Company History

The Evolution of Experian

Experian’s storied past began in 1996 when TRW Inc. sold its Credit Data Corporation business to Bain Capital and Thomas H. Lee Partners, leading to the birth of Experian. TRW, an American corporation involved in various sectors, first ventured into the credit reporting industry in 1968 with the Credit Data Corporation. The enterprise quickly gained traction and emerged as one of the top five US credit agencies.

The Game of Corporate Musical Chairs: Experian’s Changing Hands

Over the years, Experian experienced multiple changes in ownership. Initially acquired by Bain Capital and Thomas H. Lee Partners, it was later sold to The Great Universal Stores Limited (GUS). GUS then merged Experian with its credit business, CNN, the UK’s leading credit service firm at the time. In 2006, GUS separated Experian from its operations and listed the company on the London Stock Exchange.

Experian Today: A Global Credit Reporting Powerhouse

Fast forward to the present day, and Experian now operates in 37 countries, boasting employees in over 100 countries worldwide. With headquarters in Dublin, Ireland, the company serves an impressive 25 million U.S. enterprises and 235 million individual customers. As a formidable competitor to TransUnion and Equifax, Experian stands proud as one of the “Big Three” credit-reporting agencies in the US.

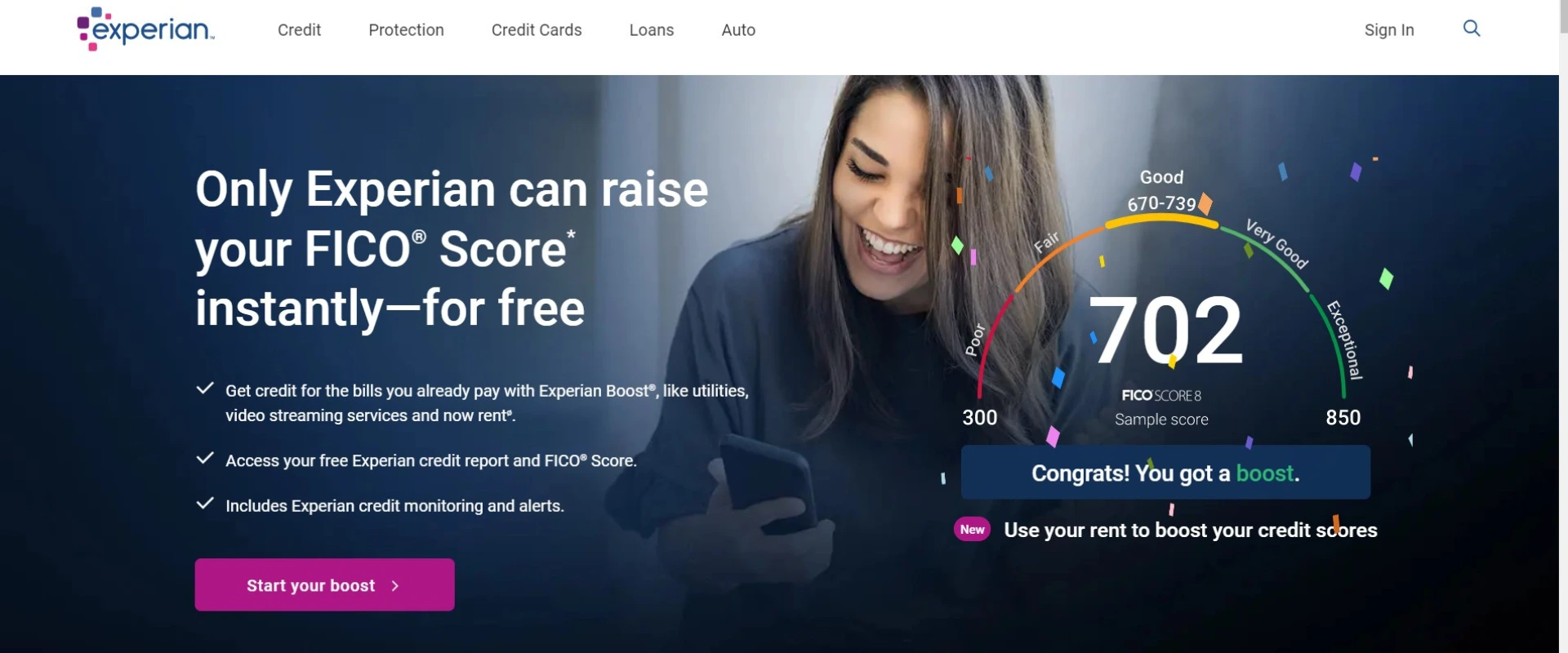

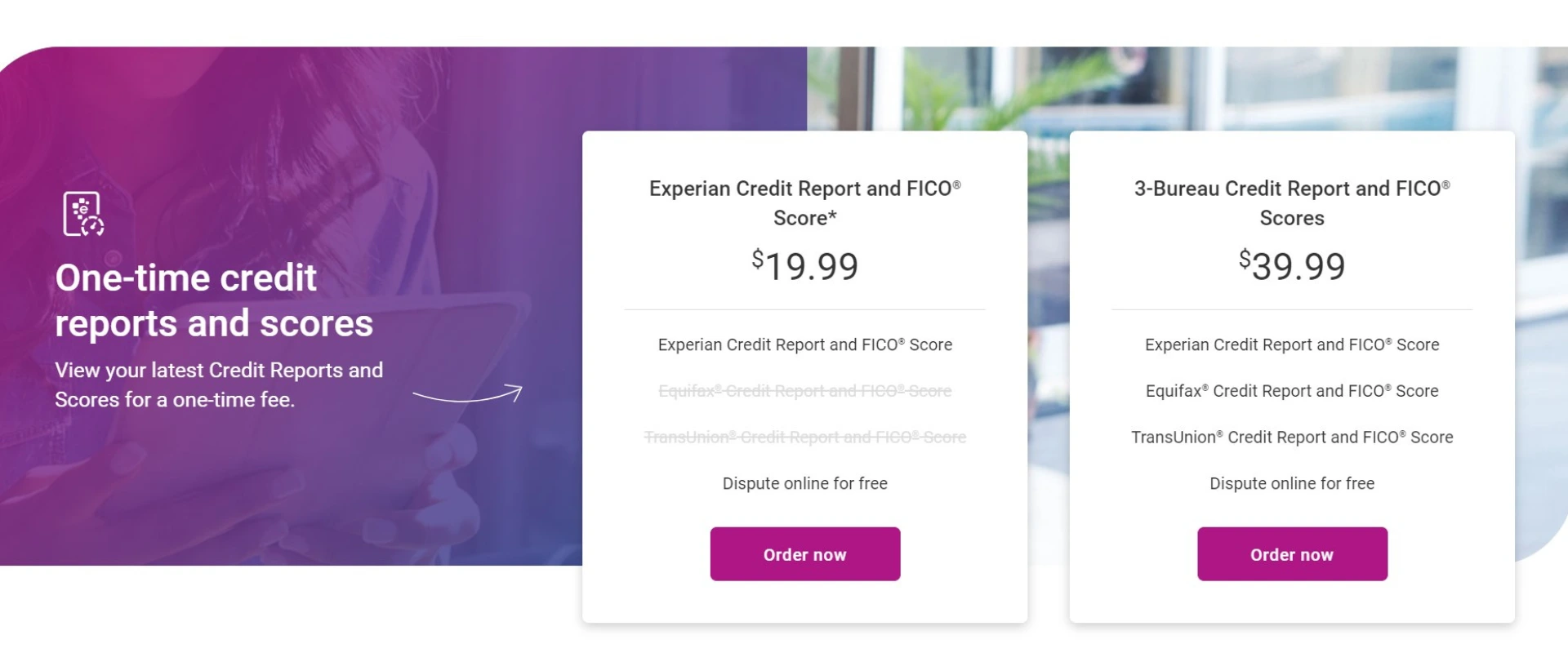

Navigating the World of Experian’s Offerings

Experian’s extensive range of services includes credit monitoring, fraud prevention, identity protection, and more. To begin your purchasing journey, visit Experian’s official website and explore the various products tailored to both individuals and businesses. You’ll find comprehensive explanations of their offerings, pricing details, and support resources to help you make an educated decision.

Experian’s rich history and expansive services make it a top contender in the credit-reporting industry.