Credit Sesame

Since its foundation in 2010, Credit Sesame has experienced tremendous growth and has solidified a significant presence in the personal finance sector. The company, headquartered in Mountain View, California, was established by Adrian Nazari, an entrepreneurial visionary committed to fostering financial well-being among individuals. Over time, Credit Sesame has gained the trust and loyalty of its users by consistently offering reliable services and resources that enable them to reach their financial targets.

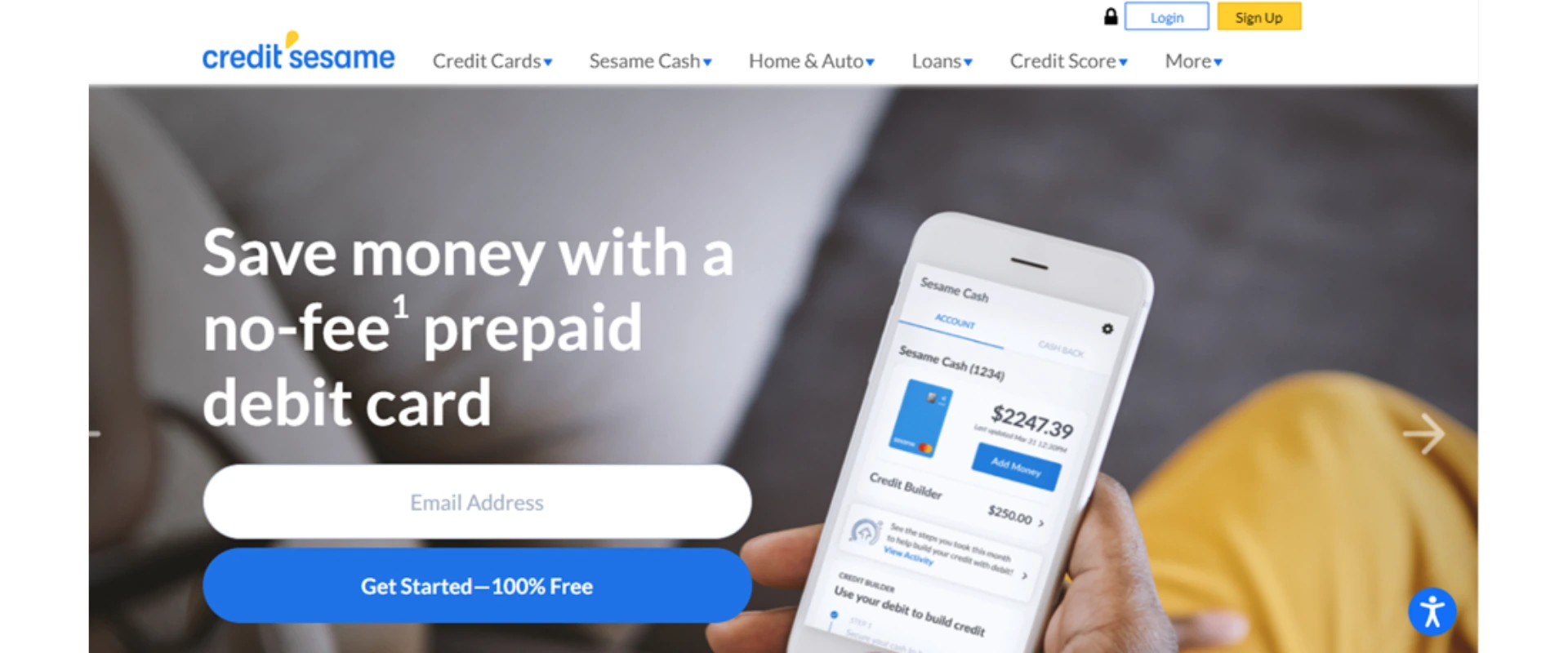

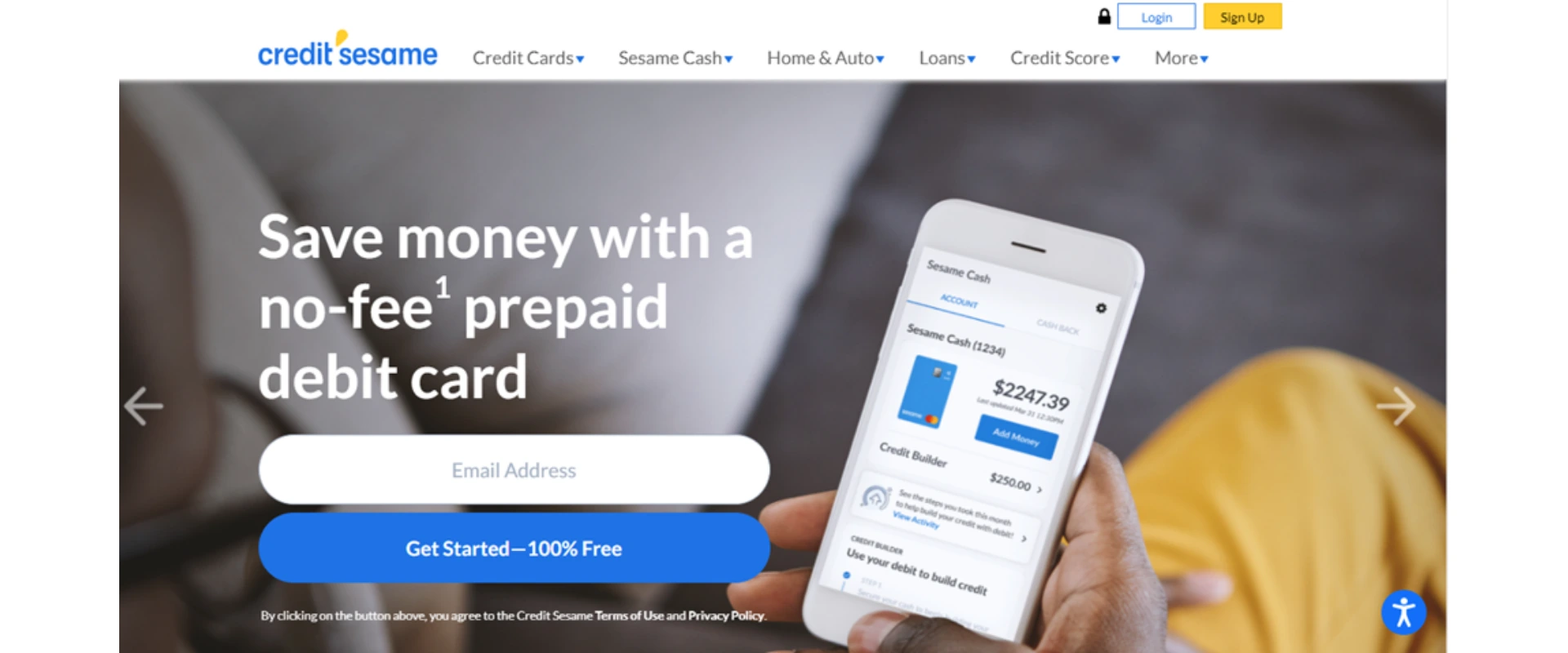

The inventive platform provided by Credit Sesame is specifically tailored to help users improve their credit scores and attain their financial objectives. The company offers a range of services, including credit monitoring, alerts, personalized guidance, and access to an assortment of financial products such as loans, credit cards, and insurance, creating a comprehensive system for effective financial management.

A distinguishing feature that sets Credit Sesame apart from its competitors is the complimentary credit monitoring service it offers. This functionality enables users to keep track of their credit scores and receive instantaneous notifications regarding any alterations or updates to their credit reports. The platform's individualized recommendations, based on each user's distinct credit history, aid them in enhancing their credit scores and making well-informed financial choices.

