Table of Contents

- Introduction: Unveiling the Personal Finance Concept of Rent-to-Own TVs

- The Rent-to-Own Industry: Understanding Rent-to-Own TVs and Their Costs

- The Mechanics of Rent-to-Own TVs and Its Payment Structure

- The Benefits of Rent-to-Own TVs for Low-Income, Poor Credit Consumers

- Case Study: Unveiling the Costs of Rent-to-Own TVs with National Credit Direct

- Debunking Rent-to-Own TV Myths: A Focus on Payments and Costs

- Navigating Potential Pitfalls of Rent-to-Own TVs: Understanding Risk and APR

- The Demographics and Benefits of Rent-to-Own TVs: A Focus on Credit and Payment

- Exploring Alternatives to Rent-to-Own TVs: From Layaway to Fintech Loans

- Conclusion: Making Rent-to-Own TVs Work for Your Financial Future

- Frequently Asked Questions

Introduction: Unveiling the Personal Finance Concept of Rent-to-Own TVs

In the realm of personal finance, the concept of "rent-to-own" has been a beacon of hope for many individuals with low income and poor credit. This system, particularly in the context of TVs, offers immediate access to a much-desired item without the need for a hefty down payment or a credit check. However, the truth about the real cost of rent-to-own TVs is often shrouded in mystery. This article aims to shed light on the rent-to-own industry, debunk common myths, and provide a comprehensive understanding of the costs associated with rent-to-own TVs. Whether you're a regular at rent-to-own stores or just considering this option, this guide will help you navigate the world of rent-to-own TVs with confidence and financial savvy.

The Rent-to-Own Industry: Understanding Rent-to-Own TVs and Their Costs

The Mechanics of Rent-to-Own TVs and Its Payment Structure

The rent-to-own industry operates on a simple premise: you select an item, such as a TV, from a rent-to-own store like Rent-A-Center, and agree to make regular payments over a specified lease term. These payments can be weekly, bi-weekly, or monthly, depending on the rent-to-own company's policy. Once all payments are made, the TV is yours.

However, the total cost of rent-to-own items can be significantly higher than their cash price. This is because the cost includes not only the price of the TV but also additional fees and interest. The Federal Trade Commission (FTC) warns that the total cost of rent-to-own items can be two to three times higher than retail prices.

The Benefits of Rent-to-Own TVs for Low-Income, Poor Credit Consumers

Despite the higher costs, rent-to-own businesses offer several benefits of rent to own tvs for consumers with poor credit or limited income. First, there's no credit check, making it an attractive option for those with a less-than-stellar credit report. Second, the immediate gratification of taking home a new TV without a large upfront payment can be a significant draw. Lastly, if you're unable to continue payments, most rent-to-own contracts allow you to return the TV without penalty, unlike traditional loans.

