Electro Finance

A Comprehensive Review of Electro Finance, including how to order, pros and cons, company review, comparisons and key company information.

A Comprehensive Review of Electro Finance, including how to order, pros and cons, company review, comparisons and key company information.

Discovering the ideal location to lease or acquire the most recent products on a rent-to-own basis can be tough. Electro Finance comes to the rescue by helping you buy the items you're after with budget-friendly payments over an extended period.

Electro Finance operates as an online store specializing in efficient and user-friendly financing for electronics through a rent-to-own model. They present a broad selection of merchandise, such as household appliances and gadgets, all paired with cost-effective financing solutions.

When it comes to leasing or renting-to-own the hottest and most in-demand items, Electro Finance steps in to support you in acquiring the products you crave with manageable installments over a set timeframe. They've earned a solid reputation as a dependable and credible provider of electronics financing, simplifying the process for clients to get their hands on their favorite products.

So, let’s dig in!

s

Electro Finance is a financial institution and was founded in 1999 with a commitment to providing innovative and reliable financial solutions for American consumers.

Electro Finance provides loans and advances, credit cards, savings and investment products, insurance products, and online and mobile banking services. Electro Finance has a had a commitment to innovation, customer service, and social responsibility since its inception which has made it a preferred choice among customers. Headquartered in New York City, the company quickly expanded to serve customers throughout the entire United States.

In addition to providing financial solutions, Electro Finance is also dedicated to making a positive impact on society. Electro Finance supports a multitude of causes, including education, healthcare, and environmental conservation.

In Electro Finance’s early years, they focused on building a strong customer base and market share and establishing a reputation for reliability and excellent customer service. Their commitment to customer satisfaction fortunately paid off, and Electro Finance quickly became a trusted name in the financial industry.

As Electro Finance grew, it expanded its product and service offerings to include credit cards, savings and investment products, insurance products, and online and mobile banking services. They have continued to invest in technology to provide its customers with convenient and secure access to its services.

Electro Finance is passionate about contributing to society by supporting various initiatives, such as education, healthcare, and environmental preservation. The company strives to offer financial solutions that empower customers to attain financial independence and accomplish their monetary objectives while positively impacting the community.

Currently, Electro Finance is a prominent player in the financial sector, boasting a substantial online presence across the United States. Their unwavering dedication to progress, customer satisfaction, and societal concerns has positioned Electro Finance as the go-to option for devoted customers who want more than just a service. The company's future plans encompass further growth, technological enhancements, and inventive product offerings.

In conclusion, since its inception in 1999, Electro Finance has traveled an impressive distance and earned a reputable standing in the finance world. As the firm continues to flourish and broaden its horizons, it is poised to become an influential force in shaping the financial industry's future landscape.

