Credit Karma

Credit Karma stands as a comprehensive financial platform designed to empower users in managing their personal finances.

Credit Karma stands as a comprehensive financial platform designed to empower users in managing their personal finances.

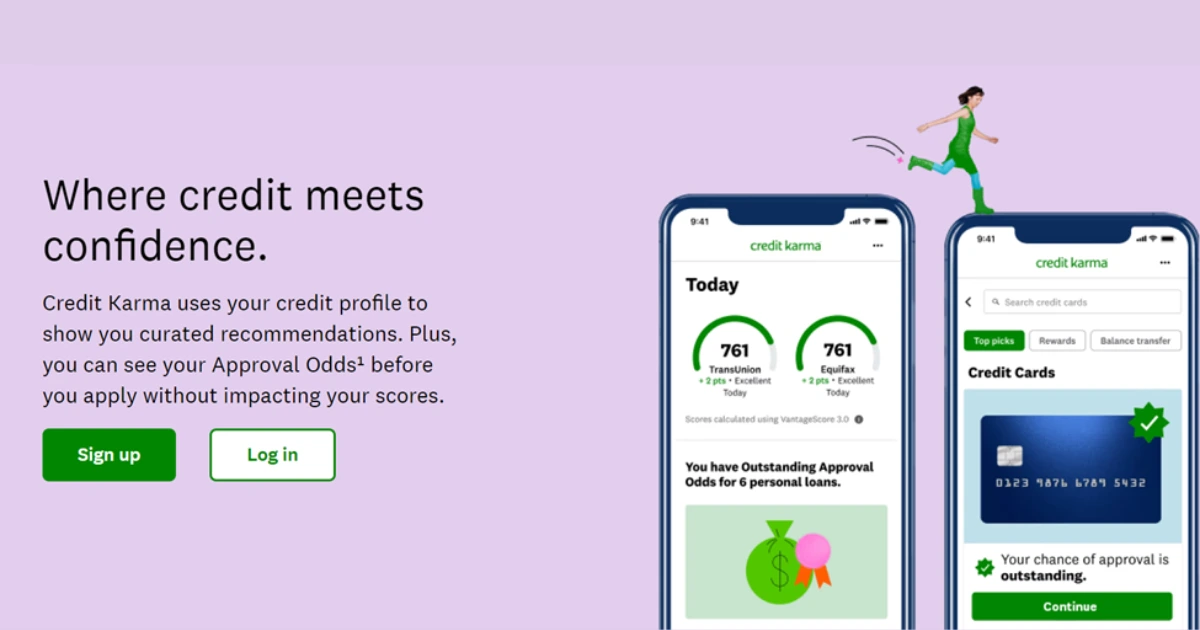

Credit Karma is a financial technology company that originated in San Francisco, California in 2007. Credit Karma has expanded its offerings to include a range of tools for monitoring and improving credit, tracking debt, and finding loans and credit cards. The company operates on a freemium business model, which allows users to access basic credit services for free

Credit Karma has become a highly popular online financial platform by offering users free access to their credit scores, credit reports, and other useful financial tools. With an impressive 120 million customers around the world, Credit Karma has now become one of the top credit monitoring services available.

However, despite its widespread use and popularity, many people may still be uncertain about Credit Karma's specific offerings and whether they align with their financial goals. If you are one of these individuals, then you have come to the right place. This Credit Karma review will provide an in-depth analysis of the platform's various features, benefits, and drawbacks, ultimately helping you make an informed decision about whether it is the perfect fit for your financial needs.

Credit Karma is a financial management company that provides users with a variety of useful financial tools and services. These include free credit scores and credit reports, as well as personalized financial advice to help users manage their credit and money more effectively.

Since its establishment in 2007, Credit Karma has expanded its offerings to include a range of tools for monitoring and improving credit, tracking debt, and finding loans and credit cards. The company operates on a freemium business model, which allows users to access basic credit services for free. To generate revenue, Credit Karma targets advertising and recommends financial products such as loans and credit cards to its customers.

In addition to credit monitoring, Credit Karma also offers a host of other financial tools and services, such as a tax filing platform and a savings account. With over 100 million members in the United States, Canada, and the United Kingdom, Credit Karma has established itself as one of the most popular financial management companies in the world.

Credit Karma is a financial technology company that originated in San Francisco, California in 2007 by its three founders - Kenneth Lin, Ryan Graciano, and Nichole Mustard. It commenced its operations as a credit monitoring service, offering its users free access to their credit reports and scores.

