FlexShopper vs National Credit Direct

If you are someone who takes great advantage of the rent-to-own

business model and a frequent rent-to-own shopper, you may not

have heard about National Credit Direct.

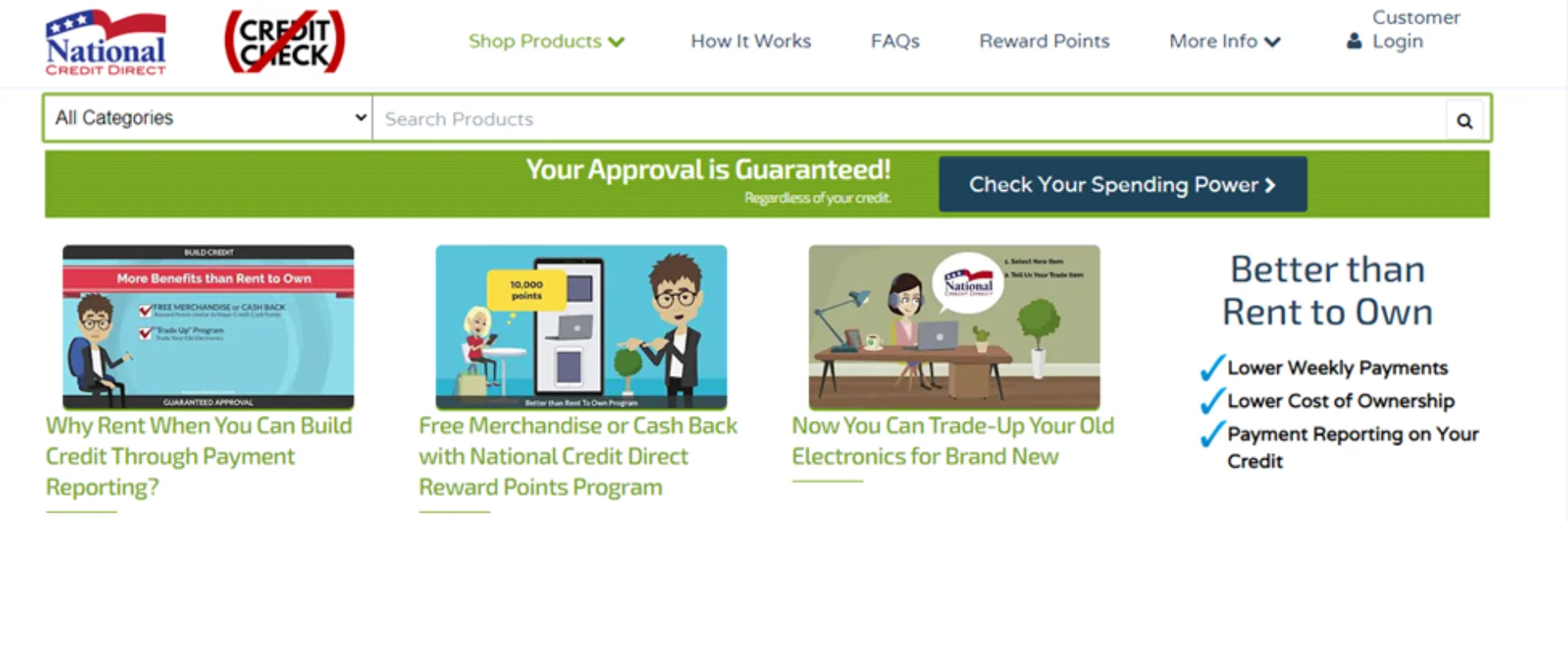

Even though National Credit Direct differs from rent-to-own

businesses in more ways than one, and the company is probably

much different from what you expect it to be, its excellent

program surpasses every other rent-to-own purchase program you

might ever come across.

Having said that, National Credit Direct is like a

lease-to-own/hybrid finance company that provides a vast range

of similar payments and products like any other rent-to-own

store. It provides affordable and flexible payment plans,

reports to credit bureaus, and assists thousands of individuals

in purchasing big-ticket purchases, which are otherwise hard to

buy upfront.

National Credit Direct's ability to offer no-credit-check

financing and an easy approval program is what differentiates it

from other businesses. This indicates your approval is

guaranteed, and your payment history will be reported.

New customers must make an initial payment and develop a

relatively short consecutive payment history. However, this only

applies to your first purchase with National Credit Direct,

after which you can order anything, and it will be shipped to

your doorstep. If you have suffered from credit issues

beforehand or are still suffering from them, and you would

prefer unnecessary interest rates and hidden charges, National

Credit Direct is your best bet for rent to own.

Apart from boasting a plethora of merchandise from top-notch

brands at flexible and affordable plans, National Credit Direct

will report your unsecured credit line every money to a

reputable credit bureau.

National Credit Direct is an excellent rent-to-own store for

those wishing to save money. It is relatively less costly

compared to other rent-to-own stores. Moreover, the company

takes great pride in having the best loyalty programs in the

rent-to-own market.

Much like the points you receive on your credit card, National

Credit Direct rewards its users 100 points for each dollar they

spend. These points you collect over time can be redeemed for

free merchandise or cash back.

However, if you are trying to sort your finances in an orderly

manner or wish to finance your own home or car one day, National

Credit Direct is your best bet. By offering top value and giving

you a chance to establish a solid payment history and get it

reported, National Credit Direct surpasses all other rent-to-own

stores.

National Credit Direct has been operational since 2006 and, since then, has been serving thousands of people. The company offers more than 15,000 consumer merchandise and goods across a vast array of categories. Some of these categories consist of the following:

After your first purchase, you will no longer need to go through

this process again, provided your account is operational and in

good standing. National Credit Direct ships extra purchases once

you place an order. The balance will be applied to your

revolving account contract.

The payment you make might stay the same on the following

purchase. As a result, this doesn’t impact your budget. Having

said that, here are the steps for how the National Credit Direct

no-credit-check approval process works:

After following these steps, you can expect to be approved for the rent-to-own purchase and program and start processing your favorite purchase for shipping.