Credit Sesame aspires to be a comprehensive hub for financial solutions. The platform's advanced algorithm allows users to explore a broad array of financial products customized to their credit history, goals, and requirements. This tailored approach ensures that users can effectively manage their finances and make knowledgeable decisions to achieve financial independence and security.

Credit Sesame has achieved several milestones since launching its free credit monitoring service in 2011, demonstrating its dedication to innovation and expansion. Notable accomplishments include obtaining $12 million in funding in 2012, launching a personalized financial analysis tool in 2014, releasing a mobile app in 2015, and broadening its services to include loans and additional financial products in 2018.

Currently, Credit Sesame serves over 15 million registered users, making it one of the world's largest providers of credit monitoring and financial management resources. The company's sustained success showcases its capacity to meet the changing needs of its users and uphold its status as a top financial solutions provider in a competitive market. With its inventive platform, personalized approach, and commitment to empowering users, Credit Sesame continues to be a reliable ally for individuals pursuing financial freedom and stability.

No Credit Check*

Since its foundation in 2010, Credit Sesame has experienced tremendous growth and has solidified a significant presence in the personal finance sector. The company, headquartered in Mountain View, California, was established by Adrian Nazari, an entrepreneurial visionary committed to fostering financial well-being among individuals. Over time, Credit Sesame has gained the trust and loyalty of its users by consistently offering reliable services and resources that enable them to reach their financial targets.

Credit Sesame's platform focuses on assisting users in achieving better credit scores and reaching their financial goals. Some of the key features include:

A distinguishing feature that sets Credit Sesame apart from its competitors is the complimentary credit monitoring service it offers. This functionality enables users to keep track of their credit scores and receive instantaneous notifications regarding any alterations or updates to their credit reports. The platform's individualized recommendations, based on each user's distinct credit history, aid them in enhancing their credit scores and making well-informed financial choices.

Credit Sesame aspires to be a comprehensive hub for financial solutions. The platform's advanced algorithm allows users to explore a broad array of financial products customized to their credit history, goals, and requirements. This tailored approach ensures that users can effectively manage their finances and make knowledgeable decisions to achieve financial independence and security.

Credit Sesame has achieved several milestones since launching its free credit monitoring service in 2011, demonstrating its dedication to innovation and expansion. Notable accomplishments include obtaining $12 million in funding in 2012, launching a personalized financial analysis tool in 2014, releasing a mobile app in 2015, and broadening its services to include loans and additional financial products in 2018.

Currently, Credit Sesame serves over 15 million registered users, making it one of the world's largest providers of credit monitoring and financial management resources. The company's sustained success showcases its capacity to meet the changing needs of its users and uphold its status as a top financial solutions provider in a competitive market. With its inventive platform, personalized approach, and commitment to empowering users, Credit Sesame continues to be a reliable ally for individuals pursuing financial freedom and stability.

As a prominent financial technology firm, Credit Sesame delivers a variety of services designed to aid users in enhancing their credit scores and attaining financial security. Nonetheless, it is crucial to weigh both the benefits and limitations of any financial resource before making a well-informed choice. In subsequent sections, we will delve into the assorted pros and cons of Credit Sesame, offering insights into each factor to assist users in deciding if the platform meets their distinct financial requirements and objectives.

Credit Sesame has become a popular choice for individuals seeking a versatile platform to address their financial needs. In this section, we will discuss the numerous benefits of using Credit Sesame that contribute to its widespread appeal among users aiming to enhance their credit scores and attain financial stability. Some of the key advantages of Credit Sesame include:

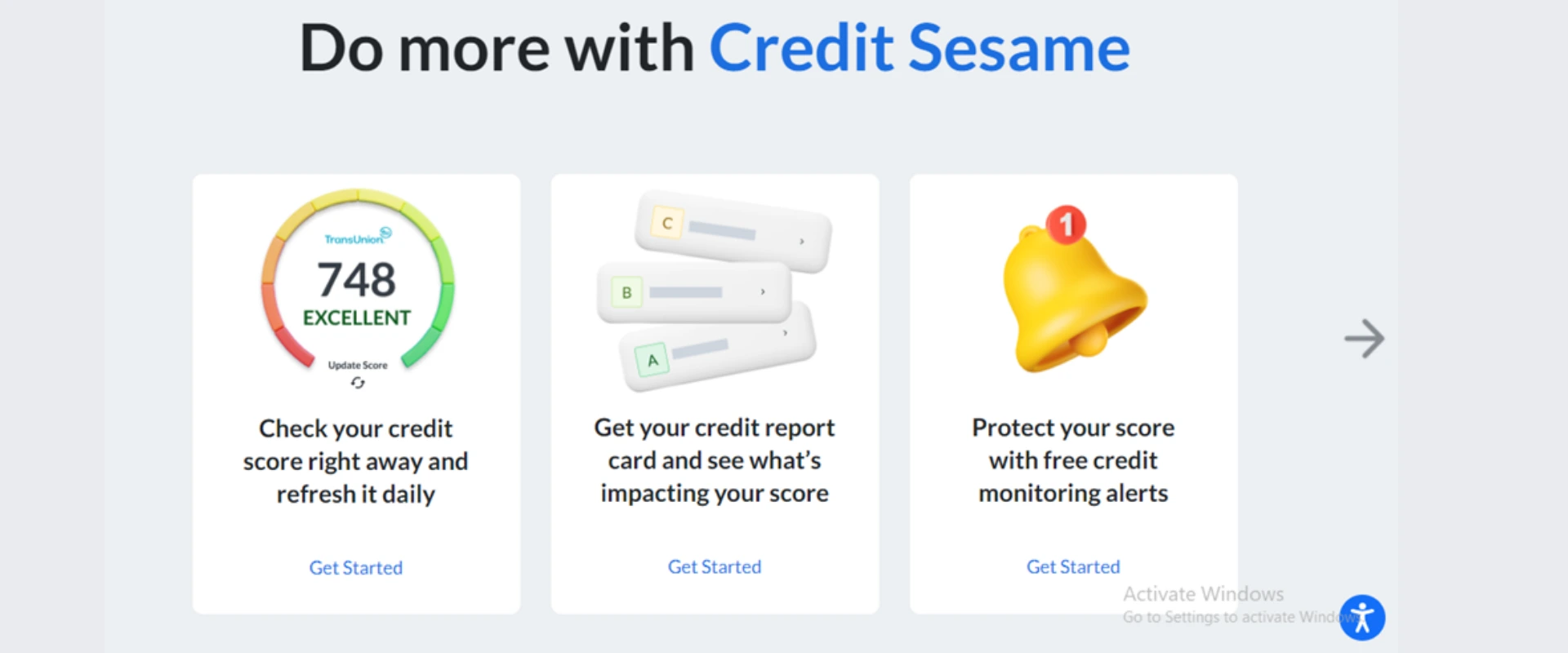

Complimentary credit monitoring: Users can take advantage of free credit score tracking, allowing them to stay informed about their credit scores and receive instant notifications about any updates in their credit reports.

Personalized Recommendations: The platform provides recommendations customized to each user's specific credit history, enabling them to make well-informed financial choices and bolster their credit scores.

All-inclusive financial resources: Credit Sesame grants users access to an array of tools and services that aid in managing their finances effectively, including personalized financial analysis and access to various financial products.

Variety of financial products: Credit Sesame links users to a diverse array of financial offerings, customized to their credit profiles and financial objectives, including loans, credit cards, and insurance plans.

Easy-to-use interface: The platform boasts a straightforward and user-friendly design, enabling users to effortlessly navigate and access the necessary features and tools.

Feature rich mobile app: The Credit Sesame mobile app permits users to handle their finances on-the-move, providing the same functionality as the web-based platform.

Protection against identity theft: The platform incorporates identity theft safeguards, granting users additional security and peace of mind.