At its inception, Credit Karma struggled to establish its credibility and trustworthiness as people were dubious about its ability to provide free credit scores without hidden charges.

However, the company was able to overcome these initial obstacles and gain prominence by implementing a unique freemium business model. This business model allowed users to access basic credit services for free, while the company generated revenue through targeted advertising and recommendations of financial products such as credit cards and loans.

Over the years, Credit Karma broadened its services to comprise various financial tools and services such as credit score improvement tools, debt tracking, and loan and credit card finding.

In 2018, Credit Karma extended its services even further by providing its users with a tax filing platform that allowed them to file their state and federal taxes for free.

In 2020, Credit Karma was acquired by Intuit, the company that produces TurboTax and QuickBooks, for $7.1 billion. This acquisition allowed Credit Karma to improve its services even further by integrating its services with Intuit's financial management products.

Currently, Credit Karma has over 100 million members from the United States, Canada, and the United Kingdom, making it one of the most famous financial management companies globally. Credit Karma continues to provide its users with free access to a diverse range of financial tools and services to assist them in managing their credit and finances more efficiently.

Credit Karma stands as a comprehensive financial platform designed to empower users in managing their personal finances. With its user-friendly interface and diverse array of features, it offers personalized guidance, educational resources, and valuable tools to help individuals make well-informed financial decisions. Here's a brief overview of Credit Karma's key advantages:

Although Credit Karma offers numerous benefits as a comprehensive financial platform, it is essential to consider its potential drawbacks before relying on it entirely. Here's a brief introduction to some of the limitations and disadvantages associated with Credit Karma:

Credit Karma garners appreciation from both customers and industry professionals for its complimentary credit tracking and financial management solutions. Though the platform has received mixed feedback on consumer review websites like Trustpilot and ConsumerAffairs, a significant number of users commend the company for its tailored financial advice offered free of charge.

Credit Karma has forged alliances with several prominent financial institutions, such as American Express, Capital One, and Chase, which bolsters its trustworthiness and credibility in the financial sector. Boasting over 140,000 reviews across various platforms, many users express satisfaction with the company's credit monitoring services and financial guidance. The following section highlights some authentic customer evaluations of Credit Karma's offerings.

Credit Karma has been a lifesaver for me! It's so easy to use, and the credit monitoring services have helped me stay on top of my finances and improve my credit score, says James B.

I love how Credit Karma gives me personalized financial recommendations based on my credit profile. It's like having my own financial advisor, says Ava Miller.

Credit Karma's app is fantastic. It's user-friendly and has helped me track my spending and manage my budget more effectively, says Issabella.

I highly recommend Credit Karma to anyone who wants to take control of their finances. It's free, easy to use, and has a ton of helpful features, says Ethan.

Now, it’s time for comparisons.

Credit Karma and LendingTree are often assessed side by side due to their similarities in the financial services domain. The following outlines the key aspects of both platforms:

While Credit Karma does not directly provide loans, it delivers tailored suggestions based on users' credit profiles. In contrast, LendingTree.com presents a comprehensive array of loan alternatives, encompassing mortgages, personal loans, business loans, and student loans.

Credit Karma mainly offers free credit scores, credit monitoring, and individualized credit card recommendations. Conversely, LendingTree primarily functions as a comparison platform for diverse loan types, personalized loan advice, access to a network of lenders, and a credit monitoring facility.

Credit Karma furnishes complimentary credit monitoring services that notify users of any modifications in their credit reports. LendingTree, however, provides a credit monitoring solution called ''My LendingTree,'' which grants access to users' credit scores and alerts them to any changes in their credit reports.

Credit Karma boasts a user-friendly interface that caters to individuals seeking credit score information and financial recommendations. The platform offers a mobile app for easy access to credit data and financial suggestions on the go. On the other hand, LendingTree primarily focuses on loan comparison, providing users with an intuitive platform to evaluate and select the best loan options based on their needs.

Credit Karma operates on a freemium model, allowing users to access basic credit services for free while generating revenue through targeted advertising and recommending financial products. LendingTree, however, generates its revenue by charging lenders for referral fees when users apply for loans through the platform. As a result, the services offered by LendingTree may indirectly influence the loan costs for users.

Credit Karma offers a wide range of educational resources, such as articles, tools, and calculators, which help users better understand their credit and finances. LendingTree also provides financial education resources, including loan-specific guides, articles, and calculators, aimed at assisting users in making informed decisions about various loan products.