Unlike other rent-to-own financing companies, National Credit

Direct does not check or inquire about your credit and measures

you on the basis of some credit score. The company only requires

you to build some kind of credit history by paying them a

minimal, single-time initial payment and 52 weeks of layaway

payments.

Still, once you pay for your purchase as agreed for just 6-13

weeks consecutively, National Credit Direct will finance the

remaining purchase price balance, order your product, and ship

it to your doorstep.

Once the company finances you and you start paying actively, it

will grant you a spending limit. This permits you to place

additional orders for your favorite products without requiring

an additional down payment.

If you want to contact the National Credit Direct customer service department, you can reach out to them via phone, mail, or email:

Phone

Customer Service: 208-779-3200 (Monday to Friday, 10 am to 7 pm

Eastern Time)

Email

For general questions regarding the company products or

services, you can contact National Credit Direct at

info@ncdfinancial.com

Mail

National Credit Direct, 3911 N. Schreiber Way, Coeur d’ Alene,

ID 83815

You can easily place your order(s) on National Credit Direct by following these simple steps.

Visit the National Credit Direct website at https://www.nationalcreditdirect.com/

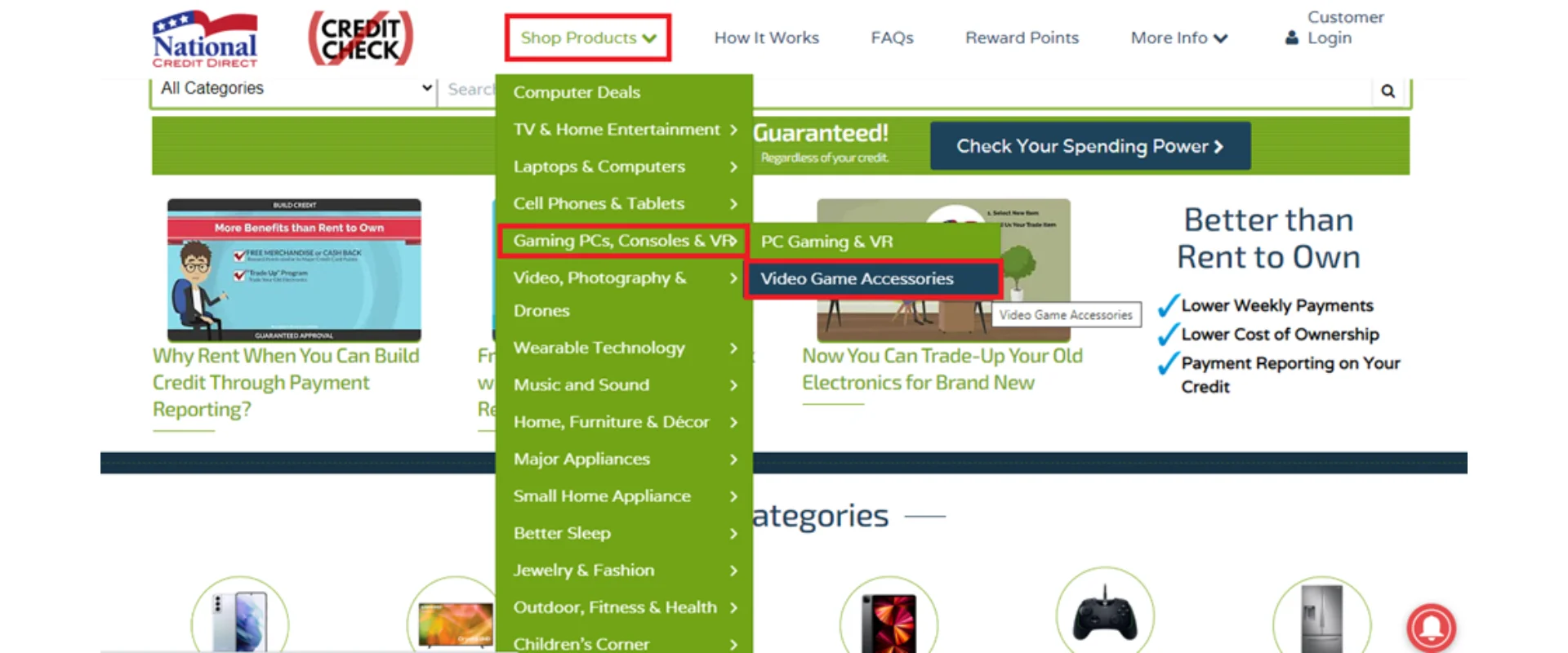

Here, you can choose from product categories. We will select the Gaming PCs, Consoles, and VR sections.