Informative materials: Credit Sesame supplies users with informative articles, guidance, and advice on credit management and personal finance, helping them make informed financial choices.

Extensive user community: With a user base of over 15 million registered members, Credit Sesame has proven to be a dependable and trustworthy platform for managing personal finances and enhancing credit scores.

Credit building support: Credit Sesame not only provides insights into users' current credit scores but also offers valuable guidance and resources to help them build and improve their credit over time. By following personalized advice and utilizing the tools available on the platform, users can develop healthy financial habits, establish a positive credit history, and ultimately achieve higher credit scores, leading to better financial opportunities and stability.

While Credit Sesame offers numerous advantages for users seeking to improve their financial standing, it is also essential to consider the potential drawbacks associated with the platform. In this section, we will discuss some of the disadvantages of Credit Sesame, shedding light on the aspects that users should be aware of when deciding if the platform aligns with their unique financial needs and goals. Some of the cons of Credit Sesame include:

In wrapping up, Credit Sesame has proven to be a helpful financial instrument, offering a range of benefits for users who aim to boost their credit scores and reach financial stability. The platform delivers all-inclusive services, a straightforward interface, and customized financial product suggestions, making it an efficient resource for many individuals. Nonetheless, it's crucial to also consider the possible disadvantages such as restricted credit bureau monitoring, targeted advertising, and the necessity for paid plans to unlock advanced options.

Taking the time to carefully assess the pros and cons mentioned above will enable users to determine if Credit Sesame is the right fit for their specific financial requirements and objectives. It's vital to keep in mind that each person's financial situation is unique, and the most suitable solution may differ based on individual circumstances and needs.

