Ovation Credit

Ovation Credit’s main objective is to help individuals boost their credit scores and attain financial stability.

Ovation Credit’s main objective is to help individuals boost their credit scores and attain financial stability.

In our modern, fast-moving world, a solid credit score is crucial for achieving financial security. However, what if your credit requires some improvement? That's when credit repair services come into play, offering assistance to get your finances back on track.

In our modern, fast-moving world, a solid credit score is crucial for achieving financial security. However, what if your credit requires some improvement? That's when credit repair services come into play, offering assistance to get your finances back on track. With a wide array of options, Ovation Credit stands out as a preferred choice for individuals aiming to enhance their credit scores. In this all-encompassing Ovation Credit review, we'll examine the company's offerings, assess its strong and weak points, and ultimately help you decide if it's worth a try. Get ready to join us on an insightful expedition as we unravel the facts about this credit repair competitor.

Established with the goal of delivering efficient credit repair services, Ovation Credit has earned a solid reputation in the industry. The company's main objective is to help individuals boost their credit scores and attain financial stability. Boasting a team of seasoned experts, Ovation Credit is committed to providing customized assistance designed to address each client's distinct financial needs.

What distinguishes Ovation Credit from other players in the field is its dedication to fostering a transparent and educational environment for its clients. The company extends a variety of credit repair services, such as disputing inaccuracies on credit reports, liaising with creditors, and offering guidance on strategies for building credit.

Moreover, Ovation Credit recognizes that the requirements and objectives of each client vary. Consequently, they present tailored credit repair plans to ensure every person receives the proper support. Their intuitive online platform also enables clients to monitor their progress and access valuable tools to advance their financial knowledge.

The exceptional customer service provided by Ovation Credit is apparent in their responsive and attentive support staff. Clients can depend on open communication and expert recommendations throughout the credit repair journey. The company's established history of success, combined with its devotion to empowering clients, guarantees an enriching and satisfying experience for those aiming to enhance their financial status.

In conclusion, Ovation Credit is a credit repair firm that delivers all-encompassing, bespoke solutions designed to aid individuals in reaching their financial objectives. By focusing on education, transparency, and tailored assistance, Ovation Credit ensures a captivating and valuable experience for clients aiming to improve their credit ratings and overall financial well-being.

As we delve deeper into Ovation Credit, it's essential to explore the roots of this reputable credit repair firm. Understanding the company's history provides valuable context, shedding light on its growth, commitment to clients, and dedication to service excellence.

Ovation Credit's journey began with a vision to offer effective credit repair solutions to individuals seeking financial stability. Over the years, the company has evolved, expanding its team and honing its expertise. The foundation of Ovation Credit's success is built upon a strong commitment to personalized service, understanding that each client's financial situation is unique.

From its inception, Ovation Credit has remained focused on providing transparency and education to its clients. The company's passion for empowering individuals with the knowledge and tools needed to navigate the complex world of credit repair has fueled its growth and earned it a loyal customer base.

Throughout its history, Ovation Credit has continuously adapted to industry changes and embraced new technology to enhance its services. Their user-friendly online platform, launched as part of this commitment, allows clients to monitor their progress and access a wealth of educational resources.

The company's dedication to exceptional customer service has remained unwavering since day one. Ovation Credit's responsive and attentive support staff play a crucial role in maintaining the high level of satisfaction among its clients. This focus on providing expert guidance and open communication has solidified Ovation Credit's position as a trusted partner for individuals seeking to improve their financial standing.

In summary, Ovation Credit's storied history is marked by a steadfast commitment to client success, transparency, and education. The company's growth and evolution have been driven by a strong foundation and dedication to delivering personalized credit repair solutions. With a keen understanding of its clients' unique needs, Ovation Credit has built a legacy of empowering individuals to achieve their financial goals.

As we assess Ovation Credit's services in our review, it's essential to consider both the benefits and drawbacks associated with their offerings. By examining the pros and cons, we can provide a well-rounded perspective, enabling you to determine if Ovation Credit is the right choice for your credit repair needs. Let's dive into the key aspects of their services to help you make an informed decision on whether to partner with Ovation Credit.

Before we dive into the distinct benefits of Ovation Credit, it's essential to recognize the key factors that contribute to their success. In this portion, we will focus on the numerous positive aspects that differentiate Ovation Credit from its competitors, shedding light on the effectiveness of their credit repair services. Armed with this insight, you'll be better equipped to determine if Ovation Credit is the most suitable partner to support your financial aspirations.

By examining these pros, you can gain a better understanding of the strengths and advantages that Ovation Credit offers. With this information, you can make a well-informed decision about whether their credit repair services are the best fit for your financial goals.