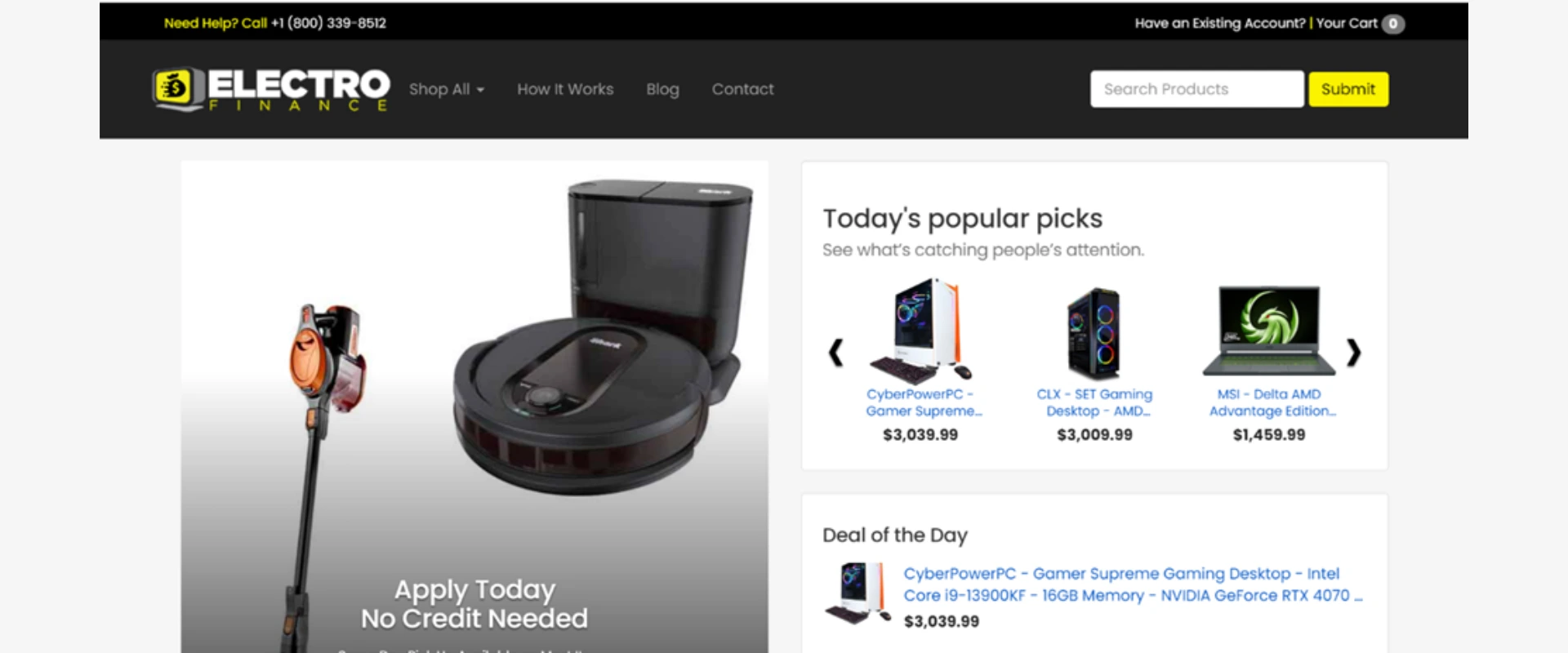

The best thing about Electro Finance is its user-friendly interface, which makes placing an order very convenient for the user.

Visit the official Electro Finance website at www.Electro Finance.com to start your journey of purchasing your favorite products:

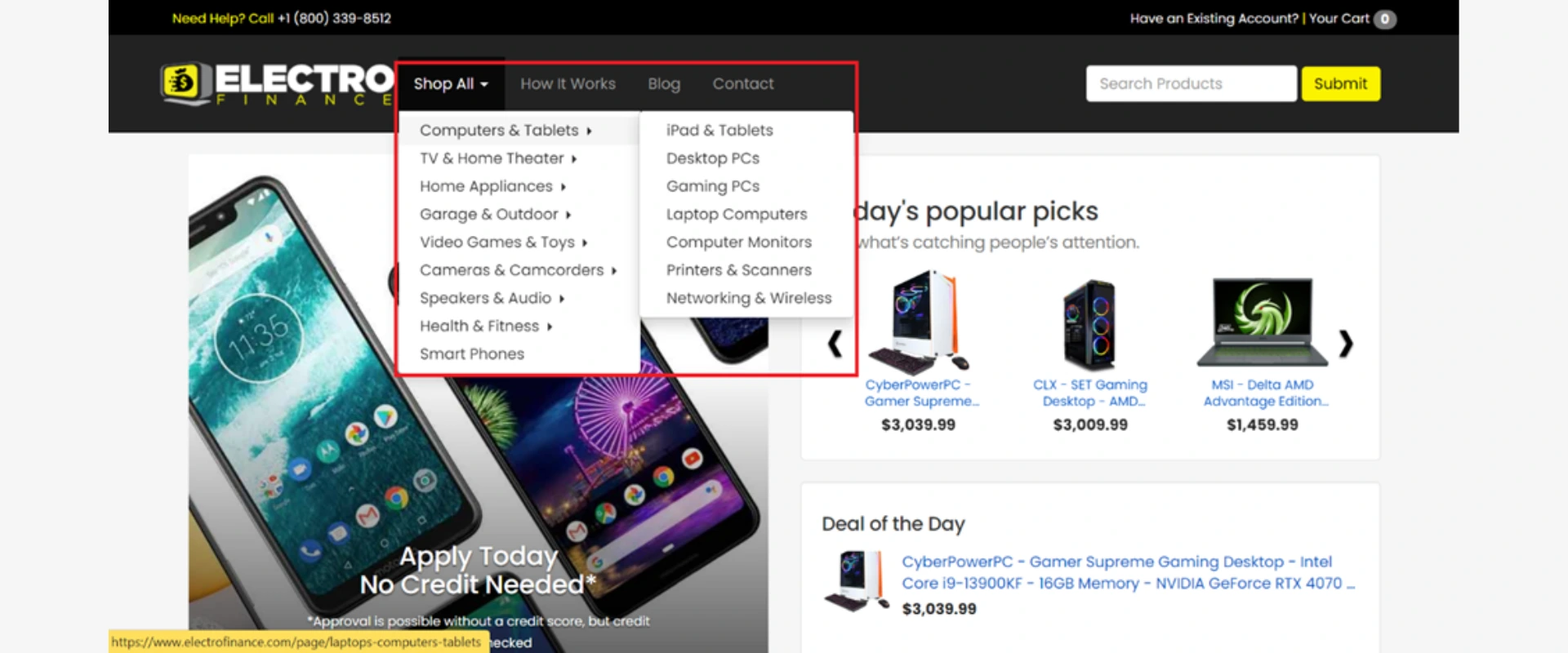

Out of the various categories of electronics and gadgets, choose your desired option and proceed further with a selection of the sub-category that you are looking for:

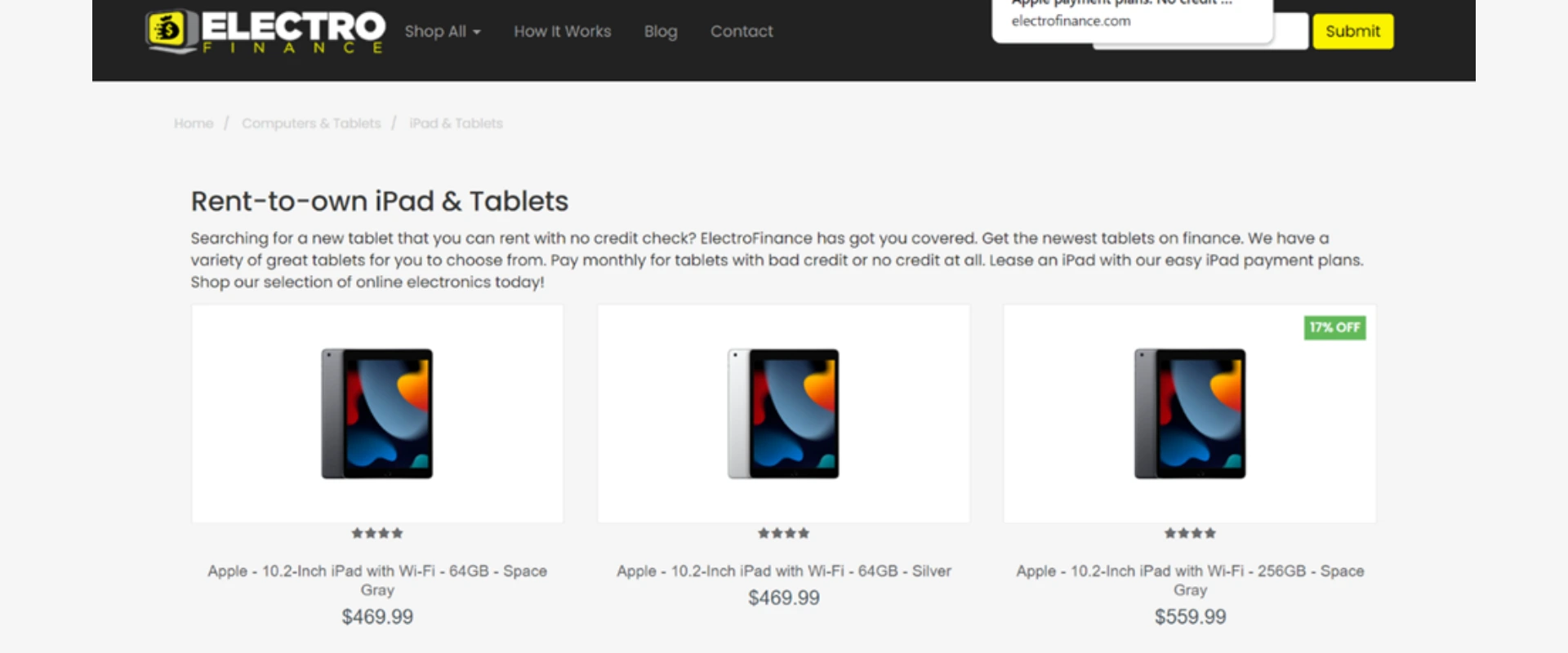

You will find various options for the product you are looking for. Check the pricing and features that suit your needs and select the product that you intend to purchase.