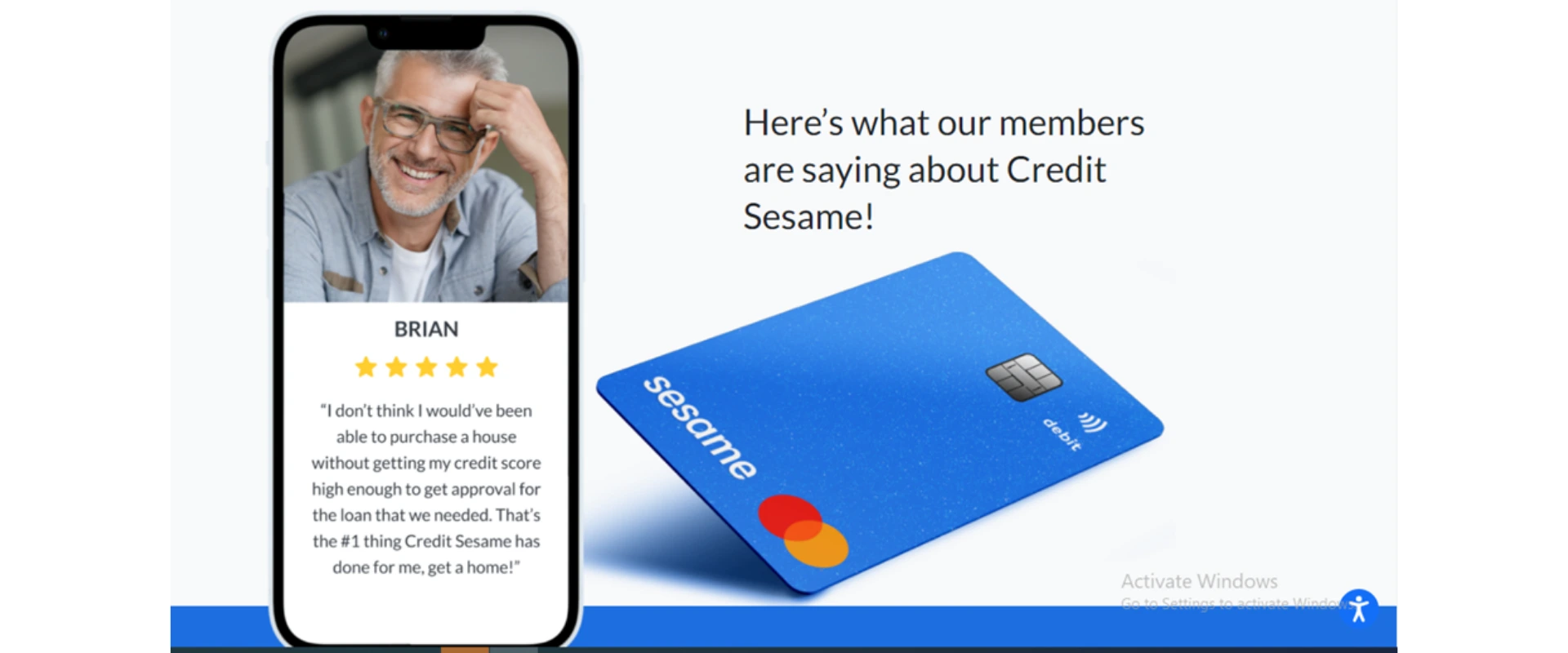

Credit Sesame has generally positive reviews and a good reputation in the industry. On their website, Credit Sesame has acquired over +323,000 5-Star reviews; similarly, at Trustpilot, Credit Sesame has an "Excellent" rating with over 12,000 reviews - a completely adorable platform. Users praise the company for its free credit monitoring services, personalized credit recommendations, and helpful educational resources.

Credit Sesame has also received positive reviews and coverage from reputable sources such as Forbes, The New York Times, and CNBC. However, like any company, Credit Sesame has received some negative reviews and complaints, including issues with the accuracy of credit scores and difficulties canceling subscriptions. Nonetheless, Credit Sesame's customer service team is generally responsive and helpful in resolving these issues. Credit Sesame is typically a trustworthy choice for those looking to monitor their credit and improve their financial well-being.

Credit Sesame is a credit report service that provides users with an array of tools and resources to track and oversee their credit. Compared to other credit report services like FreeCreditReport.com, AnnualCreditReport.com, and Credit.com, Credit Sesame stands out due to its comprehensive features and user-friendly approach.

Credit Sesame and FreeCreditReport.com both serve as noteworthy credit report providers, offering users essential tools and resources to track and control their credit effectively. These platforms possess distinct features, making it crucial to examine their differences to identify the most appropriate service for each person's requirements.

Credit Sesame is renowned for its all-inclusive offerings and easy-to-use interface, supplying users with complimentary credit monitoring, alerts, and tailored financial guidance. The service presents a VantageScore credit rating, derived from information gathered by TransUnion, one of the three primary credit bureaus. Furthermore, Credit Sesame recommends various financial products, including loans, credit cards, and insurance policies, in accordance with a user's credit background and financial aspirations. The platform also features a mobile app, enabling users to manage their finances with ease while on the move.

Conversely, FreeCreditReport.com, an Experian subsidiary, mainly concentrates on granting users access to their credit report data. This service supplies a free Experian credit report and FICO score, which is the credit score most frequently employed by lenders. However, unlike Credit Sesame, FreeCreditReport.com does not furnish ongoing credit supervision or customized financial counsel. The service primarily functions as a gateway for users to examine their credit reports and detect any possible inconsistencies or concerns.

In essence, Credit Sesame and FreeCreditReport.com address distinct aspects of credit administration. Credit Sesame provides a broader array of services, encompassing credit tracking, customized financial recommendations, and access to a diverse range of financial products. In contrast, FreeCreditReport.com mainly concentrates on presenting users with credit report details and FICO scores. The most suitable platform will depend on an individual's specific financial objectives and necessities. By thoughtfully assessing each service's offerings, users can make educated decisions regarding the platform that best aligns with their distinct financial preferences/.

Credit Sesame and AnnualCreditReport.com are two prominent

credit reporting services that enable individuals to monitor and

manage their credit history. While both platforms offer access

to credit report information, they differ significantly in terms

of their services and features.

