What does it mean to Rent-to-Own?

The rent-to-own concept is like dating your TV before marrying it. It's a financial arrangement that allows you to rent a TV with the option to buy it later. Think of it as a test drive for electronics. You pay a monthly rent, and if you decide that you and your TV are a perfect match, you can make it official and purchase it. If not, you can break up with your TV and return it, no hard feelings.

Explanation of Rent-to-Own TVs

Rent-to-own TVs are a popular option for those who want to enjoy the latest technology without the commitment of a full purchase. It's like having a VIP pass to the world of entertainment without paying the VIP price upfront. You can choose from the latest models and brands, enjoy flexible payment options, and even return the TV if it doesn't meet your expectations. It's a win-win situation, especially for those with poor credit or tight budgets.

Now, let's dive into the pros of rent-to-own TVs, where the real fun begins.

The Pros of Rent-to-Own TVs

No Need for Upfront Payment

One of the most significant advantages of the rent-to-own model is the elimination of a large upfront payment. This approach allows individuals to acquire a TV without the immediate financial burden. Instead of paying the full price at once, customers can start with manageable monthly installments, making it easier on their pockets.

Access to Latest Models and Brands

The rapid evolution of technology means that TV models are constantly being updated. With rent-to-own, you're not restricted by your immediate budget. This means you can access the latest models with advanced features, ensuring you're always at the forefront of entertainment technology.

Flexible Payment Options

Financial stability can vary from month to month. Rent-to-own models recognize this reality, offering flexible monthly payment options to suit different financial situations. If a month proves to be financially robust, there's the option to pay more. Conversely, during tighter months, customers can stick to the minimum payment.

No Credit Checks

The rent-to-own model is particularly beneficial for those with less than perfect credit histories. Traditional purchasing often requires credit checks, potentially disadvantaging potential buyers and those with past financial challenges. Rent-to-own provides an avenue to acquire a TV without the stringent checks, ensuring that past financial missteps don't impede present needs.

Option to Return the TV at Any Time

Commitment can be daunting, especially when it comes to technology that might soon be outdated. Rent-to-own offers a solution by allowing customers to return the TV if it no longer meets their needs. This flexibility ensures that individuals aren't tied down and can adapt to changing preferences or circumstances.

The Cons of Rent-to-Own TVs

Total Cost Can Be Higher Than Outright Purchase

While the allure of small monthly payments is undeniable, the cumulative cost over the rental period can sometimes exceed the TV's outright purchase price. It's essential to calculate the total amount payable over the contract's duration to determine if the convenience is worth the added expense.

Commitment to Regular Payments

Rent-to-own agreements will typically require consistent monthly payments. Missing a payment or two might not only result in additional fees but could also jeopardize your claim to the TV. It's crucial to ensure that the commitment to these regular payments doesn't strain your monthly budget.

Potential for Additional Fees

Late payments in a rent-to-own agreement can often lead to additional fees. Over time, these can accumulate, making the TV significantly more expensive. It's essential that rent to own deals be aware of all potential charges and fees before entering into an agreement.

Risk of Losing the TV if Unable to Complete Payments

The rent-to-own model operates on the premise of eventual ownership after completing all payments. However, if a customer is unable to fulfill the payment terms, there's a risk of losing both the TV and the money already paid towards its ownership.

Possible Lack of Warranty or Service Support

Not all rent-to-own agreements come with extended warranties or service support. If the TV malfunctions or requires repairs, the onus might fall on the renter, leading to additional expenses.

Things to Consider Before Opting for Rent-to-Own TVs

Assessing Your Financial Situation

Before diving into a rent-to-own deal, it's paramount to evaluate your financial situation. Can you manage the rent-to-own payments without compromising other essentials? For those with a poor credit history or tight budgets, it might make more financial sense to consider saving for a few months and purchasing a TV outright. This approach could save money in the long run, especially when considering the total cost of rent-to-own agreements.

Understanding the Terms and Conditions

Every rent-to-own store has its set of terms and conditions. When considering rent-to-own TVs, it's crucial to read and comprehend these terms thoroughly. Look for clauses related to late payments, the purchase price after all payments, and any potential late fees. Being well-informed can prevent unexpected costs and ensure you're getting a fair deal.