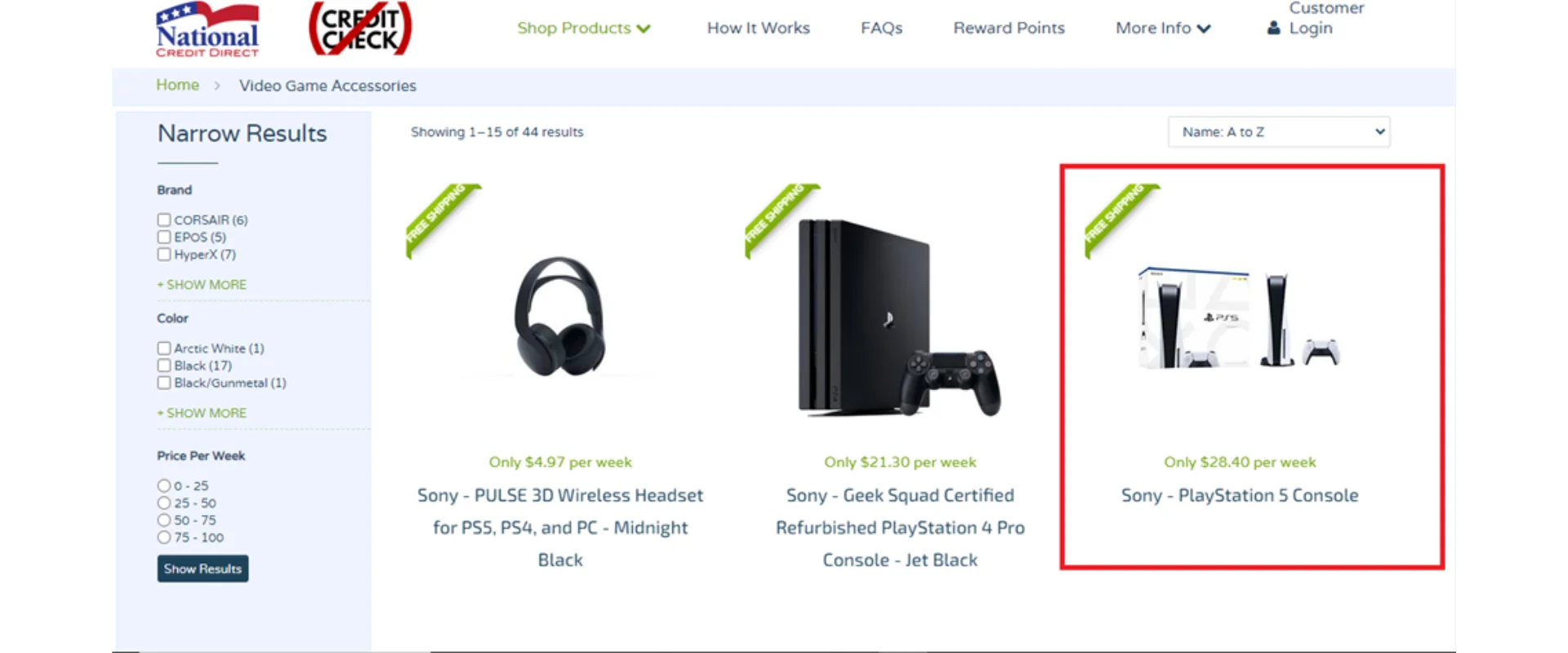

Next, narrow your search within the Gaming PCs, Consoles, and VR section product category. Here, we will choose "Video Game Accessories" Then, select your desired item.