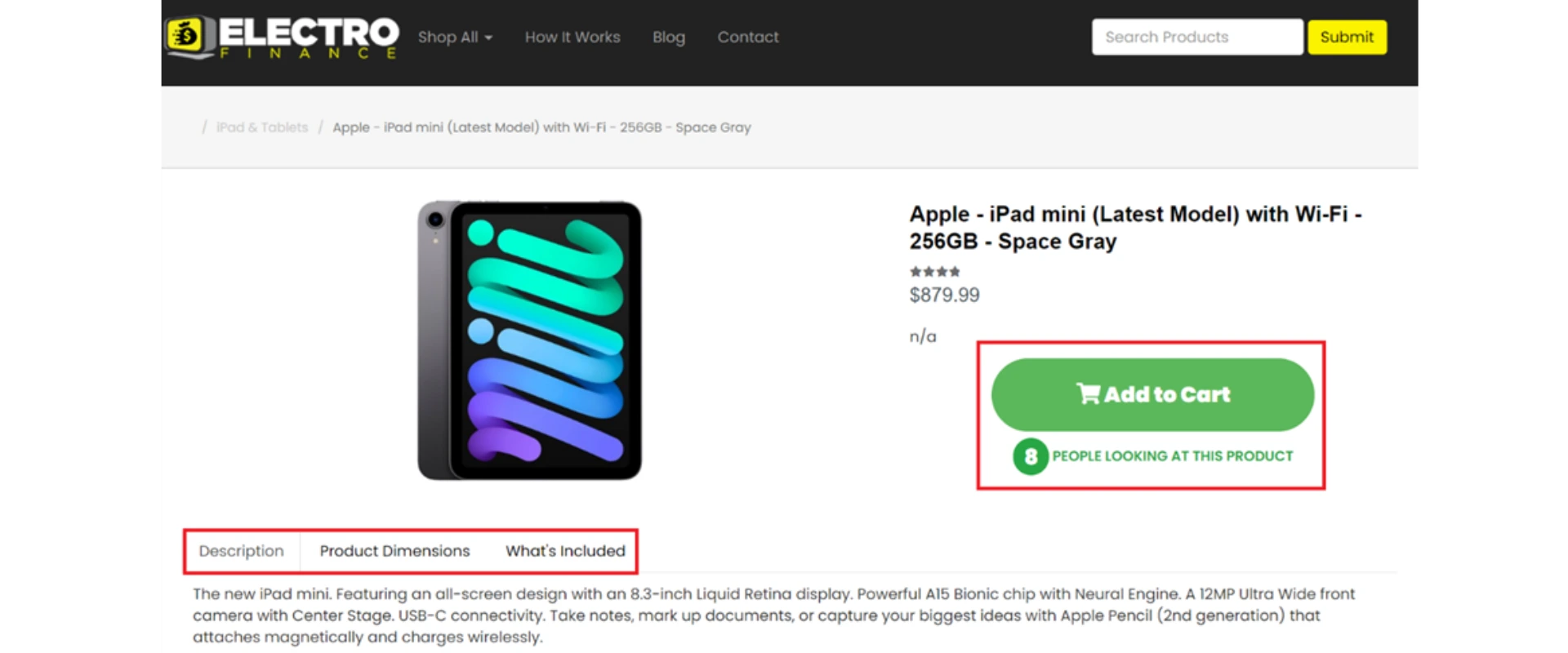

Read the details of the product that you have selected and decide if you want to proceed ahead with the purchase. If you are opting for the product, click on add to cart for all the goods you have decided to buy:

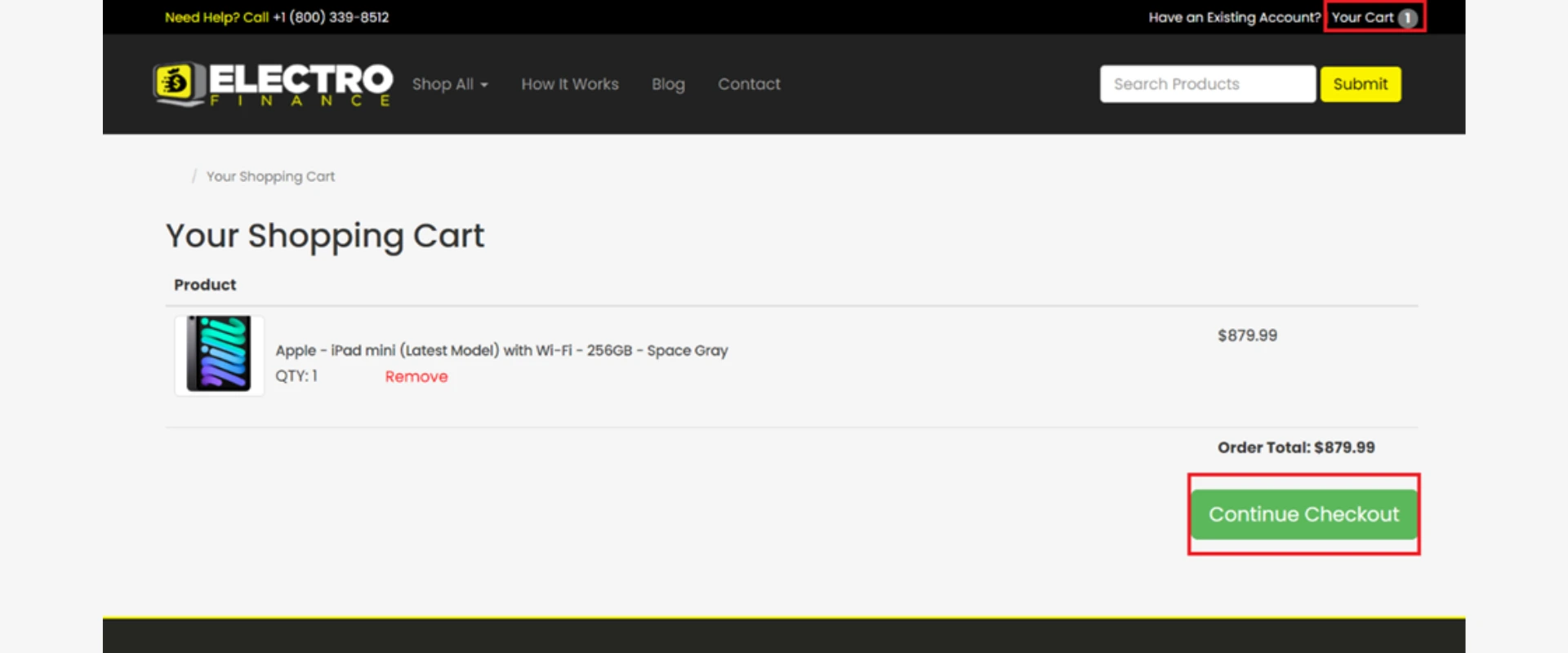

Click on view cart to take a look at the products you are proceeding to buy, and then click on continue to checkout to finalize your purchase:

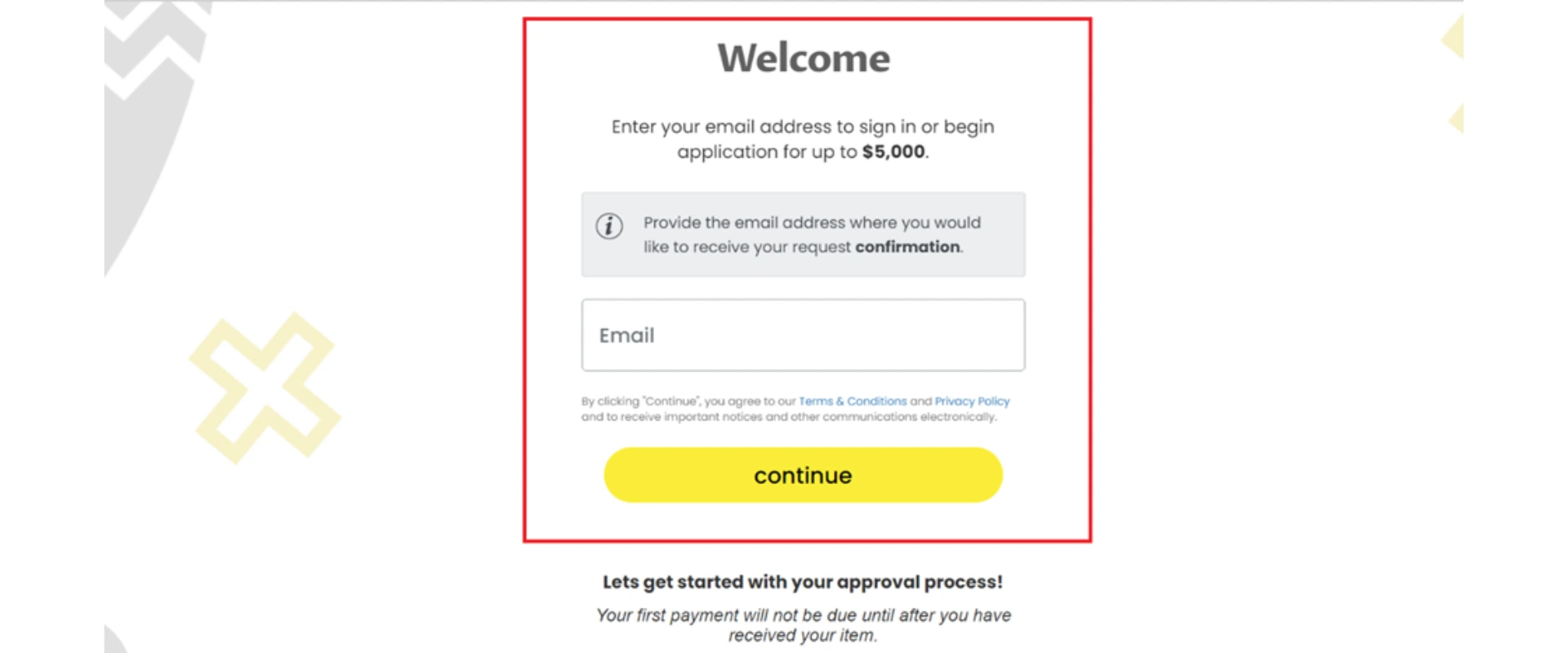

Checking out will take you to a screen where you must enter your login ID to continue the approval process of leasing the products you intend to buy:

The rise of digital technology has made banking more accessible to consumers, with Electro Finance being one of the most popular financial technology services in the market. However, like any financial product, it comes with both advantages and disadvantages. Here are the pros and cons of Electro Finance:

Electro Finance provides its customers with a convenience a variety of options to interact and shop with them. With mobile apps, customers can access their accounts, check their balances, and make transactions from anywhere at any time.

