Trinity Credit Services

Trinity Credit Services - a reputed industry player committed to helping you overcome your credit-related challenges

Trinity Credit Services - a reputed industry player committed to helping you overcome your credit-related challenges

Trinity Credit Services is committed to removing inaccuracies and unverifiable information from clients' credit reports. This approach not only improves their credit score but also enhances their ability to secure loans. The company goes beyond the call of duty to ensure optimal success for its clients, making their journey towards financial stability smoother and more achievable.

Indeed, your financial journey can be heavily influenced by the state of your credit. A less than stellar credit score may pose roadblocks to securing beneficial financial products like low-interest loans. However, with a healthy credit rating, possibilities such as effortless credit card approval, mortgage acquisition, or even streamlining job or apartment applications become feasible.

If you find yourself ensnared in a credit conundrum, seeking a reliable credit repair company might just be the lifeline you need. Allow us to introduce you to Trinity Credit Services - a reputed industry player committed to helping you overcome your credit-related challenges. Our comprehensive guide and review will provide invaluable insights into the offerings and capabilities of Trinity Credit Services, aiding you in your quest for financial freedom.

Trinity Credit Services is more than just a credit repair company; it's a beacon of hope for individuals striving to rebuild their financial credibility. Based in Texas, this esteemed company prides itself on its personalized approach, working closely with each client to understand and address their unique credit challenges.

As a comprehensive credit repair and restoration firm, Trinity Credit Services is committed to removing inaccuracies and unverifiable information from clients' credit reports. This approach not only improves their credit score but also enhances their ability to secure loans. The company goes beyond the call of duty to ensure optimal success for its clients, making their journey towards financial stability smoother and more achievable.

What sets Trinity Credit Services apart from other credit repair companies is its steadfast commitment to values such as integrity and character. This dedication extends to providing top-tier service for each client, resulting in optimal outcomes tailored to their specific needs.

While it's entirely possible to handle credit disputes on your own, the expertise of a credit repair agency like Trinity Credit Services can be invaluable. The team will champion your consumer rights, challenging even the smallest reporting errors on your behalf.

Beyond repair services, the company also places a strong emphasis on credit education. Trinity Credit Services offers its clients a comprehensive 'credit survival guide' that provides valuable insights into maintaining a healthy credit score. This guide empowers clients to understand the fundamentals of credit and learn strategies to build positive credit without accruing additional debt.

If you have specific goals, like securing an apartment, a mortgage, or an auto loan, Trinity Credit Services offers custom services to help you realize them. While the company can connect you with partner lenders, they also encourage clients to explore their own lending options.

In essence, Trinity Credit Services strives to elevate its clients' financial literacy, guide them towards better purchasing decisions and help rebuild a positive credit history. This commitment truly defines their expertise and core mission.

Having acquainted ourselves with the commendable work and mission of Trinity Credit Services, let's now journey back in time to delve deeper into the roots of this extraordinary company.

Trinity Credit Services was founded with a simple yet profound mission – to transform lives through credit education and repair. The journey began in Texas, where the company established its headquarters and began to build a reputation for its bespoke, high-quality service.

The founders recognized the significant role credit plays in everyday life, from securing a mortgage to landing a dream job. However, they also understood that many people lacked the knowledge or resources to navigate the complex world of credit. Thus, Trinity Credit Services was born, designed to fill this gap and empower individuals to take control of their financial futures.

From the outset, the company sought to distinguish itself from other credit repair firms. They did this by not just focusing on repairing credit but by also prioritizing education, teaching clients how to make informed financial decisions that would benefit them in the long term. This holistic approach quickly resonated with clients and set Trinity apart in a crowded market.

Over the years, the company has evolved and expanded its services, always keeping the needs of its clients at the forefront. Whether introducing their innovative 'credit survival guide' or partnering with lenders to help clients secure loans, every strategic move has been guided by the mission to improve clients' financial lives.

Trinity Credit Services has weathered economic downturns, regulatory changes, and increasing competition, always emerging stronger and more dedicated to its mission. The company's resilience and unwavering commitment to its clients have solidified its reputation as a trusted and reliable credit repair and restoration firm.