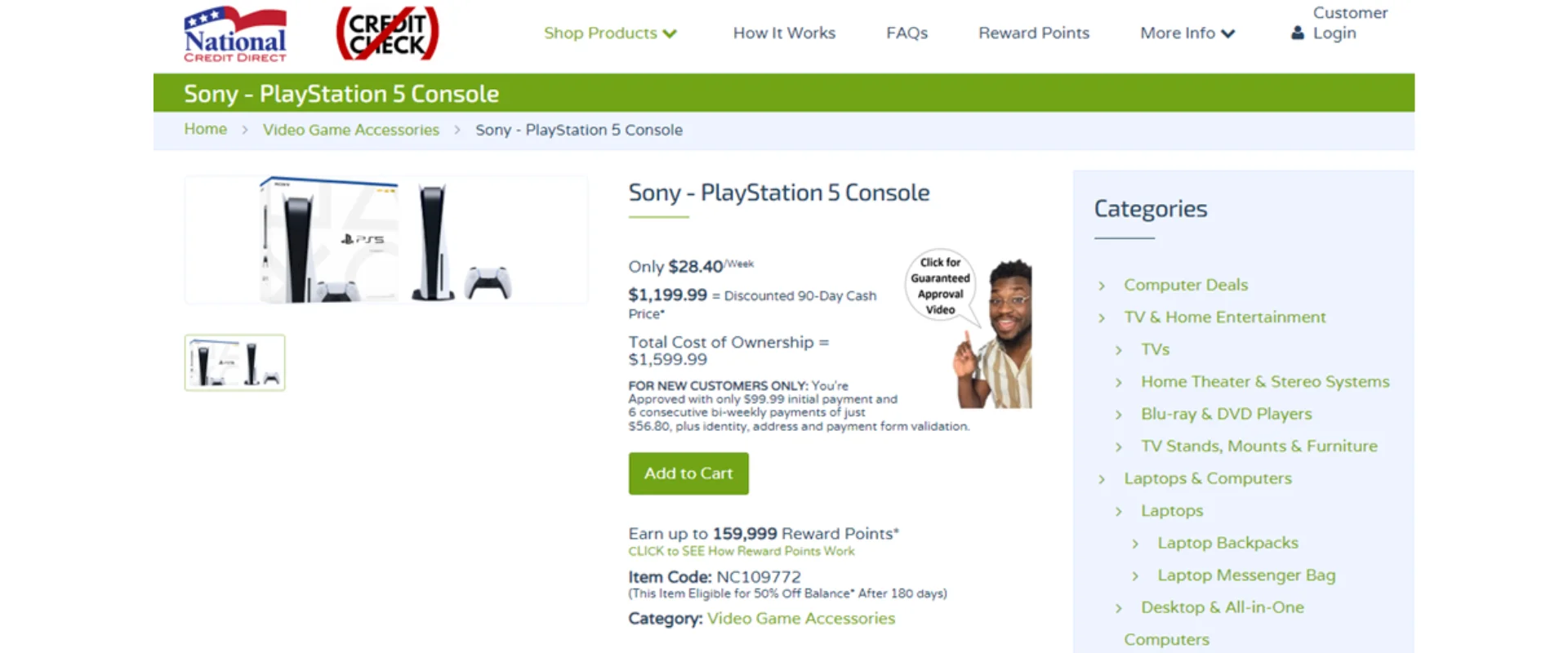

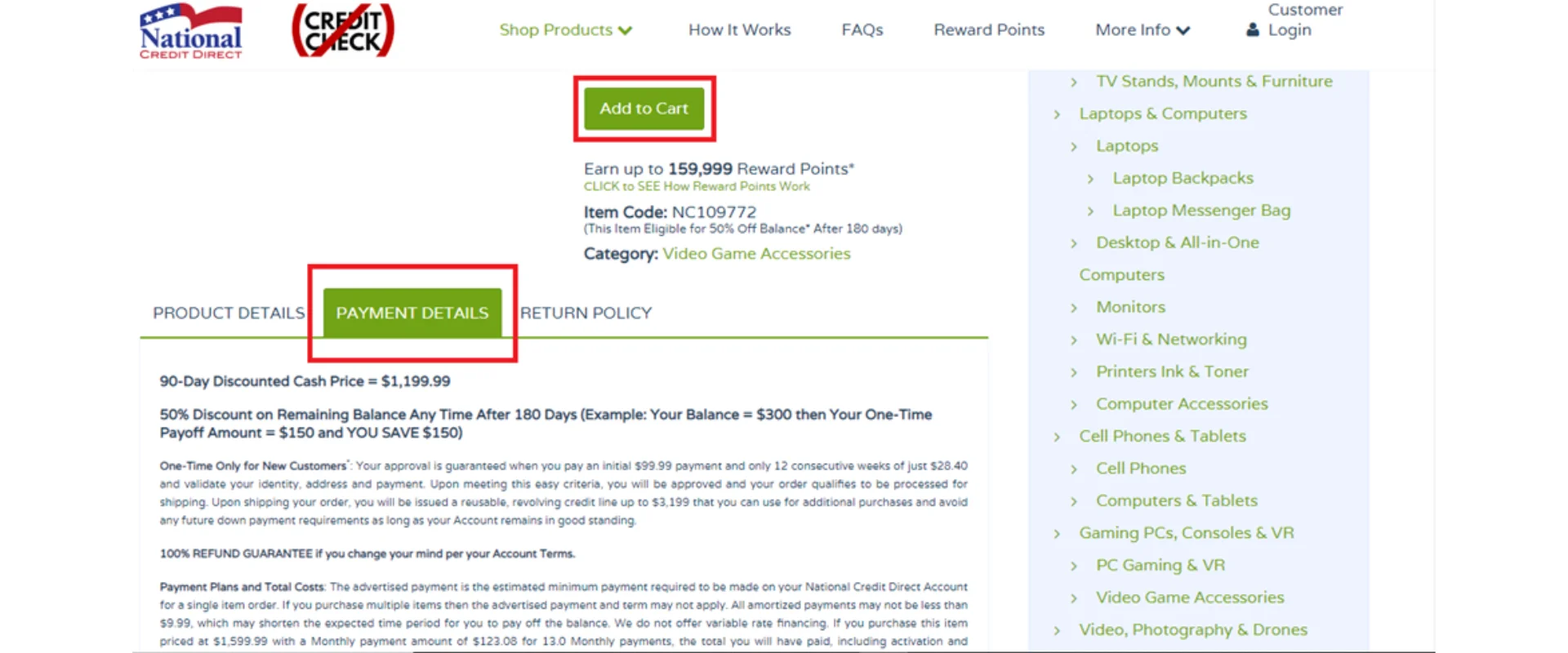

You can view the product details and detailed pricing plan for your favorite merchandise on National Credit Direct in terms of both total cost of ownership and weekly rates, discounted 90-day cash, redeemable reward points, etc.

After checking the product and payment details, you can add the product to your cart.

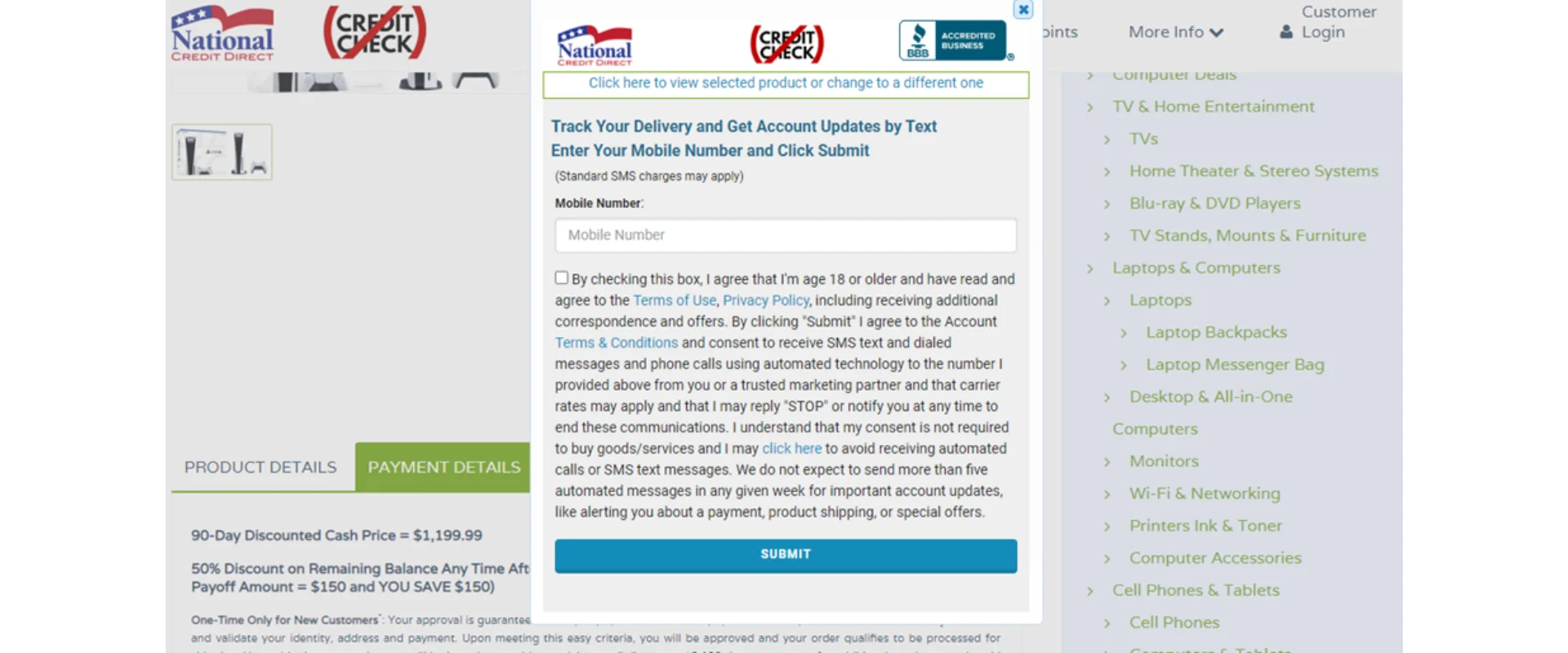

Next, enter all the relevant details, review the information, and confirm the order.