Compared to traditional banking, Electro Finance is incredibly economical. With fewer overhead costs because most of their transactions are online, financial institutions as Electro Finance can offer lower fees and interest rates to their customers.

Electro Finance makes banking more accessible to consumers who may not have access to traditional banking services. Now, with digital platforms, individuals can open accounts, apply for loans, and make transactions regardless of where they reside at any particular moment.

Electro Finance allows for quick transactions. With the high number of customers using mobile apps and digital platforms, Electro Finance has put a lot of money and effort into the latest technology for the convenience of their customers. Transactions can be completed in a matter of seconds, making it more efficient than traditional banking.

With Electro Finance, customers can customize their banking experience based on their immediate needs. Customers can set-up alerts for account balances, schedule payments, and even track their spending habits.

Electro Finance reviews are limited and mixed. Here is what we were able to find.

Upon examining Electro Finance and FlexShopper, it becomes apparent that both platforms present a comprehensive selection of electronics, appliances, and outdoor gear for consumers. However, some distinctions between the two might sway a shopper's choice. Electro Finance outshines FlexShopper by offering a more accessible and well-organized browsing experience. Conversely, FlexShopper has its unique advantages, including versatile payment methods and a rent-to-own model that attracts those seeking non-traditional financing options. Ultimately, the decision between Electro Finance and FlexShopper hinges on personal preferences and the particular requirements of each consumer.

Both Electro Finance and Rent-A-Center cater to customers seeking electronics and appliances. However, Rent-A-Center extends its offerings to include furniture and maintains numerous brick-and-mortar locations, providing face-to-face customer service and the chance to view products before making a purchase. In contrast, Electro Finance, as an online service, emphasizes a seamless and efficient digital shopping experience.

Both Electro Finance and Rent-A-Center cater to customers seeking electronics and appliances. However, Rent-A-Center extends its offerings to include furniture and maintains numerous brick-and-mortar locations, providing face-to-face customer service and the chance to view products before making a purchase. In contrast, Electro Finance, as an online service, emphasizes a seamless and efficient digital shopping experience.

Although both companies present electronics, appliances, and household items with alternative financing options, Fingerhut stands out for its credit-based catalog shopping model. This approach enables customers to build or improve their credit scores while making purchases. On the other hand, Electro Finance focuses on offering flexible financing options and an easy-to-use platform without placing credit-building as a central aspect of its service.

In summary, it is essential to consider not only the website experience provided by Electro Finance but also the differences in product variety, payment options, and customer support when comparing it to its competitors.

While both companies cater to customers seeking electronics, appliances, and various household items, Zebit sets itself apart with its interest-free financing model and a unique credit system known as ZebitLine. This approach allows customers to access an interest-free line of credit for purchasing items on their platform. In contrast, Electro Finance primarily operates online and emphasizes a smooth and user-friendly platform, focusing on offering flexible financing options without featuring a unique credit system as a central aspect of its service.

In conclusion, it is crucial to consider not only the online experience provided by Electro Finance but also the differences in product assortment, payment alternatives, and customer assistance when comparing it to its competitors, such as Zebit.

Here are some important frequently asked questions about The Credit Pros.

In this comprehensive review, we've delved into Electro Finance, a user-friendly and efficient platform specializing in electronics financing through a rent-to-own model. Electro Finance offers a wide selection of products, including household appliances and gadgets, along with budget-friendly payment options. We've explored how to place an order, the pros and cons of the platform, and compared Electro Finance to its competitors, such as FlexShopper, Aaron's Rents, Rent-A-Center, Fingerhut, and Zebit. While Electro Finance provides a streamlined online experience, it is essential to consider other factors such as product variety, payment options, and customer support when comparing it to competitors. The choice ultimately depends on individual preferences and specific customer needs.