Pros and Cons of Credit Sesame

As a prominent financial technology firm, Credit Sesame delivers a variety of services designed to aid users in enhancing their credit scores and attaining financial security. Nonetheless, it is crucial to weigh both the benefits and limitations of any financial resource before making a well-informed choice. In subsequent sections, we will delve into the assorted pros and cons of Credit Sesame, offering insights into each factor to assist users in deciding if the platform meets their distinct financial requirements and objectives.

PROS

Credit Sesame has become a popular choice for individuals seeking a versatile platform to address their financial needs. In this section, we will discuss the numerous benefits of using Credit Sesame that contribute to its widespread appeal among users aiming to enhance their credit scores and attain financial stability. Some of the key advantages of Credit Sesame include:

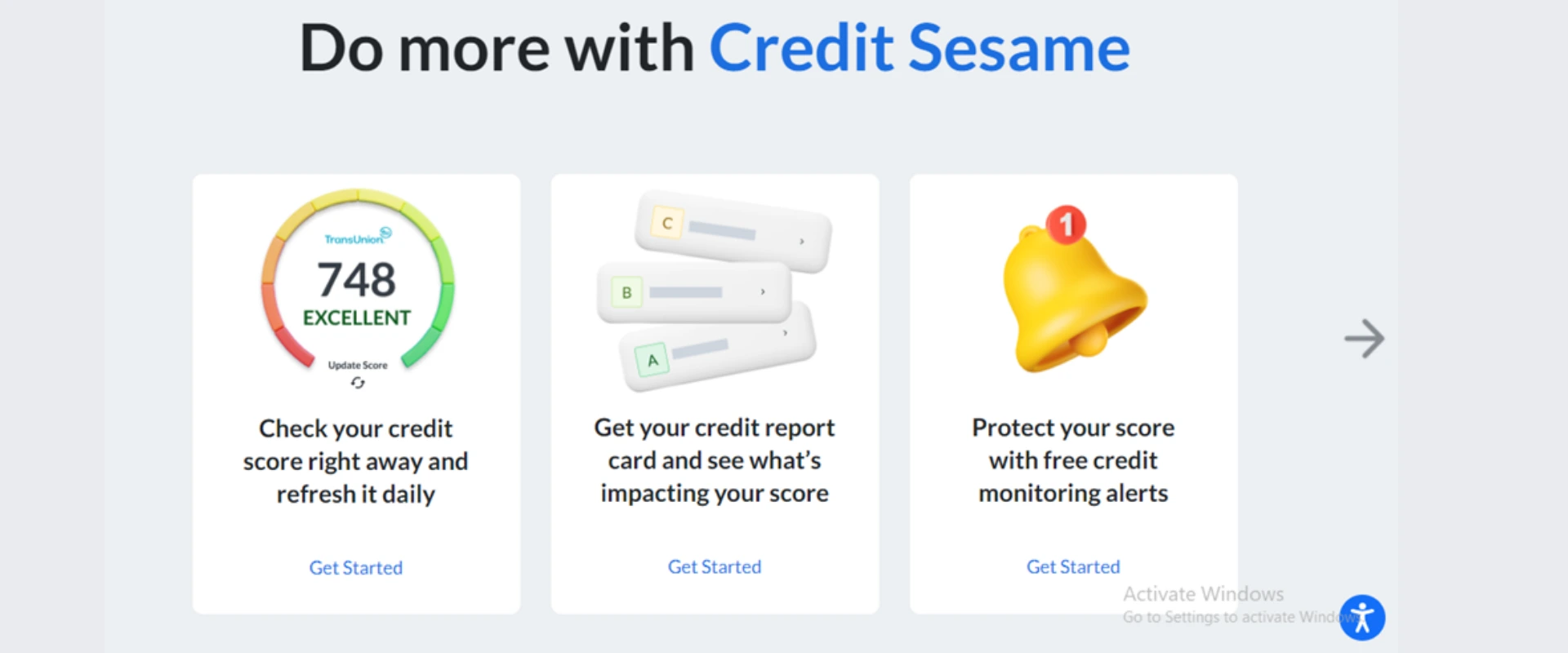

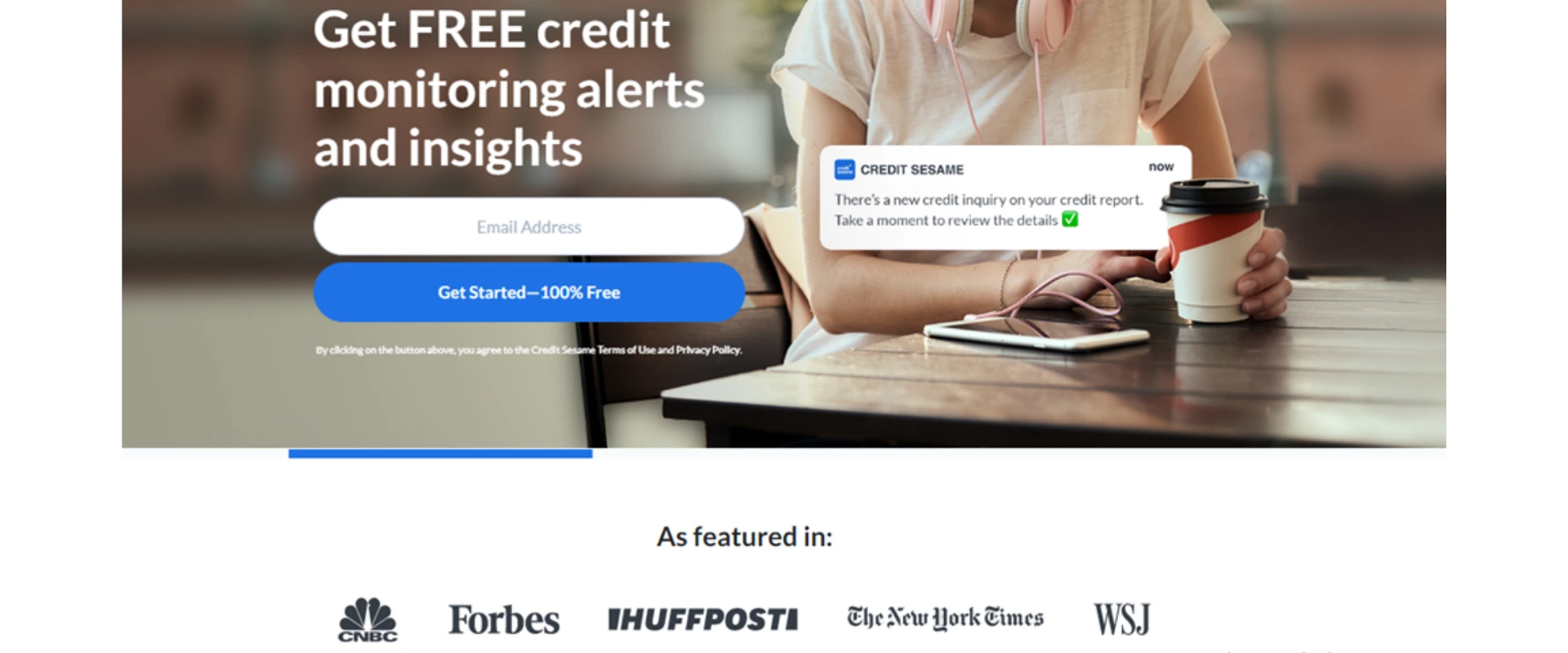

Complimentary credit monitoring: Users can take advantage of free credit score tracking, allowing them to stay informed about their credit scores and receive instant notifications about any updates in their credit reports.

Personalized Recommendations: The platform provides recommendations customized to each user's specific credit history, enabling them to make well-informed financial choices and bolster their credit scores.

All-inclusive financial resources: Credit Sesame grants users access to an array of tools and services that aid in managing their finances effectively, including personalized financial analysis and access to various financial products.

Variety of financial products: Credit Sesame links users to a diverse array of financial offerings, customized to their credit profiles and financial objectives, including loans, credit cards, and insurance plans.

Easy-to-use interface: The platform boasts a straightforward and user-friendly design, enabling users to effortlessly navigate and access the necessary features and tools.

Feature rich mobile app: The Credit Sesame mobile app permits users to handle their finances on-the-move, providing the same functionality as the web-based platform.

Protection against identity theft: The platform incorporates identity theft safeguards, granting users additional security and peace of mind.

Informative materials: Credit Sesame supplies users with informative articles, guidance, and advice on credit management and personal finance, helping them make informed financial choices.

Extensive user community: With a user base of over 15 million registered members, Credit Sesame has proven to be a dependable and trustworthy platform for managing personal finances and enhancing credit scores.