Credit Sesame is widely recognized for its intuitive user

interface and comprehensive offerings. The platform provides

free credit monitoring, alerts, and personalized financial

advice, empowering users to enhance their credit scores and

accomplish their financial goals. Credit Sesame also offers a

VantageScore credit score, based on data from TransUnion, one of

the three major credit bureaus. The service additionally

provides customized recommendations for financial products like

loans, credit cards, and insurance policies, based on a user's

credit history and financial objectives. Credit Sesame's mobile

app further enables users to manage their finances and track

their credit scores conveniently.

In contrast, AnnualCreditReport.com is a government-mandated

service that offers users free access to their credit reports

from the three major credit bureaus once per year. While this

service is invaluable for verifying the accuracy of one's credit

report, it doesn't provide ongoing credit monitoring or

personalized financial guidance.

In summary, Credit Sesame offers a broader range of services

compared to AnnualCreditReport.com. Credit Sesame presents users

with ongoing credit monitoring, personalized financial advice,

and tailored product recommendations. Meanwhile,

AnnualCreditReport.com focuses on providing users with free

access to their credit report information from the three major

credit bureaus. Depending on individual financial requirements,

one platform may be more advantageous than the other. By

carefully assessing the services and features of each platform,

users can make informed decisions regarding the platform that

best fits their unique financial needs.

Credit Sesame and Credit.com are two notable credit reporting

services that help individuals track and manage their credit

history. While both platforms supply credit report information,

they have distinct services and features.

Credit Sesame is known for its user-friendly interface and

comprehensive offerings. The platform grants users access to

free credit monitoring, alerts, and tailored financial guidance,

empowering them to enhance their credit scores and attain their

financial objectives. Credit Sesame also supplies a VantageScore

credit score derived from TransUnion data, one of the three

major credit bureaus. Furthermore, the service presents

personalized recommendations for financial products, such as

loans, credit cards, and insurance policies, based on a user's

credit history and financial goals. The Credit Sesame mobile app

allows users to conveniently manage their finances and monitor

their credit scores.

Conversely, Credit.com primarily functions as a credit education

website, offering users an array of credit score resources,

including credit report monitoring and informative articles.

However, unlike Credit Sesame, Credit.com doesn't provide free

credit scores, customized financial advice, or continuous credit

monitoring. The platform primarily serves as an educational

resource for users to learn about credit scores and credit

reports.

In conclusion, Credit Sesame delivers a more extensive range of

services compared to Credit.com. Credit Sesame equips users with

ongoing credit monitoring, individualized financial advice, and

tailored product suggestions, while Credit.com mainly operates

as an educational resource for credit scores and credit reports.

Depending on personal financial needs, one platform may be more

suitable than the other. By carefully evaluating each platform's

offerings, users can make informed decisions.