FlexShopper is another renowned lease-to-own business that

allows you to take one or more of hundreds of thousands of

name-brand items home without paying the total cost of the item

upfront.

Most shoppers have a hard time affording big-ticket items and

paying the full price for them in one go due to a lack of cash

in hand. This mainly applies to costly appliances, furniture,

electronics, etc. Others might be unable to buy these items via

conventional credit paths due to poor credit scores. This is

where FlexShopper plays a vital role.

If you are a shopper with less than a perfect credit score or

limited cash reserves, FlexShopper allows you to purchase new

items by making weekly payments towards possession of the final

item(s), all without hidden charges.

The payments are relatively small, so the overall payment

arrangement at FlexShopper is flexible and affordable for all.

While it is generally true that when it comes to rent-to-own

purchases, the cost can be comparatively higher than the normal

cost of an item.

However, FlexShopper customers can still find this a reasonable

trade-off for the convenience factor and overall rent-to-own

shopping experience.

If you lack the essential cash or available credit, FlexShopper

offers the ultimate solution to its customers in the form of

affordable weekly payments for renting to own merchandise in

under a year’s time or less.

If you want a wide range of product options and selections, FlexShopper is the ideal place to turn to. The platform offers over 100,000 products and lets you lease automobile tires and other products from renowned retail stores. Here are some popular product categories you’ll come across at FlexShopper.

Most of the online products on FlexShopper can be seen from Overstock, Best Buy, and Amazon. If you’re looking for niche or specialty items that hardly any other companies offer, it’s worth checking out FlexShopper’s extensive product selection.

The previous shopping experience that may have been overwhelming, impossible, or challenging can be made much more enjoyable and straightforward with FlexShopper. Here is how the lease-to-own program works at FlexShopper.

You must make the first payment upon receiving the product, while the remaining amount will be automatically deducted from your bank account. Once this period passes, you will gain ownership of your product(s).

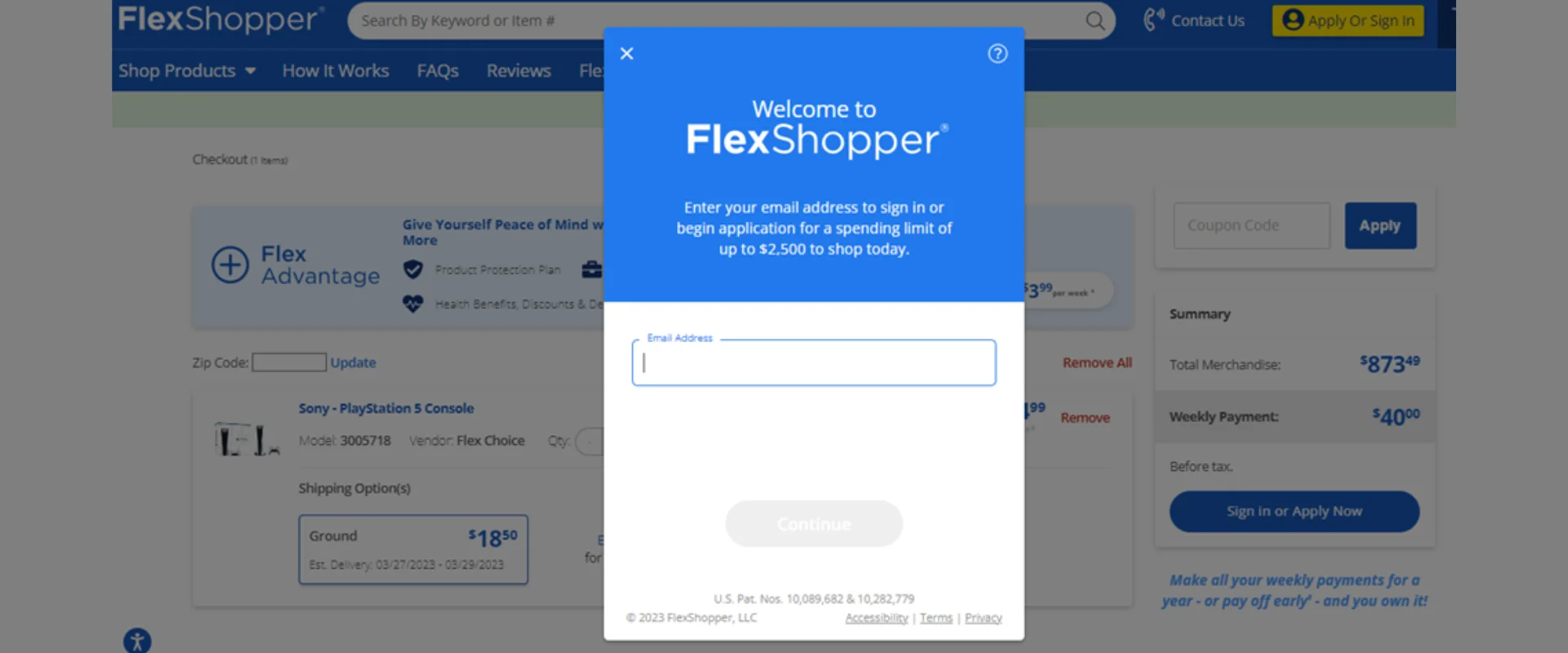

FlexShopper’s lease-to-own purchase program's approval program is fairly easy, fast, and free. The company aims to help people without cash or poor credit get the items they need today while significantly benefitting from the flexibility to pay off the amount over time.