Here’s a table of comparison of both Credit Karma and Lending Tree:

| Feature | Credit Karma | LendingTree |

|---|---|---|

| Type of Service | Credit Monitoring and Personal Finance Management | Loan Comparison and Referral Platform |

| Cost | Free | Free for consumers, fees charged to lenders |

| Credit Score Reporting | Yes | No (but lenders may check credit through LT) |

| Credit Score Analysis | Yes | No (but lenders may provide analysis) |

| Tax Preparation Services | Yes | No |

| Financial Calculators | Yes | Yes |

| Mobile App | Yes | Yes |

| Customer Support | Email, Phone, Chat | Email, Phone, Chat |

| Partnered Institutions | Limited | Extensive |

| Loan Types | Personal Loans, Credit Cards, Mortgages, Auto Loans | Personal Loans, Business Loans, Home Loans, Auto Loans, Others |

| Loan Amounts | Up to $100,000 | Varies depending on lender and type of loan |

| Loan Term | Up to 7 years | Varies depending on lender and type of loan |

| Pre-qualification | Yes | Yes |

| Loan Application Process | Through partnered institutions | Through partnered institutions or directly with lenders |

credit monitoring, financial advice, and credit card recommendations, LendingTree caters more to individuals looking for a loan comparison platform and access to a network of lenders.

In the realm of personal finance platforms, Credit Karma and NerdWallet.com are two leading contenders, each offering unique features and services to help users make informed financial decisions. This comparison delves into the key differences and similarities between these two popular platforms, enabling users to better understand their offerings and make a well-informed choice based on their individual financial needs and preferences.

Credit Karma offers free credit scores and credit monitoring from TransUnion and Equifax, while NerdWallet provides complimentary credit scores and credit monitoring exclusively from TransUnion.

Credit Karma allows users to file their taxes for free with Credit Karma Tax, whereas NerdWallet does not supply a tax filing service.

NerdWallet enables users to compare and apply for financial products directly through its site, while Credit Karma focuses on providing tailored financial product suggestions.

Credit Karma generates revenue through partnerships with financial institutions and by promoting financial products to users. In contrast, NerdWallet earns income by collaborating with financial organizations and by enabling users to apply for financial products directly through its platform.

Both Credit Karma and NerdWallet offer user-friendly websites and mobile apps for iOS and Android devices. These apps allow users to easily access their credit information, financial recommendations, and other platform-specific features.

Credit Karma and NerdWallet both provide an extensive range of financial education resources, including articles, guides, and tools, to help users make informed decisions and enhance their financial knowledge.

While Credit Karma offers responsive customer support through email and a comprehensive FAQ section, NerdWallet also provides customer support primarily via email and features an extensive help center to address users' concerns and inquiries.

Here’s a table of comparison of both Credit Karma and NerdWallet:

| Feature | Credit Karma | NerdWallet |

|---|---|---|

| Type of Service | Credit Monitoring and Personal Finance Management | Personal Finance Advice and Recommendations |

| Cost | Free | Free |

| Credit Score Reporting | Yes | Yes |

| Credit Score Analysis | Yes | Yes |

| Tax Preparation Services | Yes | No |

| Loan Referrals | Yes | Yes |

| Investment Guidance | No | Yes |

| Retirement Planning | No | Yes |

| Insurance Comparison | No | Yes |

| Financial Calculators | Yes | Yes |

| Mobile App | Yes | Yes |

| Customer Support | Email, Phone, Chat | Email, Phone, Chat |

| Partnered Institutions | Limited | Extensive |

The features mentioned above demonstrate the differences between Credit Karma and Experian Boost in regards to their credit-related services. Credit Karma provides credit monitoring alerts, credit education, credit report access, credit lock and freeze, and score tracking, whereas Experian Boost does not offer any of these services. Both platforms are free to use and provide credit score reporting, but only Credit Karma offers credit score analysis. Furthermore, Credit Karma has limited partnerships with financial institutions, while Experian Boost does not have any collaborations.

When it comes to credit monitoring and credit score enhancement, Credit Karma and Experian Boost offer distinct services catering to different aspects of credit management. Here is a comparison of their offerings, along with a brief introduction:

Credit Karma furnishes complimentary credit scores and credit monitoring from TransUnion and Equifax. In contrast, Experian Boost is a free service designed to augment your credit score by incorporating on-time utility and telecom payments into your credit report.

Credit Karma provides a comprehensive credit analysis and customized insights, offering tailored credit card recommendations. Experian Boost, however, specifically targets boosting your credit score by leveraging positive payment history from utility and telecom bills. By incorporating these timely payments into your credit report, Experian Boost aims to enhance your creditworthiness and facilitate access to improved credit opportunities.