This journey through time, while important, is just the beginning. Trinity Credit Services continues to write its history, innovating and adapting to better serve its clients and transform lives through credit education and restoration. This steadfast commitment to its mission makes Trinity Credit Services not just a credit repair company, but a genuine partner in its clients' financial journeys.

Whether you're aiming to secure an auto loan, purchase a home, obtain security clearance, land a new job, or simply desire a fresh financial start, Trinity Credit Services stands ready to guide you towards your goals through insightful credit education and assistance.

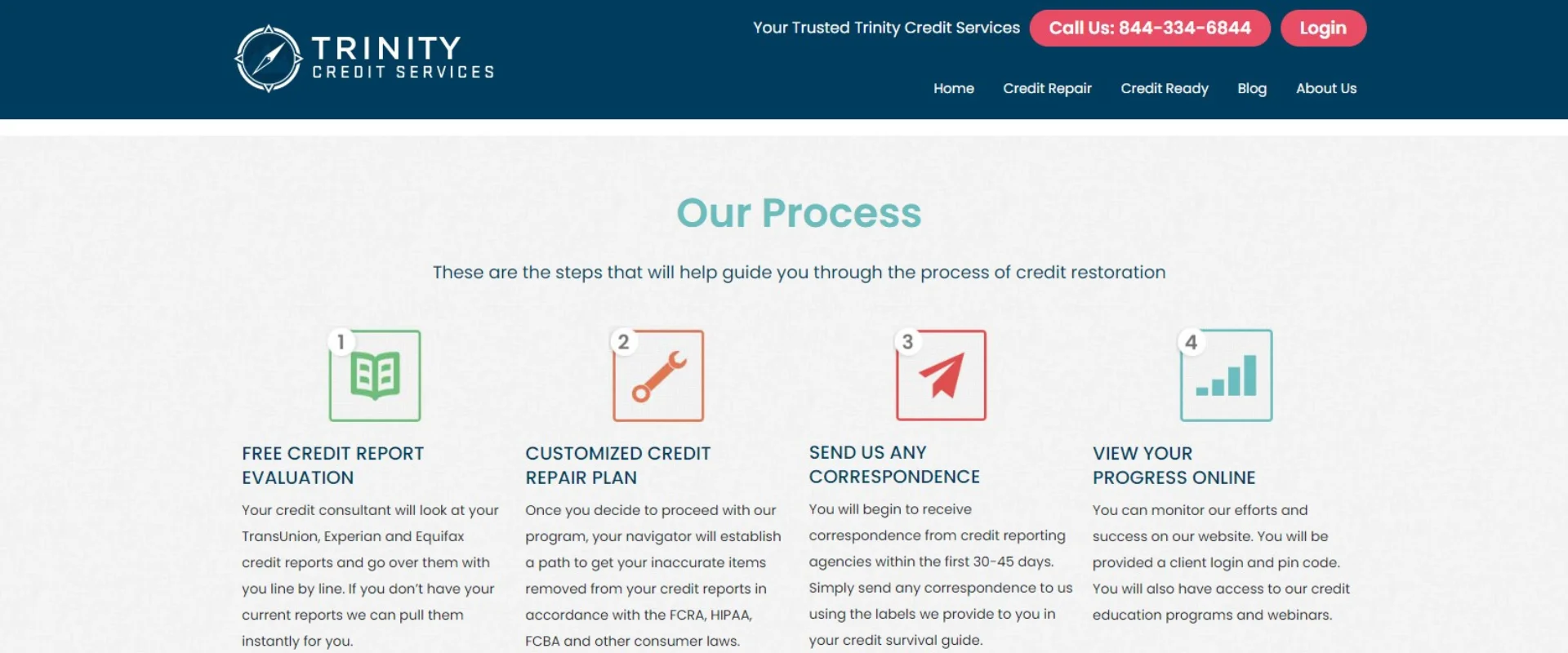

The journey begins with Trinity Credit Services dispatching its initial round of inquiries to the credit bureaus on your behalf. Anticipate receiving a response via mail within a 30-45 day window.

Upon receipt of responses from the credit bureaus, Trinity Credit Services presents you with your very own Credit Survival Guide. This guide is your roadmap, providing step-by-step directions towards credit restoration.

