The Pyramid Credit Repair

The Pyramid Credit Repair offers bespoke credit enhancement plans to suit every individual's unique needs.

The Pyramid Credit Repair offers bespoke credit enhancement plans to suit every individual's unique needs.

The Pyramid Credit Repair has been a beacon of financial hope since 2010. This stalwart credit repair company is on a mission to enable individuals to achieve financial stability by improving their credit scores. Their squad of seasoned professionals, including licensed attorneys, credit analysts, and paralegals, brings a wealth of expertise to the table.

In our financial landscape where a strong credit score can open countless doors, nurturing good credit has never been more vital. Pyramid Credit Repair, with its decade-long expertise, acknowledges this reality and passionately helps individuals bolster their credit scores using their diverse set of services.

As an industry stalwart, Pyramid Credit Repair offers bespoke credit enhancement plans to suit every individual's unique needs. From thorough credit report scrutiny to crafting compelling dispute letters and vigilant credit monitoring, they have you covered.

As we delve deeper into this comprehensive guide, we'll dissect Pyramid Credit Repair's offerings to help you decide if it's the ideal partner for your credit restoration journey. So, buckle up, and let's begin our exploration!

Pyramid Credit Repair has been a beacon of financial hope since 2010. This stalwart credit repair company is on a mission to enable individuals to achieve financial stability by improving their credit scores. Their squad of seasoned professionals, including licensed attorneys, credit analysts, and paralegals, brings a wealth of expertise to the table.

Pyramid Credit Repair is your one-stop-shop for all your credit improvement needs. They offer an impressive array of services like scrutinizing credit reports, dispute resolution and removal, credit counseling, debt settlement, and safeguarding against identity theft.

A commitment to transparency is etched into the very fabric of Pyramid Credit Repair. They take pride in educating their clients at every step of the credit repair process, offering resources that enhance understanding and ensure compliance with all relevant guidelines.

Their track record speaks volumes. Countless clients have achieved better credit scores and financial stability, thanks to Pyramid Credit Repair's customized solutions and unwavering commitment. Their promise of a money-back guarantee on the removal of inaccurate or unverifiable items from clients' credit reports further bolsters their credibility, ensuring clients only pay for successful outcomes.

In summary, Pyramid Credit Repair has carved out a solid reputation as a reliable and respected entity in the credit repair landscape. Their unwavering commitment to transparency, compliance, and personalized service sets them apart in a crowded market.

Pyramid Credit Repair, a prominent credit repair company, embarked on its mission to assist individuals in achieving financial stability back in 2010. Originating in the bustling city of New York, USA, the company was founded with the vision of helping people improve their credit scores, thereby opening doors to better financial opportunities.

The early days of Pyramid Credit Repair were marked by a dedicated team of credit industry veterans, including licensed attorneys, credit analysts, and paralegals. This team laid the groundwork for what would become a company renowned for its expertise and personalized approach.

From the outset, Pyramid Credit Repair has championed a comprehensive suite of services to cater to various credit-related needs. These services encompass credit report analysis, credit dispute resolution and removal, credit counseling, debt settlement, and identity theft protection. This robust approach has been instrumental in their success and growth over the years.

One of Pyramid Credit Repair's distinguishing features has always been its commitment to transparency and compliance. The company has prioritized educating its clients about the credit repair process, ensuring that they understand their credit rights and how to navigate the credit landscape.

Throughout its first decade, Pyramid Credit Repair has demonstrated an unwavering commitment to client success. Countless individuals have achieved better credit scores and financial stability, thanks to their tailor-made solutions and dedicated service.

Moreover, the company's promise of a money-back guarantee, ensuring clients only pay for effective services, has further solidified their reputation. This client-centric approach has been a cornerstone of their business model and a significant factor in their sustained success.

As the credit industry continues to evolve, Pyramid Credit Repair remains committed to staying ahead of the curve. They continuously adapt their services and strategies to keep pace with regulatory changes and technological advancements, ensuring they can provide the best possible solutions to their clients.

Choosing a credit repair company requires a thoughtful understanding of its benefits and drawbacks. Pyramid Credit Repair, a seasoned player in the industry, certainly has a lot to offer, but it's not without its challenges. In this brief overview, we'll examine Pyramid's standout features and potential areas for improvement to help you make an informed choice.

