Perpay Reviews

Perpay is a unique service that allows you to buy products now and pay for them over time. The company offers various products, from electronics and appliances to furniture and clothing. The process is incredibly simple: choose the desired product, and Perpay purchases it on your behalf. You then make payments over a six- to 12-month period with no interest charges or fees.

One thing that sets Perpay apart from other buy-now-pay-later services is that it doesn’t require a credit check. So even if you have poor credit or no credit history, you can still use Perpay to purchase products.

Perpay reviews are feedback from customers who have used the service. These reviews can provide valuable insights into the customer experience, including ease of use, product quality, and customer service.

Reading Perpay reviews can help you make an informed decision about whether or not the service is right for you. By learning from the experiences of others, you can avoid pitfalls and make the most of Perpay’s benefits.

When it comes to managing your finances, it’s crucial to do some research. By reading Perpay reviews, you can learn about the service and determine if it’s a good fit for you.

Reviews can also help you avoid scams and fraudulent services. By reading about others’ experiences, you can identify red flags and make an informed decision about whether to use Perpay.

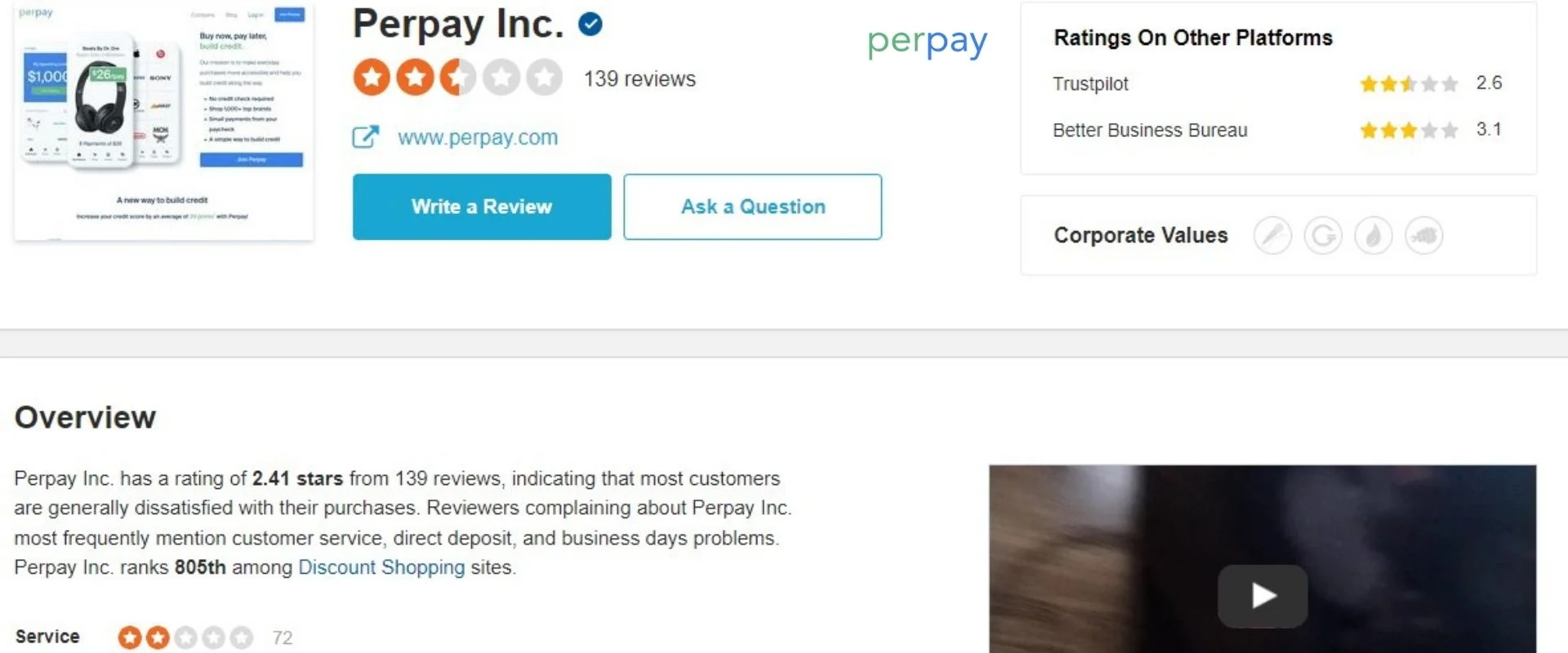

There are several places to find Perpay reviews. One of the most popular is Trustpilot, a website that allows customers to leave reviews of businesses and services. Perpay has a Trustpilot rating of 4.4 out of 5, based on over 2,500 reviews.

You can also find Perpay reviews on the company’s website; Perpay has a dedicated page for customer reviews, where you can read feedback from real customers.

Perpay reviews are collected from customers who have used the service. Customers are asked to leave a review after they have completed a purchase or made payments on their account.

Perpay uses customer feedback to improve the service and address concerns or issues. By listening to feedback, Perpay can provide a better customer experience and improve its products and services.

Like any service, Perpay has pros and cons. Here are some of the advantages and disadvantages of using Perpay:

Reading reviews from real customers is one of the best ways to get a sense of the customer experience with Perpay. Here are some highlights from Perpay reviews on Trustpilot:

“Perpay has been a lifesaver for me. I was able to buy a new refrigerator without having to pay upfront, and the payments are affordable.”

“I was skeptical at first, but Perpay has exceeded my expectations. The process was easy, and the customer service has been great.”

“I had some issues with my account, but the Perpay team was able to resolve them quickly. I appreciate their responsiveness.”

Of course, not all reviews are positive. Some customers have experienced issues with late fees or collections while others have found the product selection to be limited.

Perpay is not the only buy-now-pay-later service on the market. Other popular options include Afterpay, Klarna, and Quadpay. Here’s how Perpay stacks up against some of its competitors:

Compared to these competitors, Perpay stands out for its no-credit-check policy and flexible payment options.

If you decide to use Perpay, here are a few ways to maximize your experience:

After reading Perpay reviews and learning more about the service, the answer to whether Perpay is worth your time and money will depend on your individual needs and circumstances.

If you have poor credit or no credit history, Perpay can be an excellent option for purchasing essential items and improving your credit score over time. However, if you’re looking for a bigger selection of products or lower prices, you may want to consider other retailers or financing options.

To summarize, Perpay is a unique and innovative service offering flexible payment options and a no-credit-check policy. By reading reviews and doing your research, you can make an informed decision about whether Perpay is right for you.

^ We will issue you 35,000 Bonus Points with your paid purchase. The Smart TV is a 24" TV with apps for watching streaming videos. You may also use these Points for this or any other item we offer at our Reward Points Redemption Center. * According to Account terms. Certain restrictions apply.