Credit Karma features a user-friendly interface, making it easy for users to access their credit information, financial recommendations, and educational resources. The platform also offers a mobile app for convenient access to credit data and financial suggestions on the go. Experian Boost, on the other hand, concentrates on a single service of credit score improvement, with a straightforward interface focusing on adding utility and telecom payments to the user's credit report.

Credit Karma features a user-friendly interface, making it easy for users to access their credit information, financial recommendations, and educational resources. The platform also offers a mobile app for convenient access to credit data and financial suggestions on the go. Experian Boost, on the other hand, concentrates on a single service of credit score improvement, with a straightforward interface focusing on adding utility and telecom payments to the user's credit report.

While Credit Karma delivers personalized financial recommendations for credit cards, loans, and other financial products based on the user's credit profile, Experian Boost does not offer any such suggestions. Experian Boost's primary focus is on enhancing the user's credit score through positive payment history.

Credit Karma provides a wealth of educational resources, such as articles, tools, and calculators, to help users better understand their credit and finances. Experian

Boost does not offer a comprehensive set of financial education resources, as its primary objective is to improve users' credit scores with a focused approach.

Both Credit Karma and Experian Boost offer their services for free. Credit Karma operates on a freemium model, generating revenue through targeted advertising and recommending financial products, while Experian Boost provides its credit score improvement service at no cost to users.

In conclusion, when comparing Credit Karma and Experian Boost, users should take into account their specific financial needs and goals. Credit Karma is more suitable for users seeking comprehensive credit monitoring and management services, while Experian Boost is ideal for those looking to improve their credit score by capitalizing on their on-time utility and telecom payments.

Here’s a table of comparison of both Credit Karma and Experian Boost:

| Feature | Credit Karma | Experian Boost |

|---|---|---|

| Type of Service | Credit Monitoring and Personal Finance Management | Credit Score Improvement |

| Cost | Free | Free |

| Credit Score Reporting | Yes | Yes |

| Credit Score Analysis | Yes | No (only focuses on boosting) |

| Credit Score Improvement | Limited | Boosts FICO Score by adding non-traditional payments |

| Supported Payments | None | Utility, phone, and streaming payments |

| Effectiveness | Varies | Can increase FICO score by up to 13 points |

| Time to Boost | Immediate | Up to 1 month |

| Mobile App | Yes | Yes |

| Customer Support | Email, Phone, Chat | Email, Phone, Chat |

| Partnered Institutions | Limited | None |

| Credit Monitoring Alerts | Yes | No |

| Credit Education | Yes | No |

| Credit Report Access | Yes | No (but can be accessed through other services) |

| Credit Lock and Freeze | Yes | No |

| Score Tracking | Yes | No |

The above-mentioned features illustrate some of the distinctions between Credit Karma and Experian Boost concerning credit-related services. Credit Karma provides credit monitoring alerts, credit education, credit report access, credit lock and freeze, and score tracking, while Experian Boost does not provide any of these services. These two platforms are free to use and offer credit score reporting, but only Credit Karma offers credit score analysis. Moreover, Credit Karma has a few partnerships with financial institutions, while Experian Boost does not have any collaborations.

Although Credit Karma is an excellent resource for managing your finances and credit, it does not offer the functionality to place orders or conduct transactions directly. To complete a purchase, you will need to use a credit card.

Nevertheless, Credit Karma does provide valuable recommendations for credit cards and other financial products that may prove beneficial when making purchases. You can review these suggestions and compare offers to find the best option tailored to your requirements.