Pyramid Credit Repair offers a range of benefits, thanks to its commitment to transparency, personalized services, and comprehensive solutions. In the following section, we will provide a detailed analysis of these strengths and how they can positively influence your credit repair process.

Choosing the right credit repair company is crucial when improving your credit score. Pyramid Credit Repair has a mixed reputation among its customers and industry experts, and it's important to consider all aspects before deciding whether to work with them.

On the one hand, Pyramid Credit Repair has been accredited by the Better Business Bureau since 2016. It has an A+ rating, which is a good sign of the company's commitment to customer satisfaction. However, some customers have reported negative experiences, citing communication issues, service delays, and unsatisfactory results.

Online reviews on Trustpilot also show a mixed picture of Pyramid Credit Repair, with a 2.8-star rating based on 89 reviews. While some customers have praised the company's professionalism and helpfulness, others have expressed frustration with the length of time it took to see results.

While it's important to consider these reviews and ratings, it's also essential to remember that complaints are not always indicative of a company's overall reputation. Pyramid Credit Repair has resolved many complaints against them with the Consumer Financial Protection Bureau.

In the realm of credit repair, various companies vie for the top spot, with Pyramid Credit Repair and DisputeBee.com among the most notable.

Pyramid Credit Repair, with a decade of operation under its belt, provides an array of credit repair services such as credit report analysis, credit dispute assistance, and credit counseling. They are distinct in their approach, offering the expert guidance of an in-house team of licensed attorneys and a 90-day service guarantee. Despite this, some customers have raised concerns about communication and service delays.

On the other hand, DisputeBee.com, a relatively new entrant in the industry, leverages advanced technology to help clients rectify inaccuracies on their credit reports. They streamline the process with personalized credit dispute letters and a user-friendly online platform. While they lack an in-house legal team, they do offer access to necessary legal resources. Some customers have voiced concerns about the complexity of their platform and the desire for more customization options.

Choosing between Pyramid Credit Repair and DisputeBee.com will ultimately come down to individual preferences and requirements. It's advisable to thoroughly examine both options and read customer reviews before making a decision.

Both Pyramid Credit Repair and CreditRepair.com aim to assist individuals in enhancing their credit scores, yet they approach this goal differently.

Pyramid Credit Repair offers a personalized touch to their credit repair services, bolstered by an in-house team of licensed attorneys who assist with credit disputes and negotiations. They provide a 90-day service guarantee and offer multiple discounts to their clients.

In contrast, CreditRepair.com integrates a tech-focused approach to credit repair, offering online tools and resources to aid clients in improving their credit scores. They provide a free initial consultation and operate on a flat-rate pricing structure, offering clients an easy-to-budget service.

The decision between Pyramid Credit Repair and CreditRepair.com will hinge on your personal preferences. If you value a more personalized approach, Pyramid Credit Repair may be the choice for you, while those inclined towards a tech-oriented approach may lean towards CreditRepair.com.

Pyramid Credit Repair and Lexington Law, both renowned in the credit repair industry, offer similar services with distinctive features.

One main difference lies in their pricing models. Pyramid Credit Repair operates on a monthly fee basis, while Lexington Law charges an initial setup fee followed by fees tailored to the particular services required by the client.

The level of legal expertise also varies. Pyramid Credit Repair boasts an in-house team of licensed attorneys, while Lexington Law, as a law firm specializing in credit repair, may be better equipped to manage complex credit disputes and legal issues.

Choosing between Pyramid Credit Repair and Lexington Law will depend on the client's specific needs. If you seek a more personalized approach to credit repair, Pyramid Credit Repair may be your preferred choice, while those needing extensive legal aid might favor Lexington Law.