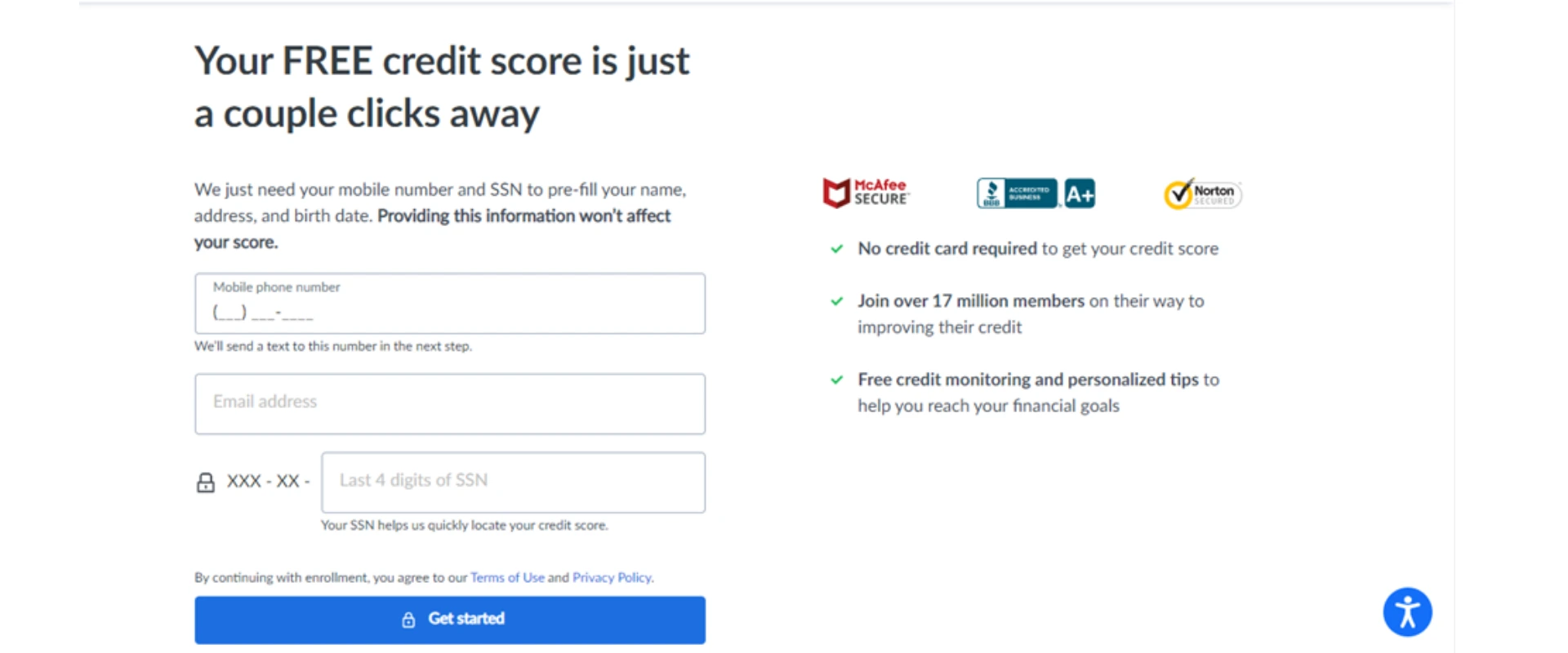

Navigating the realm of credit ratings and financial guidance can be daunting, but Credit Sesame strives to simplify the process for users. Featuring an intuitive interface, the platform provides an array of tools for keeping track of and managing your credit. Here are the steps to register for a complimentary Credit Sesame account and begin taking advantage of its helpful resources:

Credit Sesame offers free credit monitoring services without requiring payment information or subscriptions but also provides paid premium services like credit score monitoring and identity theft protection that require subscription and payment details.

Website: https://www.creditsesame.com/

Credit Sesame is a financial technology company that focuses on

helping individuals manage and improve their credit. Here are

some key details about the organization:

Even though Credit Sesame employs robust security measures, it is crucial for users to create strong, unique passwords and exercise caution when sharing personal information online.

Credit Sesame is a highly esteemed online platform offering

credit monitoring services and tools designed to help

individuals enhance their credit scores and overall financial

well-being. With access to their credit report and score, users

can monitor their progress, obtain tailored recommendations for

credit improvement, and discover reasonably priced loan and

credit card opportunities.

With its easy-to-use interface, extensive financial education

resources, and dedication to security and privacy, Credit Sesame

stands out as an unrivaled choice for anyone seeking to take

charge of their credit and financial situation. In essence,

Credit Sesame serves as a trustworthy and valuable asset for

individuals aiming to improve their financial standing while

exploring options to build credit using debit.

^ We will issue you 35,000 Bonus Points with your paid purchase. The Smart TV is a 24" TV with apps for watching streaming videos. You may also use these Points for this or any other item we offer at our Reward Points Redemption Center. * According to Account terms. Certain restrictions apply.