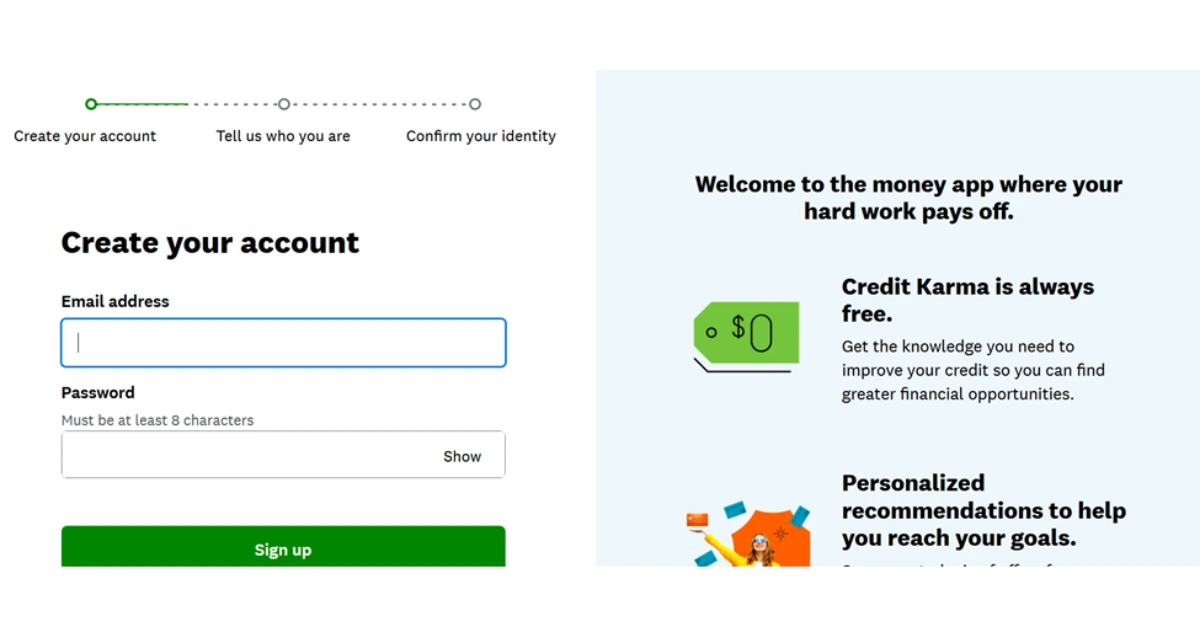

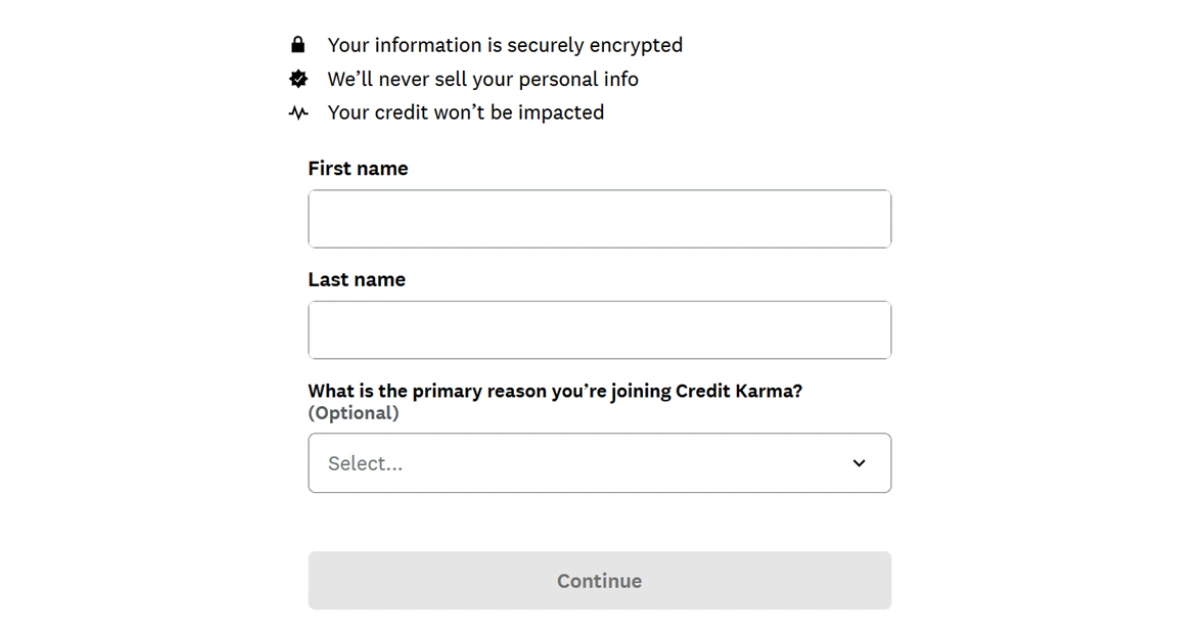

If you're interested in taking advantage of Credit Karma's services, follow the steps below to sign up:

1. Go to the Credit Karma website and click the ''Sign Up'' button.

2. Enter your email address, create a password, and click "Continue."

3. Add your personal information, including your name, address, Social Security number, etc.

4. Check or tick the terms and conditions and click "Create Account."

You will be asked to verify your email address by clicking on a link sent to your email. Follow the instructions in the email to complete the verification process.

That’s it."

Credit Karma is an American personal finance company that was founded in 2007 by Kenneth Lin, Ryan Graciano, and Nichole Mustard. Here is some key information about the company:

Here are some important frequently asked questions about The Credit Pros.