By this phase, you should have received correspondence from all three credit bureaus. It's essential to forward these to Trinity Credit Services for a meticulous review. If you haven't received any reports, be sure to inform the company promptly.

Trinity Credit Services then provides you with the tools to track your progress online. Armed with a unique login ID and pin code, you can view the company's efforts and your improvements directly on the website. This portal also gives you access to valuable resources like webinars and credit education programs.

In the final stage of the process, Trinity Credit Services conducts a comprehensive review comparing your credit report before and after the restoration process. This is where you'll truly see the fruits of your efforts. Furthermore, Trinity's team of experts will assist and guide you through the auto or home loan approval process, ensuring you're well equipped to reach your financial goals.

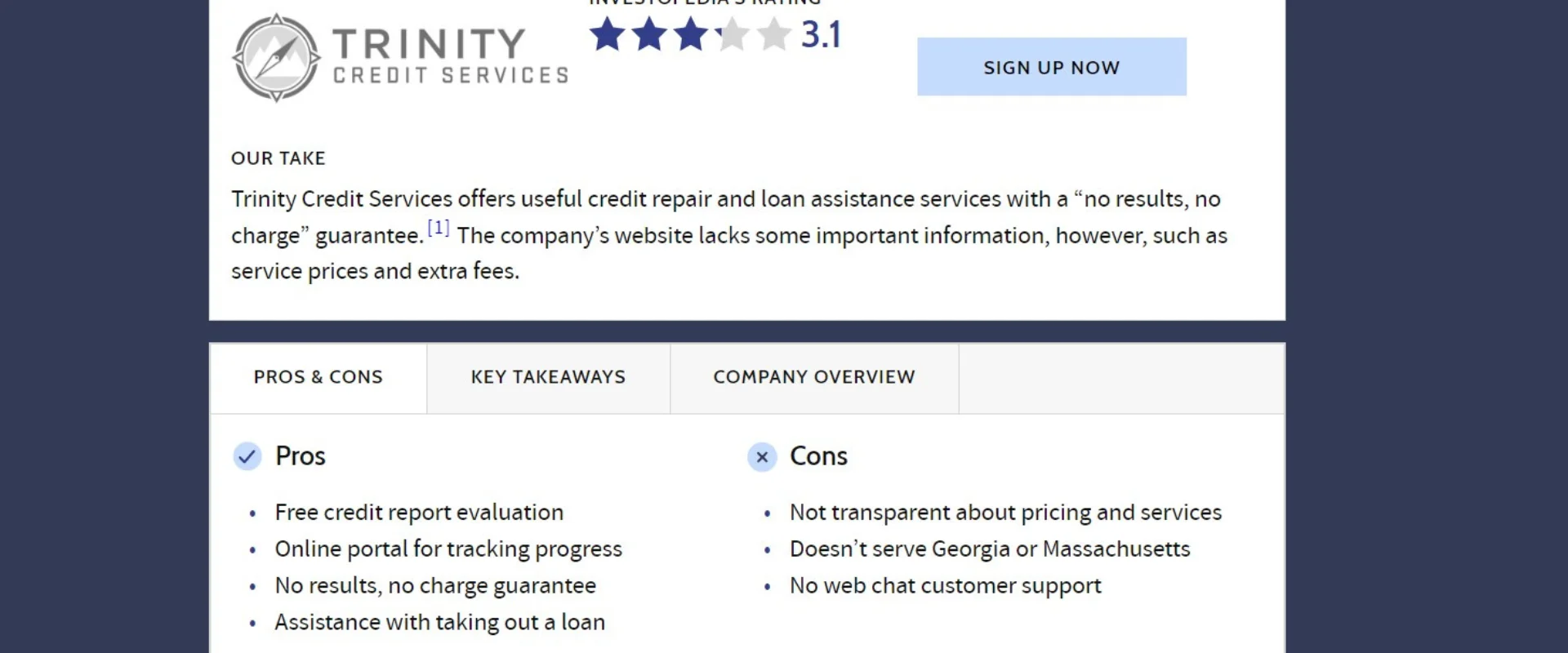

In any business, there are strengths and weaknesses. Understanding these is key for potential clients deciding if a company aligns with their needs. Here, we'll briefly examine the pros and cons of Trinity Credit Services, offering a balanced overview of this reputable credit repair firm.