While we have delved into the many advantages of Ovation Credit, it's crucial to evaluate the potential downsides as well. In this section, we will outline the various cons connected to Ovation Credit's services, offering you a more balanced perspective on their credit repair solutions. Being mindful of these potential drawbacks will help you make a well-rounded decision when deciding if Ovation Credit is the ideal partner for your financial objectives.

Taking these additional cons into account will further contribute to a well-rounded understanding of Ovation Credit's services, allowing you to make an educated decision about whether their credit repair solutions align with your financial needs.

Over the years, Ovation Credit has earned a favorable reputation as a credit repair service provider. With nearly two decades of experience since its founding in 2004, the company has become a well-established presence in the credit repair landscape.

Ovation Credit has achieved accreditation with the Better Business Bureau (BBB) and boasts an impressive A+ rating. This reflects their dedication to delivering exceptional customer service and maintaining a positive image in the industry. Moreover, Ovation Credit is known for presenting transparent information regarding its services, pricing, and procedures on its website.

Below are some authentic customer reviews from various online sources:

"I've been using Ovation Credit for a few months now, and I'm so happy with the results. They were able to identify and dispute inaccurate information on my credit report, which has resulted in a significant increase in my credit score. I highly recommend it," says Sarah .

"Ovation Credit has been a game-changer for me. My credit was in poor shape due to some inaccuracies on my credit report, and I didn't know where to start. Ovation Credit's team analyzed my credit reports and sent dispute letters on my behalf. Within a few months, I saw improvements in my credit score," says Michael.

"I was skeptical at first, but Ovation Credit has exceeded my expectations. They've been able to remove several negative items from my credit report, and their customer service has been supportive as well." says Jessica R.

Ovation Credit has often been compared to DisputeBee. Well, here’s the comparison:

Credit Sesame is renowned for its all-inclusive offerings and easy-to-use interface, supplying users with complimentary credit monitoring, alerts, and tailored financial guidance. The service presents a VantageScore credit rating, derived from information gathered by TransUnion, one of the three primary credit bureaus. Furthermore, Credit Sesame recommends various financial products, including loans, credit cards, and insurance policies, in accordance with a user's credit background and financial aspirations. The platform also features a mobile app, enabling users to manage their finances with ease while on the move.

When comparing Ovation Credit to DisputeBee, several key differences between the two services become apparent. Here's a side-by-side comparison:

Ovation Credit takes a hands-on approach, offering customized credit improvement plans and a team of credit experts to guide you through the process. In contrast, DisputeBee.com is a do-it-yourself credit repair software platform, which requires you to manage the process independently.

Both Ovation Credit and DisputeBee.com provide credit education resources. However, Ovation Credit may offer a more comprehensive range of educational materials and personalized guidance from their credit experts.

Ovation Credit actively engages with credit bureaus and creditors on your behalf as part of their credit restoration process. They handle disputes and follow up with credit bureaus and creditors to resolve inaccuracies. DisputeBee.com supplies templates and tools for drafting and sending dispute letters to credit bureaus and creditors, but you are responsible for the communication.

By understanding these differences, you can make an informed decision on which service better aligns with your credit repair needs and preferences.

| Factors | Ovation Credit | DisputeBee.com |

|---|---|---|

| Service Level | Hands-on approach with personalized plans | DIY credit repair software platform |

| Legal Compliance | Operates within credit repair regulations | Provides tools for self-management; compliance is your responsibility |

| Additional Services | Credit monitoring and identity theft protection services | Focuses primarily on credit repair |

| Credit Education | Extensive educational | Credit education resources |

| materials and personalized guidance | provided | |

| Experience | Has many years of experience | Relatively newer platform |

Ovation Credit and CreditRepair.com are both established credit repair companies that offer a range of services. Let's compare the two:

Ovation Credit provides credit analysis, dispute letters, credit monitoring, and personalized credit coaching to assist clients in understanding their credit reports and improving their credit scores. CreditRepair.com offers similar services, including credit analysis, credit dispute letters, credit monitoring, and personalized credit score improvement plans.

Ovation Credit offers two pricing plans - Essentials and Essentials Plus - with different service levels and features. CreditRepair.com uses a tiered pricing model with three plans - Basic, Moderate, and Aggressive - offering different levels of service and dispute intensity.

Ovation Credit uses a traditional credit repair approach, where they initiate disputes with credit bureaus and creditors on behalf of their clients. CreditRepair.com employs a more technology-driven approach with its patented online dispute process, allowing clients to track and monitor disputes in real-time through an online portal.