Case Study: Unveiling the Costs of Rent-to-Own TVs with National Credit Direct

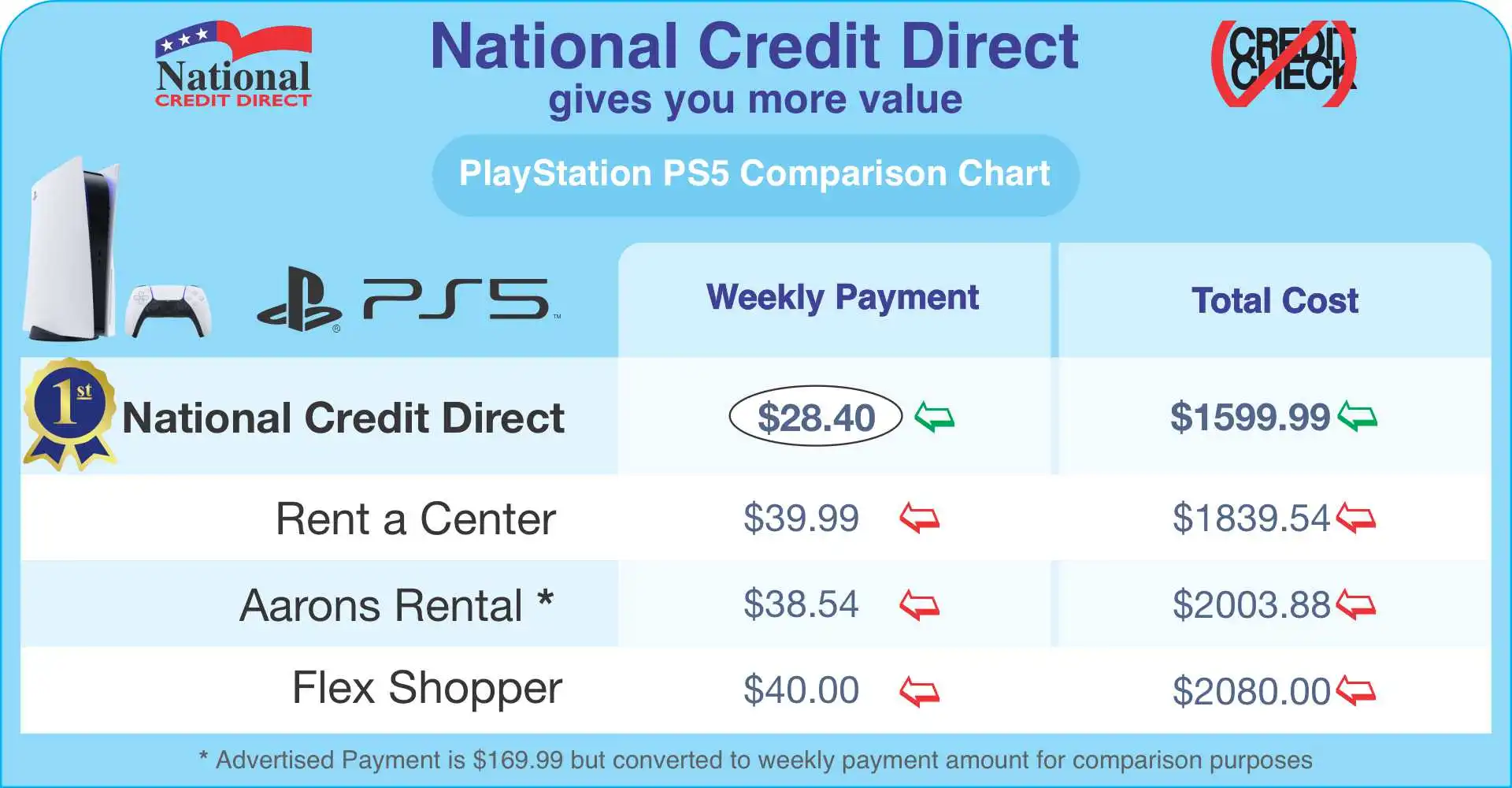

National Credit Direct, a prominent player in the rent-to-own industry, offers a broad spectrum of products, including TVs. To illustrate the flexibility and advantages associated with rent-to-own TVs through National Credit Direct, let's explore a hypothetical scenario.

Picture this: you're eyeing a 50-inch HDTV that carries a $500 price tag in a conventional retail store. On the National Credit Direct website, you might find a comparable TV offered with a monthly payment plan. Let's assume the advertised payment is $99.99 per month for a 24-month term.

At first glance, this might appear as a higher cost. However, when you factor in the flexibility and benefits over the 24-month term, the value becomes evident. The total cost amounts to $2,399.76, which is spread over two years, making it a manageable and budget-friendly option for many individuals.

This case study underscores the unique benefits of rent-to-own TVs through National Credit Direct and emphasizes the importance of understanding the rent-to-own payment structure. While the total cost over the term of the agreement might be higher than the retail price, the monthly payments are designed to be affordable and flexible, catering to a wide range of financial situations.

Moreover, it's important to note that National Credit Direct, like other rent-to-own businesses, does not require a credit check, making it an accessible option for those with poor credit or no credit history. This inclusivity is a significant advantage for individuals who might be excluded from traditional financing options.

The slightly higher total cost also includes additional benefits such as delivery, setup, and customer service support, which are often overlooked but add significant value to the overall package.

In conclusion, National Credit Direct offers a viable and flexible alternative to traditional purchasing methods, especially for those who value manageable payments, no credit check requirements, and the ability to eventually own the product.

Debunking Rent-to-Own TV Myths: A Focus on Payments and Costs

Myth 1: The Misinformation Around Saving the Rent-to-Own Charge for TVs

One common myth is that the rent-to-own charge for TVs is a small amount that can be easily saved. However, the reality is that these charges, when accumulated over the lease term, can significantly inflate the total purchase price of the TV. The rent-to-own cost comparison with the retail price often reveals a stark difference, making it an expensive way to acquire a TV.

Myth 2: The Reality of Considering Loans or Used Goods as Alternatives for TVs

Another myth is that loans or used goods are always better alternatives to rent-to-own TVs. While it's true that loans can offer lower interest rates, they also require a good credit score, which many rent-to-own customers lack. Used goods, on the other hand, may come with their own set of problems, such as lack of warranty or hidden defects.

Myth 3: The Risks of Using Plastic as a Last Resort for TVs

Many people believe that using a credit card to buy a TV is a better option than rent-to-own. However, this can lead to high interest rates and hefty fees if the balance isn't paid off each month. In fact, the annual percentage rate (APR) on credit cards can often be higher than that of rent-to-own agreements, making it a risky last resort.

Navigating Potential Pitfalls of Rent-to-Own TVs: Understanding Risk and APR

The Total Cost and APR in Rent-to-Own TV Contracts

Understanding the total cost and APR of rent-to-own TV contracts is crucial. The total cost includes the cash price of the TV, the cost of rent, and any additional fees. The APR, on the other hand, is a measure of the cost of credit, expressed as a yearly rate. It's important to note that the APR for rent-to-own items can be significantly higher than that of traditional loans or credit cards.