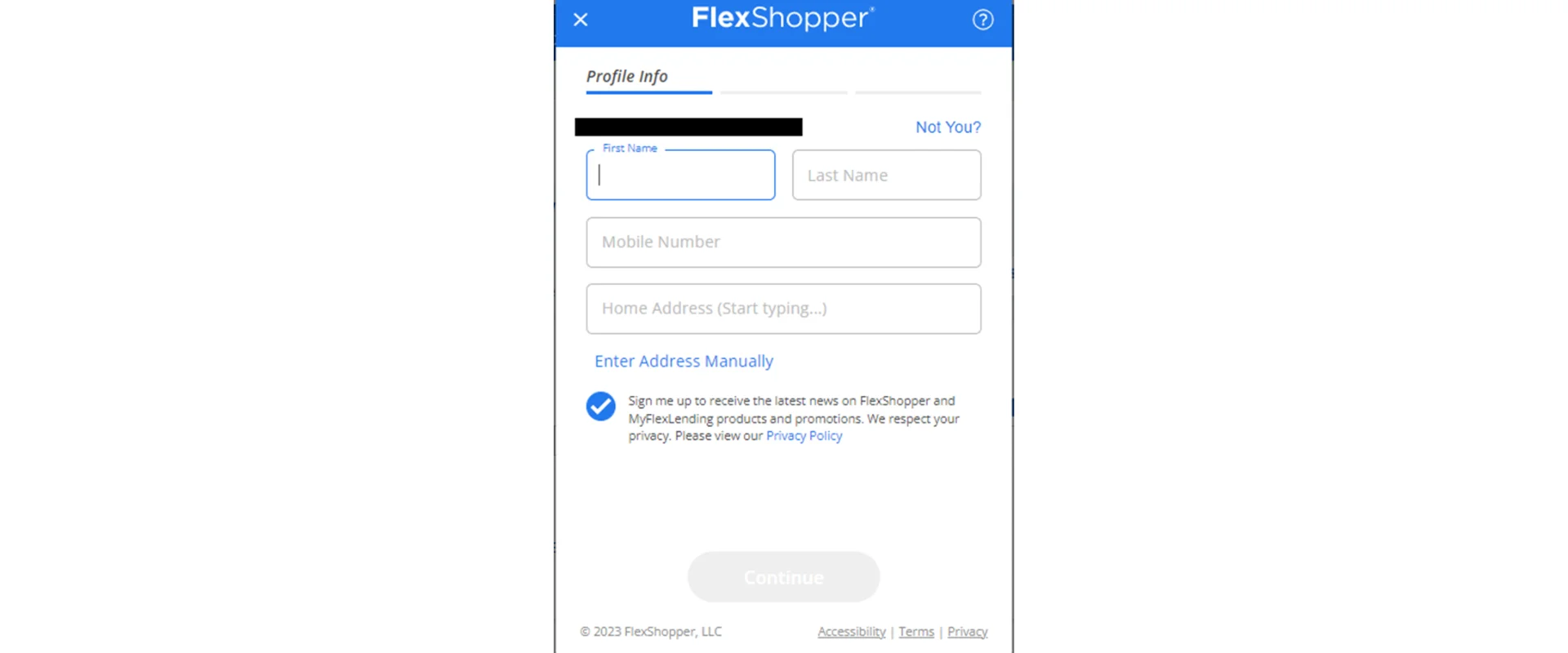

You can securely apply for an immediate spending limit of $2500 in just a few simple steps. Anyone can get approved for FlexShopper as long as they fulfill the specified requirements:

The chances of getting approved for the lease-to-own purchase program at FlexShopper are suitable for anyone who fulfills these criteria.

If you want to contact FlexShopper for queries, tracking order information, or returns, here is how you can reach out to them:

FlexShopper offers excellent weekly online chat support: Monday to Saturday – 9 am to 9 pm EST, and Sunday – 11 am to 6 pm EST.

If you wish to find your tracking number against your order, just log in to your account and go to View Orders. If you still cannot find your tracking number, email customer service at tracking@flexshopper.com.

For return purposes, you can email customer service at returns@flexshopper.com. FlexShopper is operational 6 days a week, Monday to Friday: 8 am – 10 pm, and Saturday, 8 am – 7 pm EST. It is closed on Sundays. If you wish to find your tracking number against your order, just log in to your account and go to View Orders. If you still cannot find your tracking number, email customer service at tracking@flexshopper.com.

You can easily place your order(s) on FlexShopper by following these simple steps.