Trinity Credit Services distinguishes itself in the credit repair industry with its plethora of features and benefits. Here are just a handful of the advantages that make it a renowned credit repair company in the US.

Trinity Credit Services provides an in-depth, line-by-line review of its clients' credit reports - all at no cost. These reports are pulled from all three credit-reporting agencies: Equifax, Experian, and TransUnion.

Unlike many credit repair companies, Trinity Credit Services stands out with its tailored credit repair process. The journey begins with a complimentary credit report evaluation conducted by one of the company's credit consultants. This process leads to the development of a personalized credit repair plan, which, once implemented, starts to show progress within 30 to 45 days.

Trinity Credit Services offers an interactive online portal where clients can access educational resources, participate in webinars, and track the progress of their credit repair program.

Trinity Credit Services is committed to client satisfaction, offering a 100% money-back guarantee if results are not delivered, though the specifics of this guarantee are not elaborated on the website.

If you're in the market for an auto loan or a mortgage, Trinity Credit Services offers guidance throughout the process, connecting clients with its lending partners and providing a range of rates and options to choose from.

Trinity Credit Services extends its services beyond credit repair by offering assistance in securing the best deals on car and home purchases, courtesy of its extensive network of lending partners.

Trinity Credit Services enriches its clients' experience with a plethora of online resources. These include an active credit blog covering a wide array of topics and direct contact details for key staff members, a feature that sets Trinity apart from other firms in the industry.

While Trinity Credit Services has many compelling advantages, it is also important to acknowledge a few areas where the company could improve.

Unlike many credit repair firms that openly share their pricing and service details, Trinity Credit Services maintains a degree of opacity online, making it harder for potential clients to make an informed decision.

The company's services are currently only available to residents of Texas and Louisiana. While it's not uncommon for credit repair firms to serve limited areas, those residing outside these two states will need to look elsewhere for their credit repair needs.

One significant limitation of Trinity Credit Services is the lack of a web chat support function on their website. This means clients must rely on email or phone calls to resolve queries or gather information.

Even though it does offer some insights regarding its easy and straightforward credit restoration process, many essential things aren’t available or accessible on the website, such as:

Prospective clients who want to gather details on these areas need to get in touch with Trinity Credit Services directly.

The company does not offer any legal assistance to clients, which could be crucial in certain credit situations. Many top-tier credit repair firms provide access to legal counsel if necessary.

Trinity Credit Services has limited business hours, which might not be convenient for some clients who may need assistance outside of these hours.

The company does not offer a free trial period for its services, which could deter some potential clients who prefer to test out a service before committing.

Unlike some competitors, Trinity Credit Services does not provide a mobile app, limiting clients to accessing their services via the website.

Trinity does not provide credit monitoring services, an offering that many competitors include and that could provide added value to clients.

The company only provides service and support in English, potentially limiting accessibility for non-English speaking clients.