By analyzing these differences, you can better assess which service provider aligns with your credit repair needs and preferences.

| Factors | Ovation Credit | Credit Repair.com |

|---|---|---|

| Availability | Available in all states in the United States. | Available in all states in the U.S. except for Kansas and South Carolina. |

| Money-back Guarantee | Offers a Proactive Service Warranty, where clients can | Offers a satisfaction guarantee in which you can |

| request a refund for unused services. | get your money back if you are not satisfied. | |

| Discount | Offers a 20% discount for couples who enroll together. | No discount available |

| Online Experience | Does not have a mobile app | Online dashboard and mobile app for easy access |

| Plans | Essentials and Essentials Plus plans with different levels of service and features | Basic, Moderate, and Aggressive plans with varying levels of service and dispute intensity |

Ovation Credit and Lexington Law are two popular credit repair companies that offer similar services. Here's a breakdown of how they compare:

Ovation Credit offers credit analysis, dispute letters, credit monitoring, and personalized credit coaching to assist clients in improving their credit scores. Lexington Law also offers credit analysis and dispute letters, but they also provide identity theft protection and legal interventions.

Ovation Credit offers two pricing options: Essentials and Essentials Plus, with different levels of service and features. In contrast, Lexington Law offers three pricing tiers: Concord Standard, Concord Premier, and PremierPlus, with varying levels of service and pricing.

Ovation Credit follows a traditional credit repair approach, initiating disputes with credit bureaus and creditors on behalf of clients. Lexington Law employs a direct and attorney-led approach, with dedicated paralegals and attorneys to handle credit disputes.

While Ovation Credit does not have a mobile app, Lexington Law provides an online portal and mobile app for clients to track their progress, communicate with credit advisors, and access educational resources.

By analyzing these differences, you can make an informed decision about which credit repair company best aligns with your needs and preferences.

| Factors | Ovation Credit | Lexington Law |

|---|---|---|

| Availability | Available in all states in the U.S. | Available in all states in the U.S. except for Oregon and North Carolina. |

| Money-Back Guarantee | Offers a Proactive Service Warranty, where clients can request a refund for unused services. | Offers a refund policy if no improvements are made to the client's credit reports within the first 90 days of service. |

| Reputation | Has a decent reputation, but individual research and checking BBB ratings are recommended. | Has a strong reputation and is one of the oldest credit repair companies in the industry, with positive BBB ratings. |

| Pricing | Offers two plans: Essentials and Essentials Plus | Offers three plans: Concord Standard, Concord Premier, and PremierPlus |

| Credit Education | Provide some credit education resources to clients. | Offer credit score analysis, financial management tools, and personalized credit coaching. |