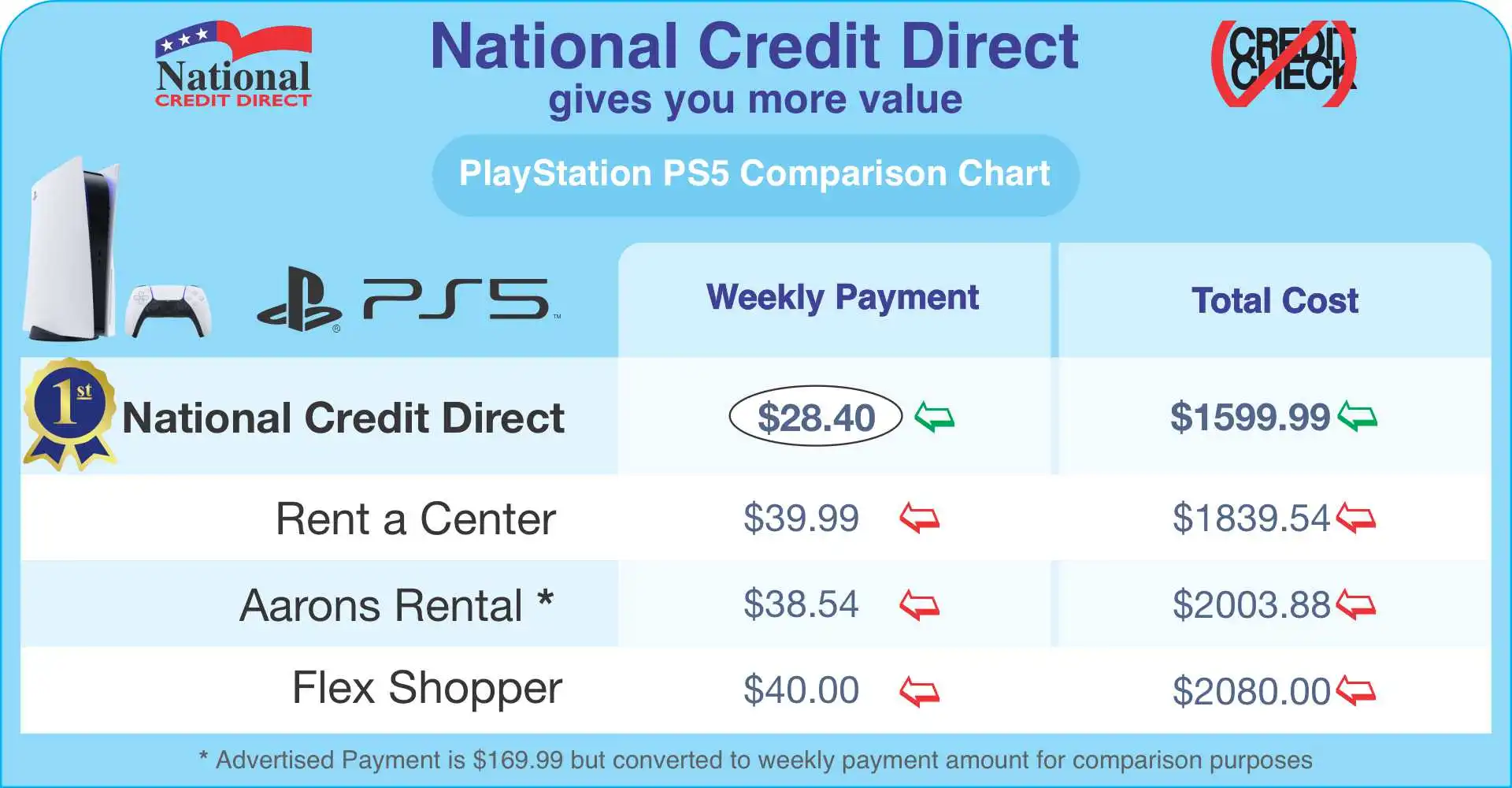

Comparing Different Rent-to-Own Stores

In the vast world of rent-to-own, several prominent players stand out, each with its unique offerings and customer experiences. Let's delve into a comparative analysis of some of the leading rent-to-own stores, focusing on their differences and highlighting why National Credit Direct might just be your best bet for renting to own a TV.

National Credit Direct

National Credit Direct shines in its commitment to customer satisfaction. Unlike many other rent-to-own stores, it offers a wide variety of latest TV models, ensuring customers have access to the newest technology. The store's flexible payment options cater to a broad audience, especially those with poor credit. Furthermore, National Credit Direct often has promotional offers, making it even more affordable to get that dream TV. Their transparent terms and conditions, coupled with an easy-to-navigate online platform, make the rent-to-own process seamless.

FlexShopper

While FlexShopper offers a vast array of products, from electronics to furniture, its focus isn't solely on TVs. This can sometimes mean a limited range of TV models compared to specialized stores. Their payment terms are relatively flexible, but they might not always have the latest TV models in stock.