The Risk of Repossession and the Importance of Manageable Payments for TVs

If you fail to make regular payments, the rent-to-own company has the right to repossess the TV. This is why it's crucial to ensure that the weekly payment or monthly payments are manageable within your budget. It's also worth noting that missed payments can negatively impact your credit score.

The Need for Financial Discipline in Rent-to-Own TV Agreements

Rent-to-own agreements require a high degree of financial discipline. It's easy to be lured by the immediate access to a new TV, but it's essential to consider the long-term costs. Making regular payments over an extended period can be challenging, especially for those with unstable income.

The Demographics and Benefits of Rent-to-Own TVs: A Focus on Credit and Payment

The Typical Rent-to-Own TV Customer Profile

The typical rent-to-own customer often has a poor credit score or no credit history at all. They may have a low income and struggle to save enough money for a large down payment on a TV. These customers value the opportunity to make regular payments without the need for a credit check or the risk of high interest rates from credit cards.

Situational Benefits of Rent-to-Own TV Services

Rent-to-own services can be beneficial in certain situations. For instance, if you need a TV for a short period, such as for the Super Bowl party you're hosting, rent-to-own can be a cost-effective solution. Additionally, if you're in the process of improving your credit score, making regular payments on a rent-to-own item can demonstrate financial responsibility.

Exploring Alternatives to Rent-to-Own TVs: From Layaway to Fintech Loans

The Layaway Option: An Old-School Alternative for TVs

Layaway is a method of purchasing that allows customers to reserve an item and pay for it over time. Unlike rent-to-own, you don't take the item home until it's fully paid for, but it also doesn't carry the risk of high interest rates or repossession.

The Rise of Fintech Loans as a Modern Alternative for TVs

Fintech companies like Affirm and Upgrade offer personal loans with competitive interest rates. These loans can be a good alternative for those with fair to good credit scores. They offer immediate access to funds, allowing you to buy the TV outright and pay back the loan over time.

The Traditional Savings Account: A Time-Tested Alternative for TVs

A traditional savings account is a time-tested alternative. Regularly depositing money into a savings account until you have enough to buy the TV outright can save you from paying interest or dealing with the potential pitfalls of rent-to-own.

Conclusion: Making Rent-to-Own TVs Work for Your Financial Future

Recap of the Benefits and Potential Pitfalls of Rent-to-Own TVs

Rent-to-own TVs offer immediate access to a new TV with manageable payments, making them an attractive option for low-income, poor credit consumers. However, the total cost can be significantly higher than the cash price, and there's a risk of repossession if payments are not made.

Final Thoughts on Making Rent-to-Own TVs Work for Low-Income, Poor Credit Consumers

While rent-to-own can be a viable option in certain situations, it's essential to understand the costs and risks involved. By considering alternatives and making informed decisions, you can make rent-to-own work for your financial future.

Frequently Asked Questions - FAQs.

- Q1. Why should one not use a rent-to-own store for merchandise?

- A1. While rent-to-own stores offer immediate access to items like TVs without the need for a credit check or a large down payment, they can be more expensive in the long run. The total price paid after all the weekly payments or monthly payments can be significantly higher than the cash price of the item. This is due to the added costs of rent, interest, and additional fees. Moreover, if regular payments are not made, the item can be repossessed, and this could negatively impact your credit score. Therefore, it's crucial to understand the true cost and potential risks before opting for a rent-to-own item.

- Q2. Why do people rent TVs?

- A2. People may choose to rent TVs for a variety of reasons. For some, it's a matter of immediate gratification - they can take home a new TV without having to pay the full purchase price upfront. This can be particularly appealing during big events like the Super Bowl. For others, particularly those with bad credit or limited income, rent-to-own offers a way to make regular payments without the need for a credit check. It's also a way to avoid high-interest rates from credit cards or payday loans. However, it's important to remember that the total cost of rent-to-own can be significantly higher than the cash price of the TV.

- Q3. What are the risks associated with rent-to-own TVs?

- A3. The main risk associated with rent-to-own TVs is the potential for repossession if regular payments are not made. Additionally, the total cost of the TV can be significantly higher than its cash price due to the added costs of rent, interest, and additional fees. There's also the risk of falling into a cycle of debt if the weekly or monthly payments become unmanageable. Lastly, missed payments can negatively impact your credit score, making it harder to obtain credit in the future.

- Q4. Are there alternatives to rent-to-own TVs?

- A4. Yes, there are several alternatives to rent-to-own TVs. One option is layaway, where you reserve an item and pay for it over time, taking it home once it's fully paid for. Another alternative is a personal loan from a fintech company like Affirm or Upgrade, which can offer competitive interest rates. Traditional savings is another alternative - regularly depositing money into a savings account until you have enough to buy the TV outright can save you from paying interest or dealing with the potential pitfalls of rent-to-own.