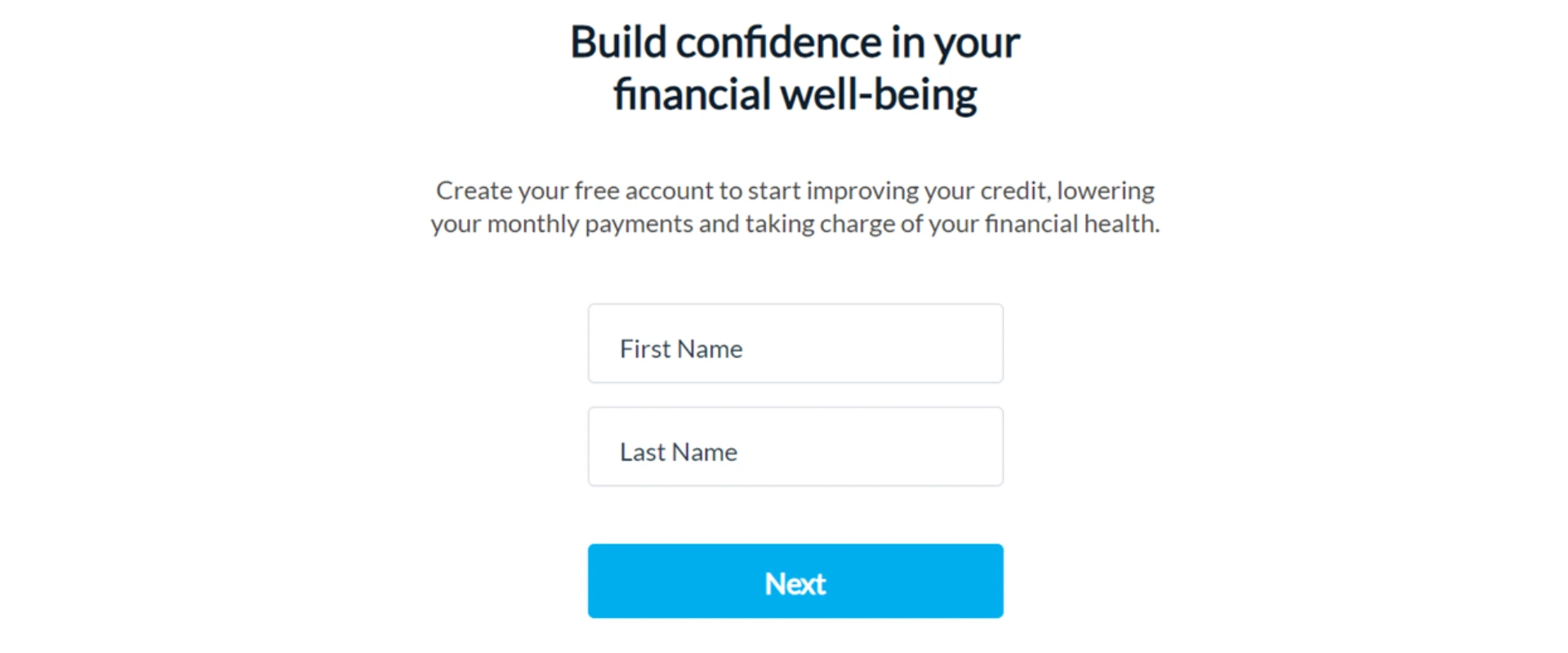

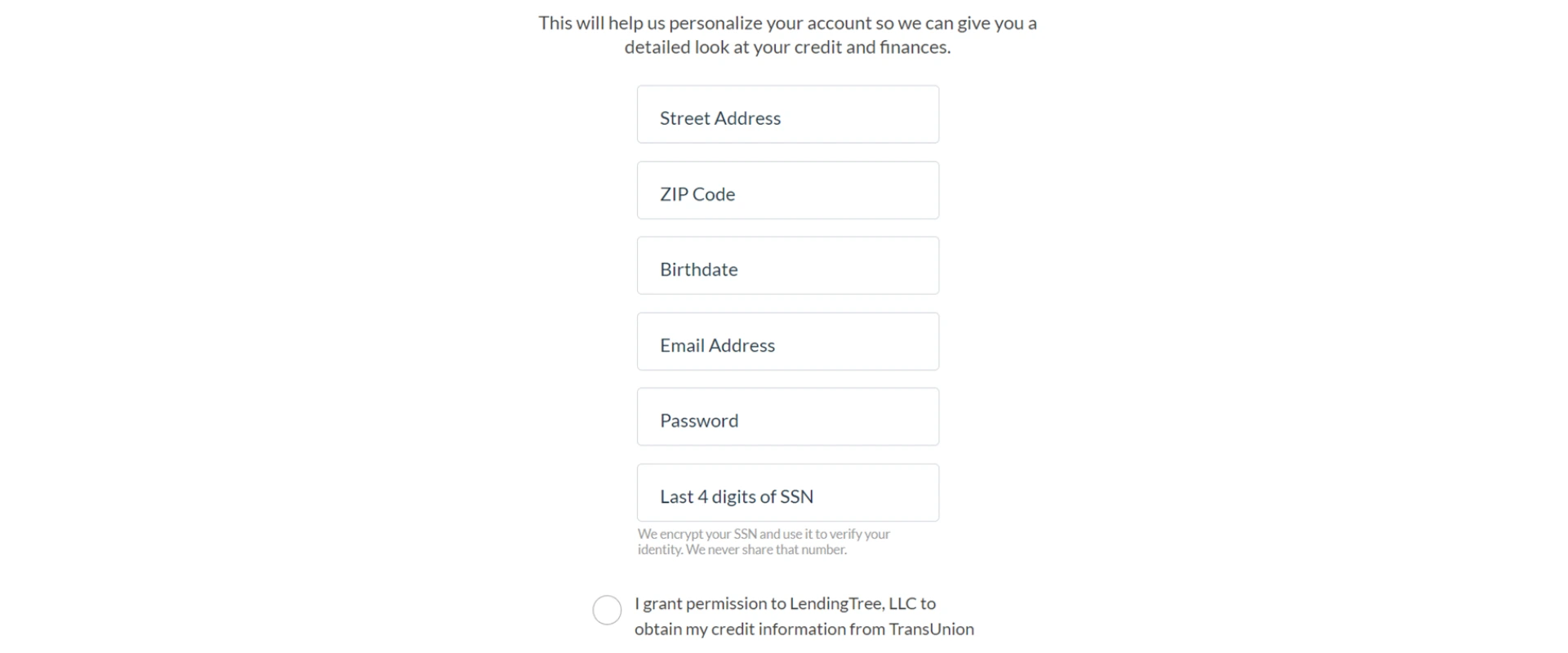

To place an order, follow these steps:

After submitting your order, you may receive a confirmation email or other communication from Ovation Credit with further instructions on how to proceed with their credit repair services.