Aaron's

Aaron's has been a long-standing player in the rent-to-own industry. They have physical stores, which can be a plus for those who prefer in-person shopping. However, this can also mean overhead costs that might reflect in their pricing. While they offer a range of TVs, their online platform isn't as user-friendly as National Credit Direct, which can make the shopping experience a tad more cumbersome.

Rent-A-Center

Rent-A-Center is another veteran in the rent-to-own market. They offer a variety of TVs, but their terms can sometimes be less favorable than those of newer, online-focused stores. Additionally, while they do have an online presence, many of their deals and promotions are centered around in-store purchases, which might not be convenient for everyone.

When comparing these rent-to-own stores, it's evident that while each has its strengths, National Credit Direct offers a blend of modern online shopping convenience, a vast range of TV options, and customer-friendly terms. Especially for those keen on getting the best TV without the burden of a hefty upfront payment, National Credit Direct emerges as a top contender.

Evaluating the Need for the Latest TV Models

While the allure of the latest TV model from top brands is undeniable, it's essential to ask yourself if you genuinely need all the new features. Sometimes, opting for a slightly older model from a rent-to-own store can significantly reduce monthly rent and overall payments. This approach can be especially beneficial for those looking to save money and still enjoy a quality viewing experience.

Conclusion

The rent-to-own industry has carved a niche for itself, especially among those who face challenges with traditional purchasing methods. Whether it's a poor credit history, a lack of upfront cash, or just the need for flexibility, rent-to-own offers a solution, especially when it comes to getting that brand-new TV you've been eyeing.

However, like all financial decisions, it's essential to approach rent-to-own with a clear understanding. The allure of no credit checks, low weekly or monthly payments, and the promise of ownership at the end of the lease or the rental period can be tempting. But, it's crucial to be aware of the total cost over time, which might exceed the TV's original price.

For some, the benefits outweigh the cons. The ability to upgrade to a newer model without waiting years to save up, the flexibility of returning the TV if circumstances change, or the potential to boost one's credit score can be significant advantages. On the flip side, the potential for higher overall costs, the risk of late fees, and the commitment to regular payments are factors to consider.

In the ever-evolving landscape of personal finance, rent-to-own has found its place. For those who've faced doors closed due to poor credit or lack of down payment, rent-to-own stores open a window of opportunity. But as with all windows, it's essential to look through clearly, understand what's on the other side, and decide if it's the right view for you.

In the end, whether you're exploring the housing market, looking at furniture deals, or diving into the world of rent-to-own TVs, knowledge is power. Equip yourself with the right information, weigh the pros and cons of lease option, and make the choice that best suits your financial situation and personal needs.

Frequently Asked Questions - FAQs.

- Q1. Why should one not use a rent-to-own store for merchandise?

- A1. While rent-to-own stores offer the allure of immediate possession without the need for a hefty down payment or a credit check, there are reasons to tread cautiously. Firstly, the total cost of an item from a rent-to-own store can end up being significantly higher than its outright purchase price. Over time, those seemingly manageable weekly or monthly payments can accumulate, making you pay considerably more than the item's retail value. Additionally, some rent-to-own agreements come with stringent terms, which might include hefty late fees if you miss payments. Lastly, while some might see it as a way to get around poor credit, not all rent-to-own stores report timely payments to credit bureaus, meaning your credit score might not get the boost you're hoping for.

- Q2. What happens if I can't make the payments on my rent-to-own TV?

- A2. If you miss payments, most rent-to-own agreements have provisions for late fees. Continual missed payments might result in the TV being repossessed. It's crucial to understand the terms of your rental agreement, especially concerning missed payments and any associated penalties.

- Q3. What are the advantages and disadvantages of rent-to-own?

- A3. The advantages of rent-to-own include the absence of credit checks, allowing those with poor credit history to acquire items they might not otherwise qualify for. It also offers flexible payment options, catering to those who can't afford a large down payment. Moreover, there's the potential to return the item without obligation if one's financial situation changes. On the flip side, the disadvantages encompass the risk of paying a higher total cost than the item's original price. There's also the commitment to regular payments, and failure to meet these can result in additional fees. Furthermore, there's the potential risk of losing the merchandise if you can't complete the payments.

- Q4. Does rent-to-own hurt your credit?

- A4. Rent-to-own, in itself, doesn't necessarily hurt your credit. Most rent-to-own stores don't conduct a credit check when you initiate an agreement. However, the double-edged sword lies in how these stores report to credit bureaus. If they don't report your timely payments, your credit score won't benefit from your financial responsibility. Conversely, some rent-to-own stores might report missed payments, which could negatively impact your credit score. It's essential to understand the store's reporting practices before entering into an agreement.