Credit building support: Credit Sesame not only provides insights into users' current credit scores but also offers valuable guidance and resources to help them build and improve their credit over time. By following personalized advice and utilizing the tools available on the platform, users can develop healthy financial habits, establish a positive credit history, and ultimately achieve higher credit scores, leading to better financial opportunities and stability.

Cons Of Credit Sesame

While Credit Sesame offers numerous advantages for users seeking to improve their financial standing, it is also essential to consider the potential drawbacks associated with the platform. In this section, we will discuss some of the disadvantages of Credit Sesame, shedding light on the aspects that users should be aware of when deciding if the platform aligns with their unique financial needs and goals. Some of the cons of Credit Sesame include:

- Limited credit bureau monitoring: Credit Sesame primarily provides credit scores and monitoring from one credit bureau, which may not provide a comprehensive picture of a user's overall credit health. Users seeking complete credit monitoring across all major bureaus may need to consider additional services.

- Potential targeted marketing: As Credit Sesame offers personalized financial product recommendations, users may receive targeted marketing and promotional offers from partner companies, which could be perceived as intrusive.

- No direct credit report access: Although Credit Sesame allows users to monitor their credit scores and receive alerts for changes in their credit reports, it does not provide direct access to full credit reports from the credit bureaus. Users may need to request their reports separately from the respective bureaus.

- Limited customer support: Some users have reported challenges in contacting Credit Sesame's customer support, which could be a drawback for those who require timely assistance with the platform or their account.

- Ad-supported platform: The free version of Credit Sesame's platform is supported by ads, which may be distracting or disruptive for some users. Those seeking an ad-free experience may need to consider upgrading to a premium plan or exploring alternative platforms.

In wrapping up, Credit Sesame has proven to be a helpful financial instrument, offering a range of benefits for users who aim to boost their credit scores and reach financial stability. The platform delivers all-inclusive services, a straightforward interface, and customized financial product suggestions, making it an efficient resource for many individuals. Nonetheless, it's crucial to also consider the possible disadvantages such as restricted credit bureau monitoring, targeted advertising, and the necessity for paid plans to unlock advanced options.

Taking the time to carefully assess the pros and cons mentioned above will enable users to determine if Credit Sesame is the right fit for their specific financial requirements and objectives. It's vital to keep in mind that each person's financial situation is unique, and the most suitable solution may differ based on individual circumstances and needs.