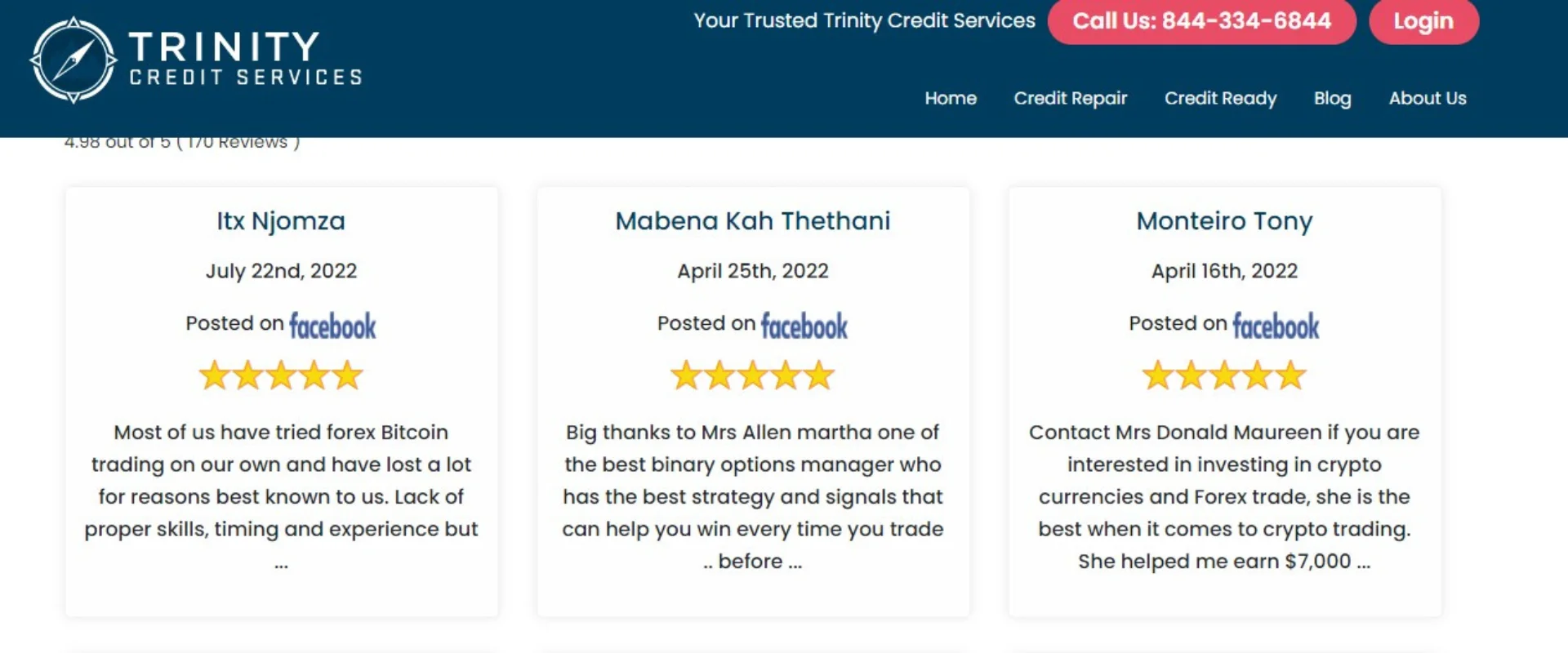

Despite Trinity Credit Services' extensive history of over 17 years in the industry, the number of online customer reviews is surprisingly sparse. However, those reviews that are available paint a largely favorable picture of the company's services.

As of March 2023, there were just 2 customer reviews on Trustpilot, with an average of 3.8 stars out of 5. Besides this, you’ll find some customer reviews for the company on Yelp, where 12 out of 13 individuals gave the company 5 out of 5 stars and a single customer review of 1 star.

Overall, Trinity Credit Services has a single complaint lodged with the Consumer Financial Protection Bureau in 2015. Still, it was dealt with promptly, and the complaint was closed with monetary relief to the client.

DisputeBee, a cutting-edge credit repair software, automates essential tasks like creating dispute letters, importing credit reports, and tracking client communications with furnishers and credit reporting agencies. It takes pride in its competitive pricing and top-tier customer service. Yet, Trinity Credit Services goes a step further by offering credit consultation and education alongside its repair services. Furthermore, Trinity offers a money-back guarantee and complimentary credit report evaluations, adding more value for their clients.

Creditrepair.com is more than a one-time credit repair service. It's committed to helping clients foster healthier, stronger relationships with their credit. Much like Trinity Credit Services, it emphasizes the personal stories of clients and their resolve to improve their credit situation. Trinity Credit Services shares this focus on restoring clients' reputations and assisting them in securing beneficial deals on homes or vehicles.

Lexington Law is a popular choice for individuals seeking professional credit repair services. With over two decades of industry experience, Lexington Law has assisted over half a million clients, in contrast to Trinity Credit Services' 20,000 clients. Nonetheless, both Trinity Credit Services and Lexington Law are reputable, established credit repair firms that offer a broad array of benefits and services to their clients.

Trinity Credit Services, being a non-profit company, offers most of its services free of charge. Clients enrolled in the company's debt management program will find a monthly fee incorporated into their total monthly payment. This fee depends on your debt amount, your residing state, and the payment due to creditors, ranging between $8 and $50 monthly. On average, however, the monthly fee is $34.