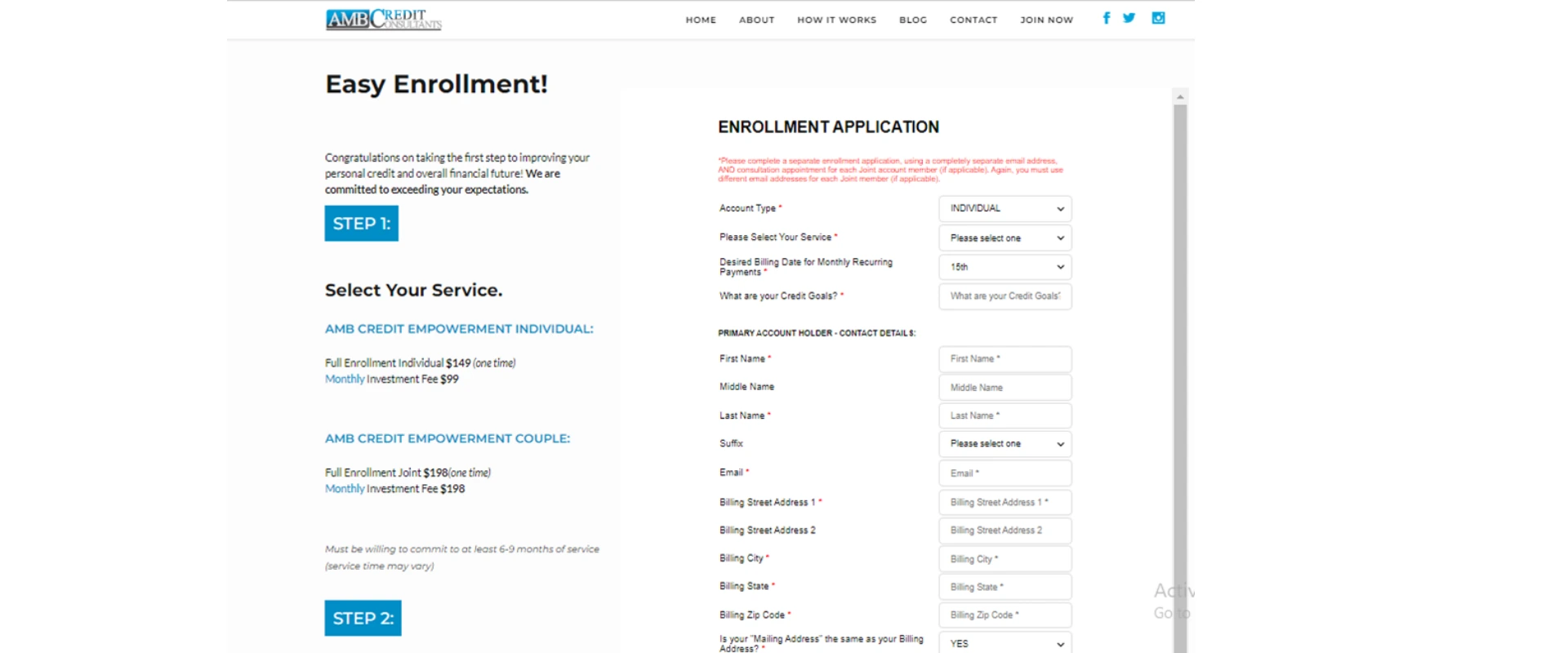

Throughout the application procedure, you will receive regular updates and support from AMB Credit Consultants to process hassle-free.

It's critical to note that the correct process of ordering their services can differ depending on your specific credit requirements and the services you want. Regarding queries about how to order their services, it's best to contact AMB Credit Consultants for thorough information directly.

The following queries and their answers are helpful for the customers to have an in-depth understanding of ABM Credit Consultants.