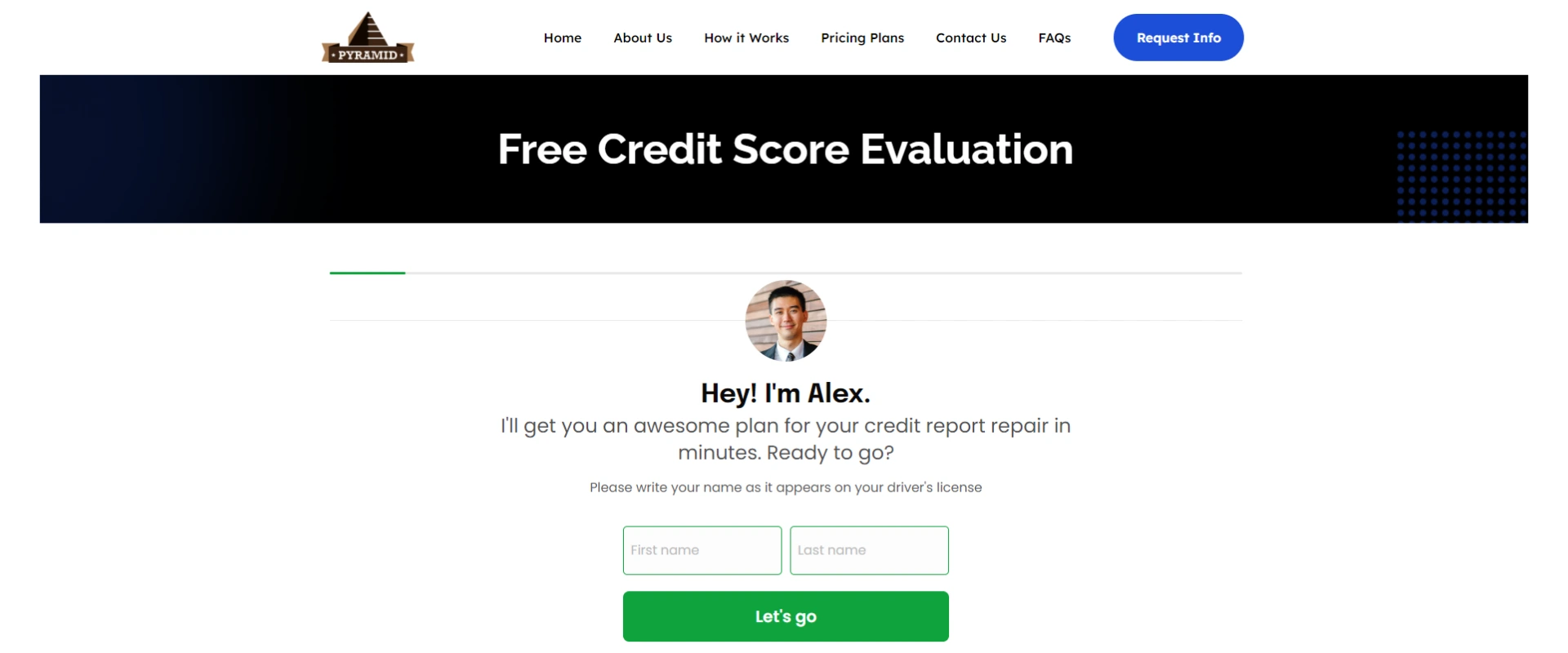

Here is a step-by-step guide on how to place an order with Pyramid Credit Repair:

Once you have completed these steps, you will receive a confirmation email with instructions on accessing your personal client dashboard. You can track your progress and communicate with your assigned credit repair specialist there.

Headquartered in the bustling heart of New York, Pyramid Credit Repair is a trusted credit repair firm with a proven track record since its establishment in 2010. With a diverse suite of services, they cater to individuals aiming to elevate their credit scores through an array of services such as credit report analysis, optimization, and dispute resolution.

What truly distinguishes Pyramid Credit Repair from its competitors is their unwavering dedication to delivering bespoke credit repair solutions. They understand that each client has a unique credit situation, and therefore, they meticulously tailor their strategies to align with each individual's needs and financial goals.

Another remarkable facet of Pyramid Credit Repair is the presence of an in-house team of licensed attorneys well-versed in consumer protection laws. These legal professionals work hand-in-hand with clients, guiding them through the intricate labyrinth of the credit repair process and assisting in the resolution of any potential credit disputes.

Moreover, Pyramid Credit Repair stands by their services with a robust 90-day warranty, further solidifying their commitment to their clients. They also make their services more accessible by offering several generous discounts, including a 50% discount for couples, a 20% discount for veterans and active military personnel, and a 15% discount for educators, enhancing their appeal to a broad demographic of clients.

Here are some important, frequently asked questions related to Pyramid Credit Repair.