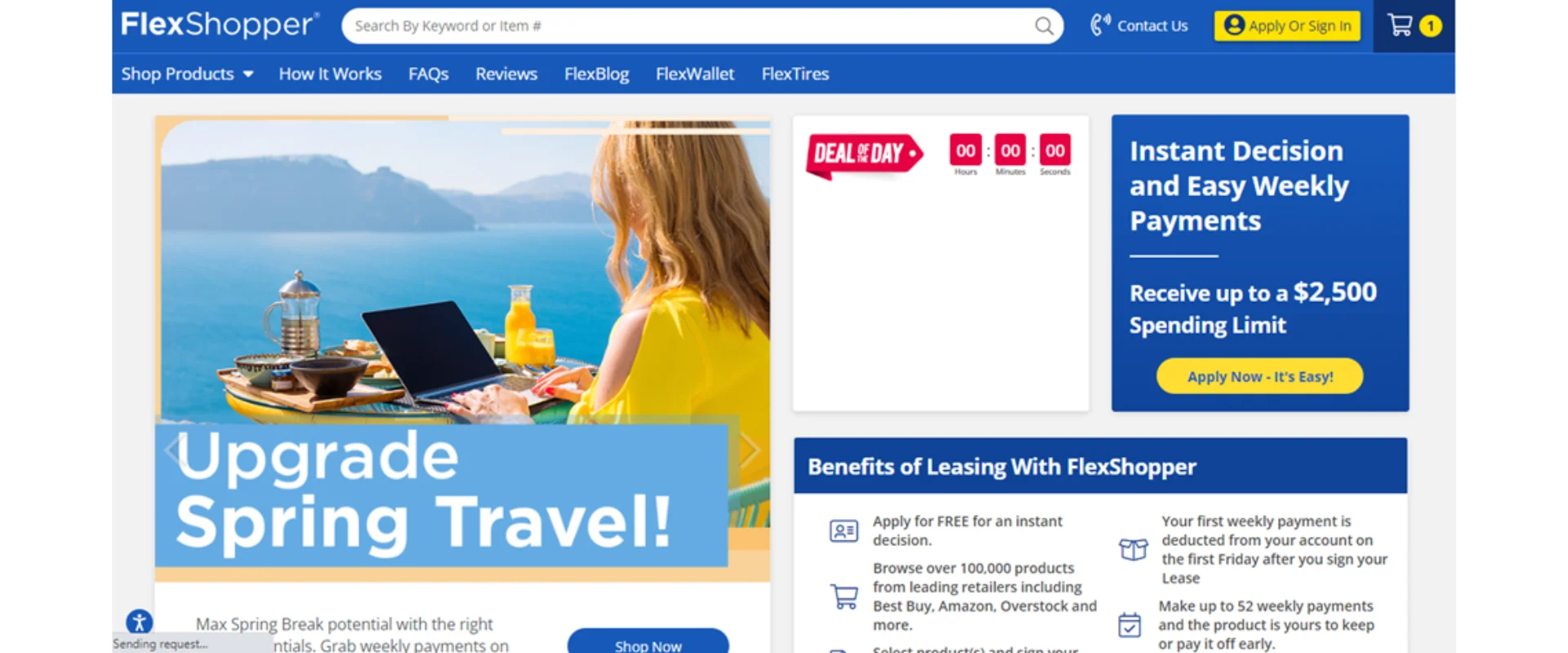

Visit the FlexShopper website at https://www.flexshopper.com/.

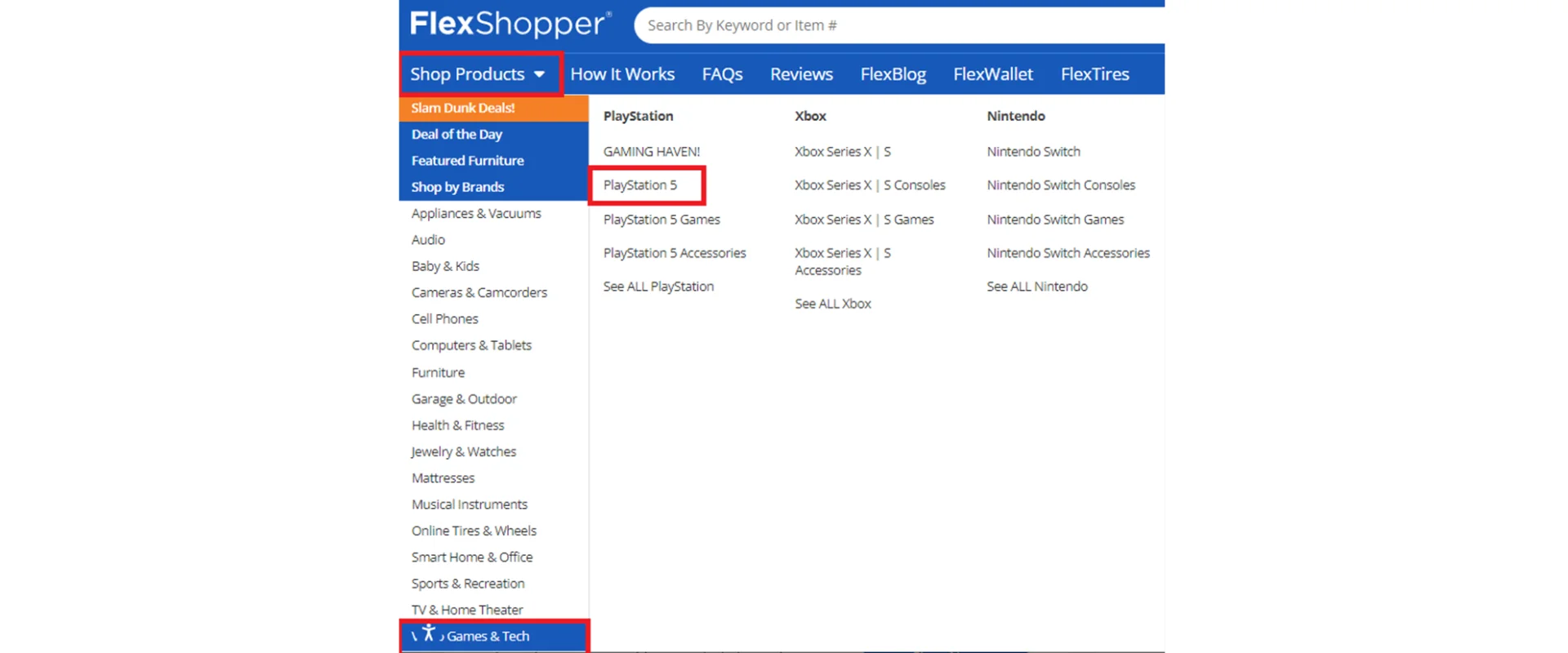

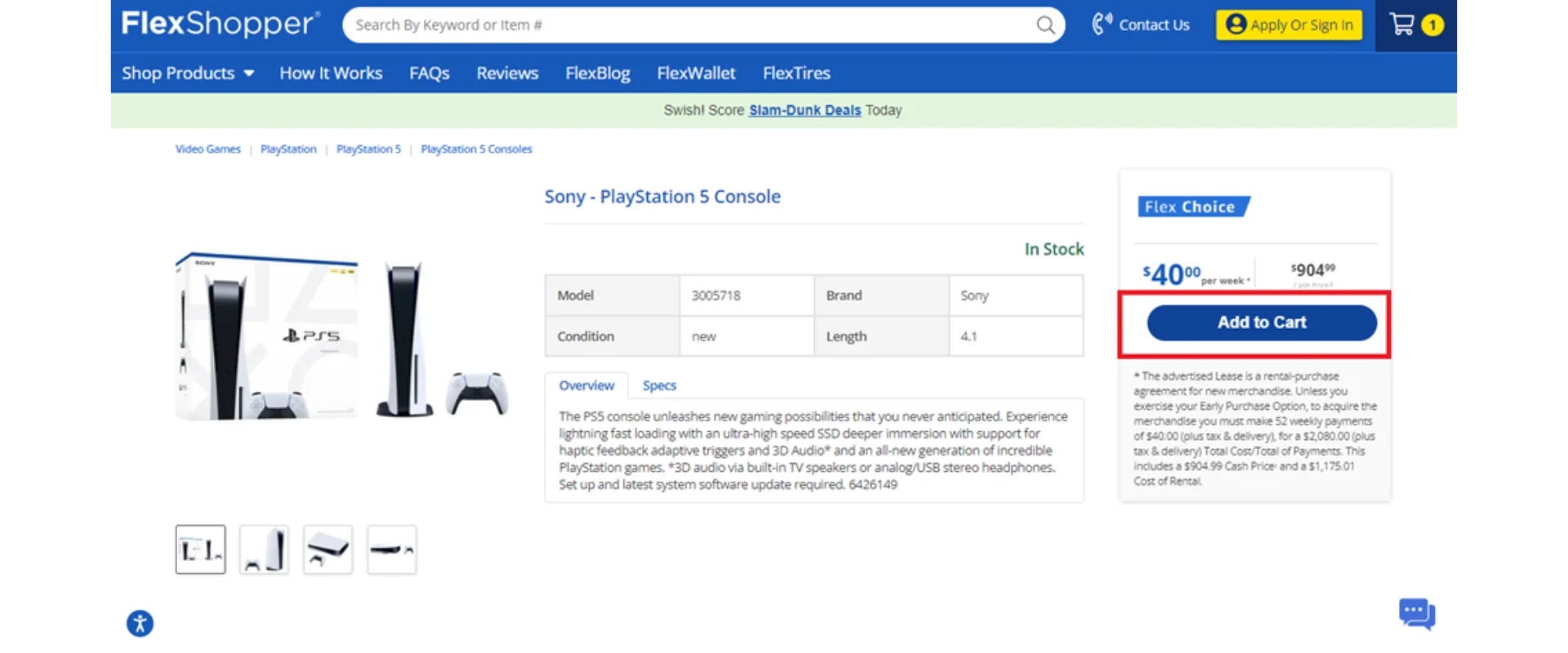

Here, you can choose from product categories. We will select the Video Games and Tech section.

Next, narrow your search within the Video Games and Tech section. Here, we will choose “PlayStation 5” Then, select your desired item.

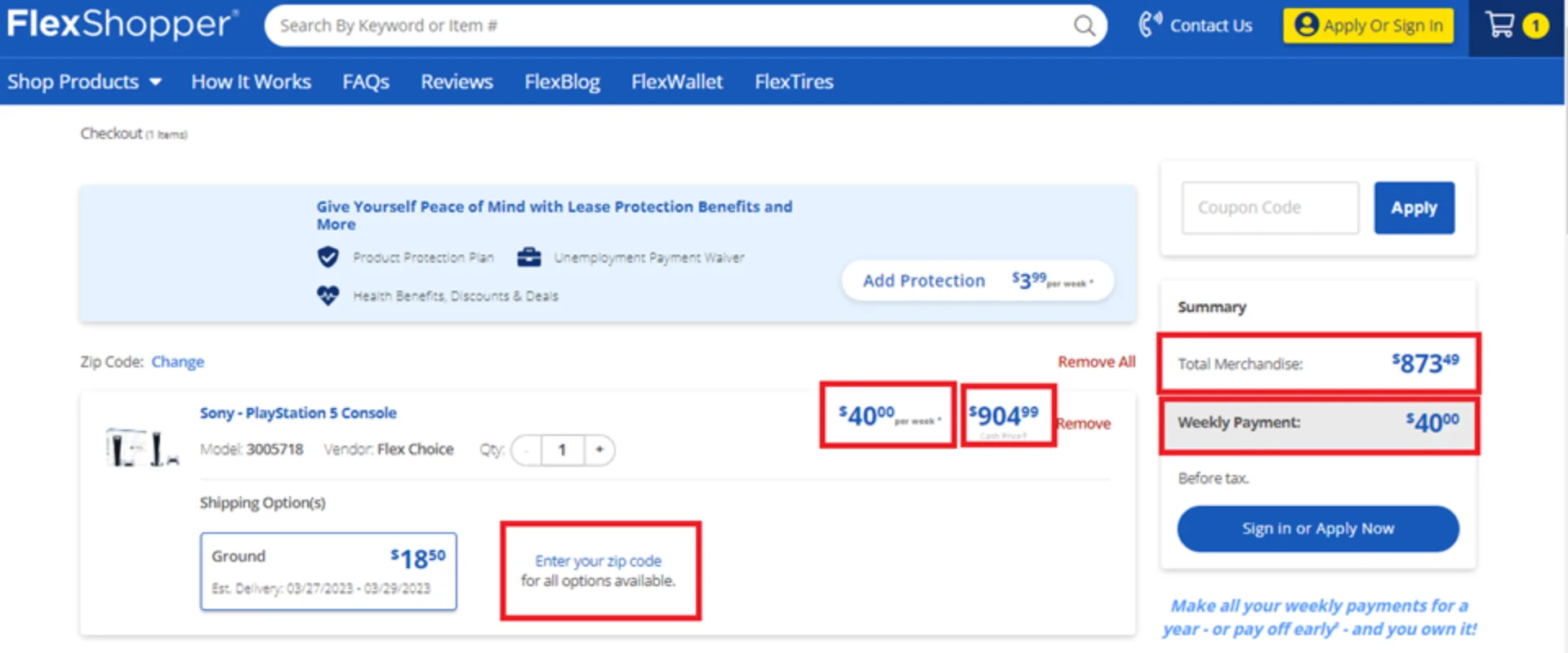

You can view the product details and detailed pricing plan for your favorite merchandise on FlexShopper in terms of both total payments and weekly rates, cost of the rental, and cash price.

Next, enter all the relevant details, review the information, and confirm the order.

While plenty of other rent-to-own businesses you will come across serve their customers well in their own way, National Credit Direct especially stands out in the rent-to-own market due to its ability to finance users without performing credit checks.

It is the only legit company operating on a no-credit-check basis across the country. While many other companies claim to not check your credit either, you will often experience quite the opposite as it is usually stated in their Terms and Services conditions in fine print that they check your credit.

National Credit Direct's unique credit algorithm allows it to determine when and how much money is needed to finance your purchase. In addition, the company guarantees approval, which is fairly easy and quick.

^ We will issue you 35,000 Bonus Points with your paid purchase. The Smart TV is a 24" TV with apps for watching streaming videos. You may also use these Points for this or any other item we offer at our Reward Points Redemption Center. * According to Account terms. Certain restrictions apply.